Younger Individuals in Fancy Vehicles

[ad_1]

Have you ever seen extra high-end automobiles on the street today? And do the drivers of those automobiles appear to be getting youthful and youthful? In fact, it is perhaps simply me noticing these items. I graduated from faculty not too way back and think about myself lucky to be driving my dad and mom’ outdated Hyundai. Nonetheless, once I pull as much as a lightweight and look over to see somebody about my age or youthful driving the most recent Mercedes or one other good automobile, I do begin questioning. How can such an adolescent afford that automobile?

What’s Up with the Economic system?

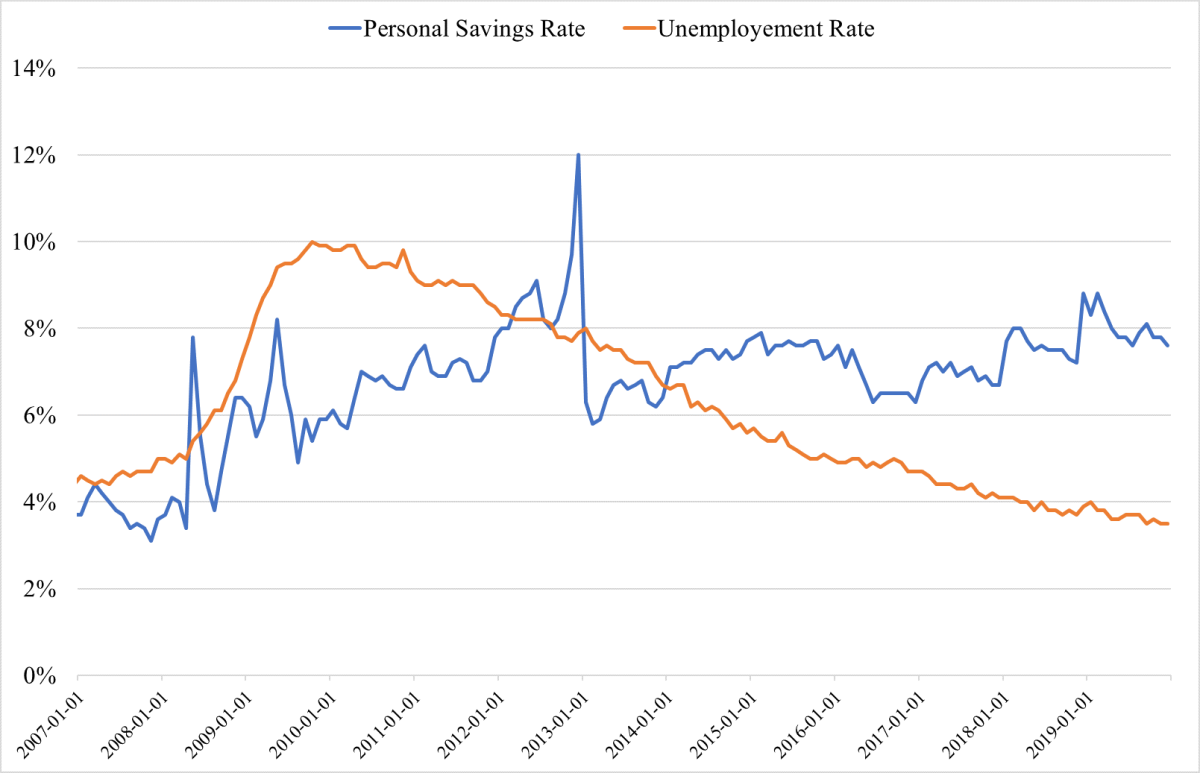

Greedy for a solution usually leads me to ideas about what’s happening within the financial system. (Sure, I work in finance and I do assume like this.) First, when contemplating my very own monetary scenario and that of my buddies, I acknowledge that we’re lucky to have jobs and in a position to dwell on our personal. For the broader financial system, the present numbers for unemployment and private financial savings additionally look fairly good, as illustrated within the graph beneath. Unemployment is at a historic low, and persons are saving extra because the recession.

Supply: Federal Reserve Financial institution of St. Louis

Trying Underneath the Hood

Though these knowledge factors paint an excellent image of the financial system, they do increase a query. If private financial savings have elevated significantly because the recession, how are folks spending extra on new automobiles? This looks like an odd dynamic between saving and spending. To clarify it, we have to look below the hood, so to talk.

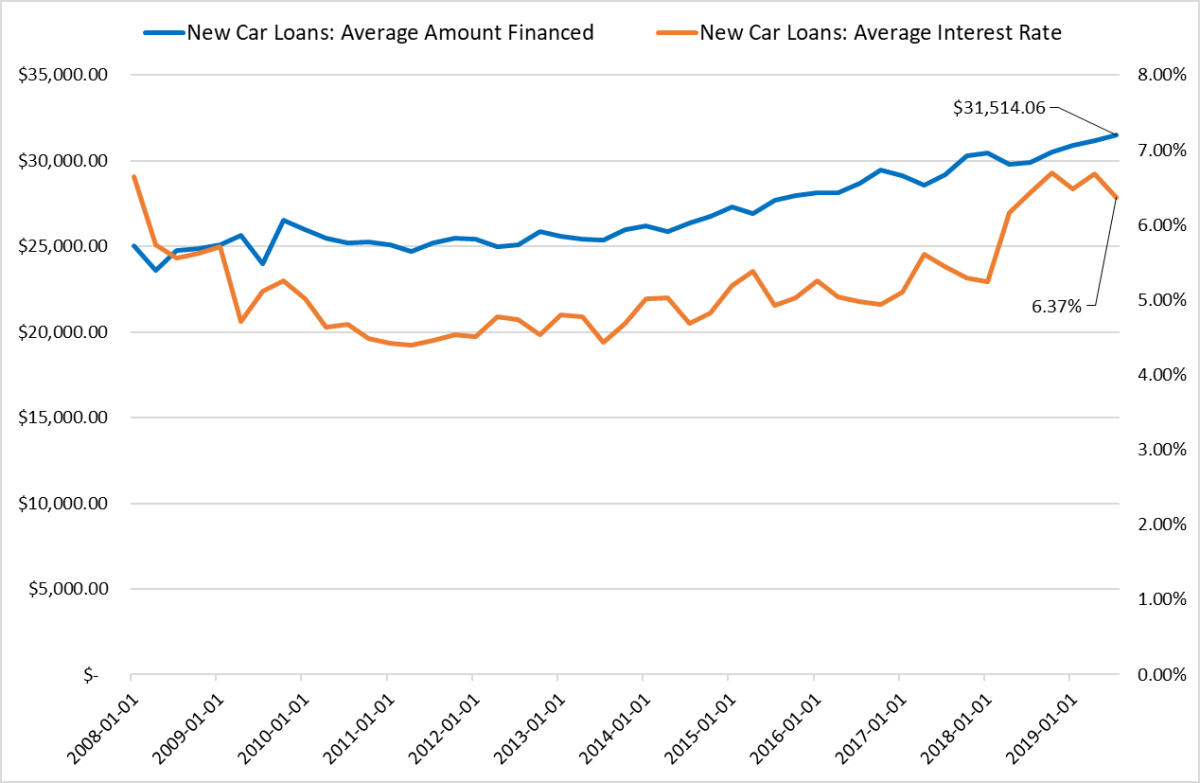

First, let’s examine how persons are shopping for new automobiles. As you possibly can see within the graph beneath, persons are beginning to borrow extra to accumulate a automobile. For the reason that recession, the typical quantity borrowed to buy a brand new car has elevated significantly. So as to add to this narrative, there’s been no scarcity of tales about folks having the ability to borrow greater than the automobile they’re buying is price.

Supply: Haver Analytics

Moreover, through the time interval by which the typical mortgage measurement has elevated, there’s been an increase within the common rate of interest on new automobile loans. Greater charges put additional stress on debtors, inflicting them to take out bigger loans that include greater month-to-month funds. How lengthy can this relationship persist earlier than we see rising charges of client mortgage defaults?

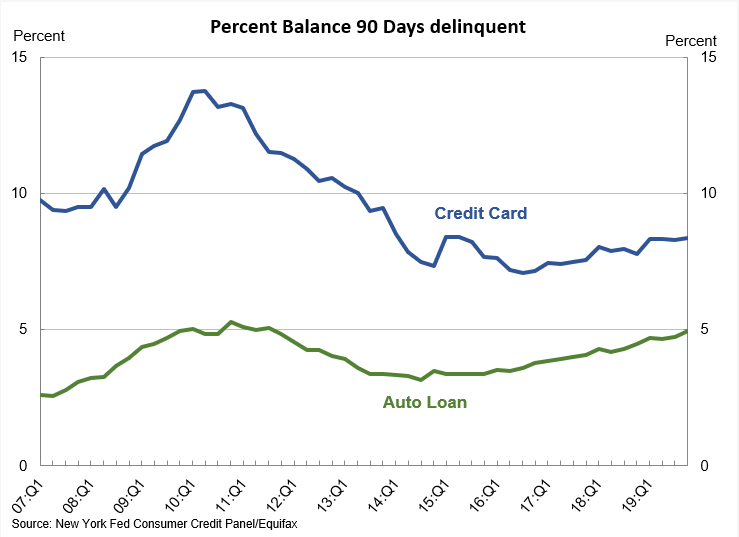

Not lengthy—actually, the development is already underway. Within the graph beneath offered by the Federal Reserve Financial institution of New York, we are able to see a rise in defaults within the auto mortgage area. Following the recession, the steadiness of defaulted auto loans and bank card loans dropped, but it surely’s slowly begun to return up. The auto mortgage default charges are notably attention-grabbing. At their present stage of slightly below 5 p.c, they’re very near the height seen through the recession. In the meantime, bank card defaults, regardless of a slight uptick, aren’t even near the height hit in 2010.

What Does the Information Imply?

At a excessive stage, the financial system is doing nicely. On common, persons are working and saving extra. Client confidence stays fairly excessive. As we are able to see from auto mortgage defaults, nonetheless, areas of the market bear watching. Clearly, simply common auto loans and auto defaults doesn’t inform the entire story. However these indicators present a glimpse into potential behaviors and weak spot that would have bigger results on the financial system down the street.

Given the business I work in, I most likely have a look at the financial system and funds a bit of in a different way than many individuals. Once I mirror on client habits and monetary knowledge, I ponder what I ought to be taught from it. I’m nonetheless working issues out. However one factor I do know for positive is that I gained’t be the younger grownup in a brand new, high-end automobile you pull up subsequent to at a lightweight. I plan to maintain on saving my cash and driving my handed-down Hyundai into the bottom.

Editor’s Observe: The authentic model of this text appeared on the Unbiased

Market Observer.

[ad_2]