What's Your Retirement Quantity? - A Wealth of Frequent Sense

[ad_1]

A reader asks:

After we learn articles about “How a lot it is best to have saved by age X”, ought to it not be “How a lot revenue you can be incomes with financial savings Y”? Right here’s my state of affairs: Mid 30s, labored at a public College for 11 years and left to take a job within the personal sector. I’ve a pension on the College with a assured fastened revenue and simply beginning a brand new 401(Okay). Whole retirement financial savings doesn’t assist me know if I’m on tempo. Assuming a presumed 5% withdrawal price and eight% 401(ok) development price, wouldn’t a “calculated retirement payout” that may embody issues like pensions and Social Safety be higher than “be sure you have $1M by 50, and so forth.”?

Bear in mind this industrial the place individuals are strolling round carrying their retirement quantity:

I would like $500,000 to retire. Properly I would like $1 million. I couldn’t retire on something lower than $5 million!

I get the concept.

Targets and benchmarks are an necessary a part of any long-term planning course of. How do you intend forward if you happen to don’t know the place you need to be?

However in the case of retirement planning there are just too many unknown variables. That is very true for some of their 20s, 30s and even 40s.

Former Fed Chair Ben Bernanke as soon as stated, “Life is amazingly unpredictable; any 22-year-old who thinks she or he is aware of the place they are going to be in 10 years, a lot much less in 30, is solely missing creativeness.”

Life modifications over time however so do incomes, financial savings charges, spending charges, inflation charges, rates of interest, inventory market returns and a couple of hundred different issues you haven’t any management over.

This is the reason monetary planning is a course of not an occasion. You could make course corrections to your plan alongside the way in which as new data and circumstances come to gentle.

I do like the concept of backing into how a lot you should save based mostly on how a lot you should spend.

Daniel Kahneman as soon as requested, “How do you perceive reminiscence? You don’t examine reminiscence. You examine forgetting.”

As Charlie Munger likes to say, “Invert, all the time invert.”

It’s pointless to strive to determine how a lot you’ll want in financial savings or revenue if you happen to don’t have a great understanding of how a lot it prices so that you can stay.

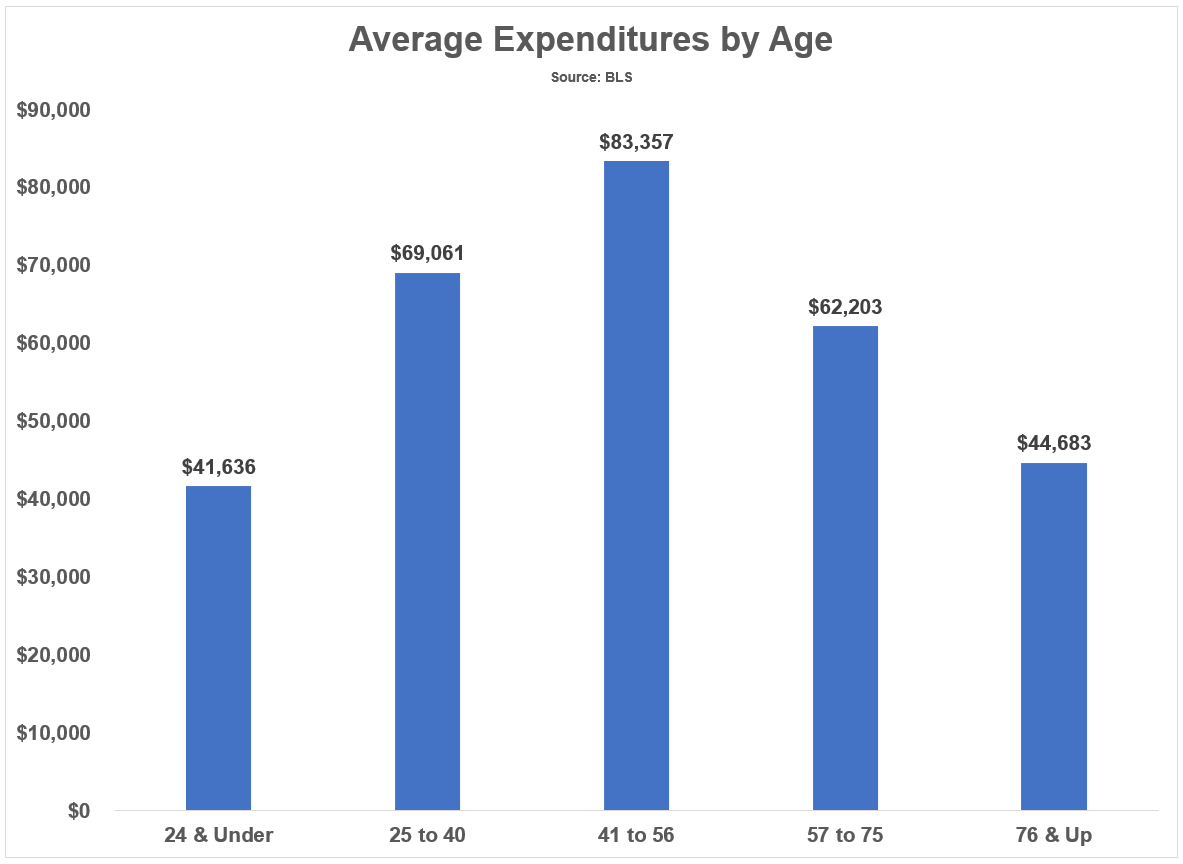

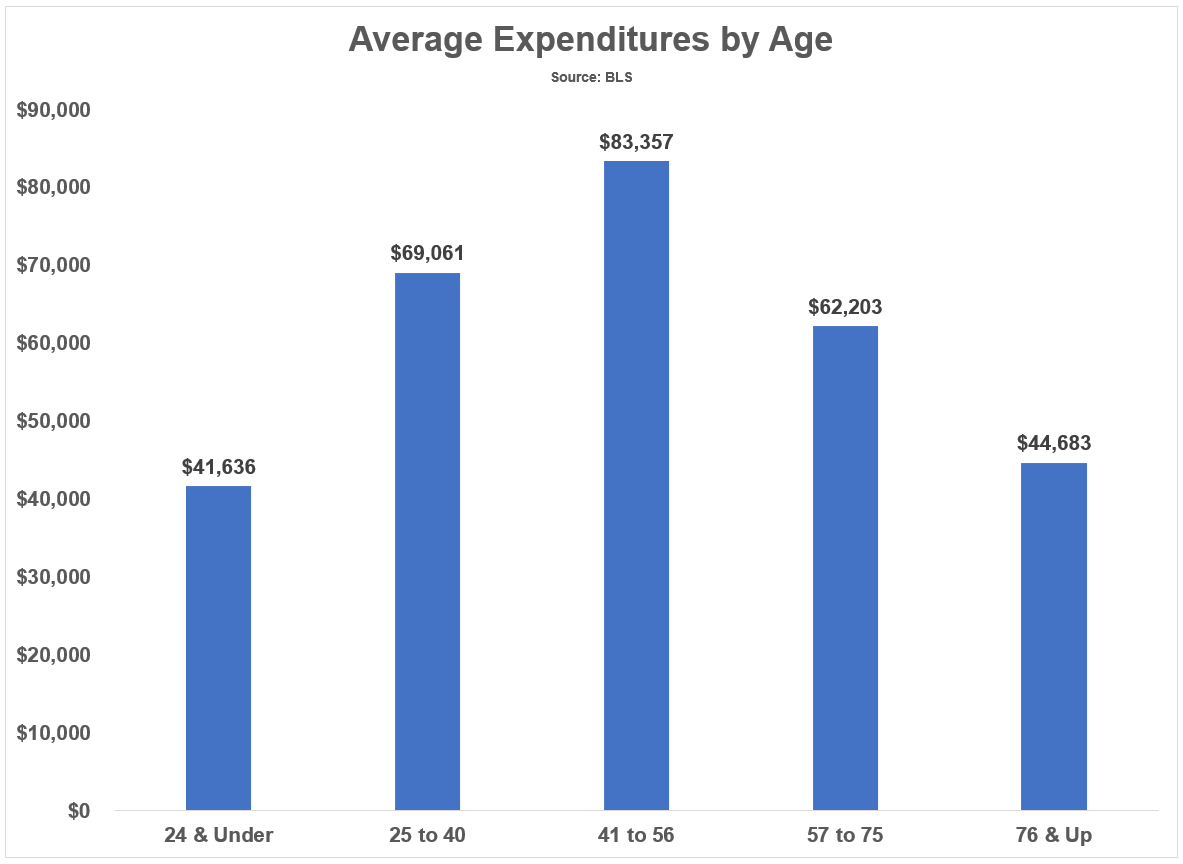

The Bureau of Labor Statistics publishes common annual spending ranges by completely different age ranges:

Everybody’s circumstances are completely different but when we take a look at spending ranges by completely different age teams you may see spending typically ramps up in your 20s and 30s, peaks in your 40s and 50s and slowly declines from there.

This is smart as a normal rule of thumb.

Younger folks don’t have excessive sufficient incomes to spend so much. In your 40s and 50s, there are extra duties in the case of spending plus you attain your peak incomes years. And if you stand up there in age, you’re not as energetic anymore so that you don’t spend as a lot.

There are a variety of laborious questions in the case of retirement planning:

- Do I find the money for saved?

- How a lot will healthcare price throughout retirement?

- When ought to I take Social Safety?

- What if there’s a market crash proper after I retire?

- What is going to my tax price be in retirement?

- What returns ought to I financial institution on going ahead?

- How can I make sure my cash will final?

The retirement equation is commonly fuzzy as a result of there aren’t a variety of concrete solutions to those questions. The dreaded ‘it relies upon’ applies right here.

The one technique to reply these questions is to ask your self much more questions:

- How a lot debt do I’ve?

- What’s my way of life inflation?

- What’s my financial savings price and the way will it change over time?

- What assumptions am I utilizing for market returns?

- Will I’ve any dependents counting on me to assist them financially?

- How costly is the price of dwelling the place I reside?

- How a lot of my portfolio do I plan on spending down annually?

- How will my spending change as I age?

- How versatile will I be with my spending relying on market efficiency?

- What are my different sources of revenue in retirement (pensions, social safety, part-time work, and so forth.)?

- What do I really need to do with my cash?

- How lengthy am I going to stay?

This is the reason it’s so necessary to tie your investments along with your objectives. How are you going to presumably know what to spend money on if you happen to don’t know why you’re investing within the first place?

The previous is for certain however the future must be checked out by means of a spread of potential outcomes.

As expectations flip into actuality, you may replace your priors and your monetary plan when obligatory.

The reality is your quantity will change over time as you age and spend down your portfolio and see anticipated returns flip into historic returns.

The query of how a lot you’ll want can and can change over time.

Monetary planning requires you to maneuver the goalposts on a constant foundation each when it comes to numbers and expectations for the reason that future by no means seems how we anticipate.

We mentioned this query on the newest version of Ask the Compound:

RWM advisor Ross Cohen joined me this week to go over different questions on saving vs. spending, yields on short-term bonds vs. cash market funds, the completely different funding accounts you may open to your youngsters and retirement accounts for people who find themselves self-employed.

Additional Studying:

How A lot Ought to You Have Saved in Your 30s?

Podcast model right here:

[ad_2]