Will this week's Price range be pre-election giveaways, or present indicators of strategic pondering?

[ad_1]

See additionally postscript beneath written shortly after the Price range

To say that a lot of

the media treats Budgets as if the federal government was a family will not be

actually correct. A lot Price range evaluation treats the federal government as a money

constrained family, such that any change in anticipated tax income

is thought to be cash the Chancellor has to spend or give away. Most

households don’t work like that, as a result of they’ve the capability to

save and borrow. The federal government after all finds it a lot simpler to

borrow than households.

Sadly some

governments encourage the media’s angle to Budgets. On this

event, nonetheless, the federal government’s fiscal guidelines are medium time period,

with targets all the time 5 years into the long run. So there’s nothing

in these fiscal guidelines to recommend that short-term enhancements to the

authorities’s fiscal place have to be spent or given away. The

purpose they’re more likely to be spent or given away within the forthcoming

price range is as a result of we’re near an election. However as a result of many in

the media deal with the federal government like a money constrained family,

what in actuality is fiscal electioneering can be portrayed as regular

apply.

The forthcoming

election is more likely to affect Chancellor Hunt’s first Price range in

two methods. First, he’ll need to produce fiscal giveaways that can

make newspaper entrance web page headlines the subsequent day, and maybe sway

some voters to vote Conservative. Second, he’ll need to attempt to get

the financial system rising once more as shortly as potential. The rationale why can

be seen from this chart.

Whereas the US

financial system on the finish of final 12 months had GDP per head round 4% above its

degree on the finish of 2019, the UK financial system had GDP per head round 2%

decrease. This quantity could also be flattering to the US as a result of on the finish of

final 12 months a minimum of it was in all probability working a bit scorching, however the identical

is true of the UK but GDP per head continues to be considerably decrease than

earlier than the pandemic. The UK’s relative efficiency during the last

three years has been even worse than its

efficiency within the decade since 2010. The Chancellor

can be determined to see some constructive financial information earlier than the

election, and hope that sufficient voters are myopic sufficient to overlook how

dangerous issues have been since 2010.

One of many causes

why the US has carried out so a lot better than the UK since 2019 is

that Biden had a transparent long run plan of how he was going to assist progress,

whereas the UK didn’t. That plan concerned first guaranteeing a powerful

vaccine enabled restoration from the pandemic utilizing a fiscal stimulus

centered on poorer residents. Then got here massive instructure tasks,

adopted final 12 months with incentives for greening the financial system. In

distinction the technique of the Conservative authorities since 2010 has

concerned shrinking authorities, tax cuts for companies and Brexit. The purpose

was to let an ‘unburdened’ non-public sector do all of the work, and it

has been an entire failure.

A traditional

pre-election fiscal stimulus runs the danger of encouraging the Financial institution of

England to boost rates of interest but additional. That means he’ll

take a look at measures that improve mixture provide in addition to mixture

demand, and so could be regarded by the Financial institution as inflation impartial.

Making an attempt to extend mixture provide is laudable after all, however

sadly he’s more likely to shun the 2 most blatant selections: extra

public funding and higher well being.

In his Autumn

Assertion he had already in the reduction of on public funding, and it’ll

be attention-grabbing if he goes additional. Delaying the

completion of HS2 is an instance of what John Elledge

had earlier

known as ‘Treasury mind’. Such delays in

funding not often

lower your expenses in the long term, and clearly they

delay getting the good thing about the funding. It’s not as if the UK is

‘world beating’ with excessive pace rail – it’s really method

behind a lot of Europe. What’s necessary right here is not

the rhetoric, which is all the time constructive in Price range

speeches, however the precise numbers for mixture public funding,

which I’ll report on within the postscript after the Price range. With so

many good causes to extend public funding in so many areas, it

is so brief sighted to be reducing it again. If public internet funding

over the subsequent few years stays beneath 3% of GDP this can be a

consequence of the stupidity

of together with public funding within the fiscal rule targets.

The Chancellor will

in all probability do one thing to deal with the big variety of inactive folks

of working age that is among the two key elements behind the UK’s

present labour scarcity (the opposite is Brexit). Nonetheless, as this

report argues, the primary purpose why this drawback has

been so uniquely persistent within the UK for the reason that pandemic is the big

variety of folks not working as a result of they’re sick, which in flip

displays the continual state of the NHS after 13 years of

Conservative authorities.. Offering extra money to the NHS (the report

dubs this “check-ups to pay cheques”) is the easiest way to attain

this. But different studies

recommend that the Treasury is making an attempt to cease plans for extra NHS nurses

and medical doctors, which in flip suggests the Chancellor is unlikely to

present help the place it may be only.

One space the place he

could effectively act to extend demand and provide is incentives for

funding by companies. Whereas these incentives usually sound like a

good thought, there’s a hazard that each one they do is carry ahead

funding to years the place the inducement applies from years when it

doesn’t. If that’s all that occurs then little has been achieved

from a long run perspective, but with the price of authorities

payouts to the companies doing the intertemporal switching. Nonetheless if

the Chancellor desires to spice up funding in an election 12 months, on the

expense of decrease funding beneath what could be a Labour

authorities, this is probably not his main concern!

Low public

funding, ignoring the long run sick, and politically motivated

subsidies to companies are all examples of the place poor political choices

imply that fiscal coverage fails to enhance the financial system within the longer

time period. If the headline grabbing giveaways embody not

elevating petrol obligation but once more, then we will add that to

the listing. The media will report this as ‘in style with motorists’,

as if motorists are united in welcoming local weather change.

As I famous in this

publish, the USA has for the primary time a transparent

plan to encourage the form of inexperienced industries which can play such

an necessary half in all main economies over the subsequent few a long time.

As their plan can also be protectionist, it has inspired the EU to

improve

subsidies for these industries. The UK wants its personal

response. As Torsten Bell factors

out, it can not simply be an try to duplicate what

the US and EU are doing, as a result of the UK is a smaller, extra open

financial system that should play to its strengths. It is going to be attention-grabbing

if we get any thought from the Price range about whether or not the present

authorities has began to consider what the UK’s technique on

encouraging inexperienced industries needs to be, or whether or not it’s persevering with

with the failed plan of hoping common company tax breaks will

invigorate the financial system.

Price range Postscript (16/03/23)

There have been few

surprises on this price range, so the feedback above nonetheless largely apply.

The federal government’s strategic imaginative and prescient, in as far as it exists, stays to

squeeze

public companies and to hope giving cash to (a couple of) people

and (quickly) to companies spurs a powerful restoration. The response to

new inexperienced subsidies within the US and EU must wait till a bit

later, however when public funding will not be anticipated to extend past

this 12 months I would not maintain your breath. (OBR Desk A.1). The price range

additionally confirmed

the anticipated dying of any grand levelling up technique, though the

small quantities allotted are maybe higher

directed.

The 2 welcome

measures not covered

above have been abolishing

Work Functionality Assessments

and the enlargement of free baby look after very younger

youngsters. In line with the OBR the latter ought to improve GDP by

about 0.2%. Though what was introduced will definitely improve the

demand for baby care, questions

stay about whether or not provide of kid care will improve to match

this (see additionally

right here).

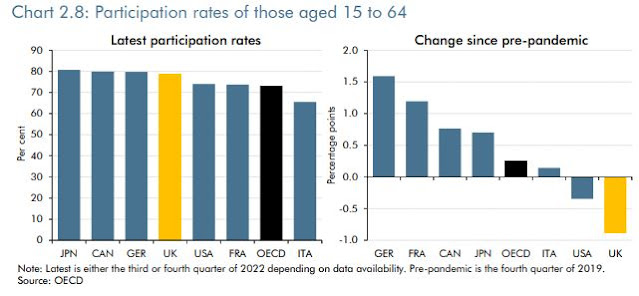

Because the OBR notes,

the primary purpose labour provide has shrunk within the UK, by excess of

in different economies (see chart beneath), is the rise in long run

illness. To reverse this requires extra money for the NHS, and there

was nothing within the price range to assist with this.

The one different

measure to extend labour provide within the price range was a big

tax giveaway to the very wealthy. Whereas the motivation might need

been to cease senior medical employees retiring early, this might have

been accomplished otherwise and it might need been extra productive to make use of

this cash to assist cease the alarming

price younger GPs are leaving the NHS. Because of the

Chancellor’s selections, we now have one other Conservative price range that helps

these on excessive incomes extra

than anybody else.

Tax breaks for companies

to extend funding have been introduced as anticipated, however just for three

years, that means that the OBR expects them to do little

greater than shift funding expenditure ahead, as prompt

above. As the next OBR chart reveals, even that is small in contrast

to the collapse in funding brought on by Brexit.

When it comes to fiscal

electioneering, there was the anticipated freezing of petrol obligation, however

in any other case not a lot. The Chancellor is aware of he has yet one more Price range to go

earlier than the election. The truth that he’s solely simply assembly his 5 12 months

fiscal guidelines should not idiot anybody. This goal may have moved on a

12 months by the subsequent Price range anyway, however extra importantly the general public

spending numbers he has in for the post-election interval are largely

fiction. If he must make them much more fictitious to pay for

introduced tax cuts subsequent 12 months he’ll.

Listening to a bit

of Hunt’s

Price range speech, I remembered how I as soon as wrote a couple of posts pointing

out the macroeconomic errors in George Osborne or David Cameron’s

speeches. I simply could not do this now, as a result of the posts could be far

too lengthy. Nearly each sentence is deceptive nonsense. I bought to

sentence quantity 9 earlier than I discovered one thing I could not take aside:

the sentence was

“However

that’s not all we’ve accomplished.”

This

could mirror a deterioration within the high quality of the Chancellor’s speech

writers, however I anticipate it is extra that they only don’t have any good

materials

to work with. Can

a couple of tax cuts subsequent 12 months and an financial system simply beginning to develop once more

actually offset in voters minds what has been essentially the most dismal 13

years

for the UK financial system since WWII?

[ad_2]