What France can educate the UK about Pensions

[ad_1]

If you happen to learn among the UK

headlines, evidently France is having issue adjusting to the

actuality of longer lifespans. Its earlier retirement age (the age

when you will get a state pension) was 62, which is nicely beneath most

different international locations. Macron has made that 64, in a reform imposed

on parliament. 64 remains to be comparatively low, but there

have been strikes and demonstrations in opposition to this transformation which have

been massive even by French requirements. A rolling strike by bin

collectors in Paris has left garbage on the streets.

Commentators

are asking whether or not these protests will convey in regards to the

finish of the present constitutional order in France.

At a macro stage, it

is smart to boost the pension age alongside life expectancy. In

most European international locations, together with France and the UK, state pension

schemes are unfunded, which signifies that at present’s pensions are paid

for by these working at present. If individuals dwell longer you both have to

cut back the worth of the state pension, increase these contributions, or

increase the retirement age. But whereas the life expectancy of these

reaching 65 elevated considerably within the a long time earlier than 2010,

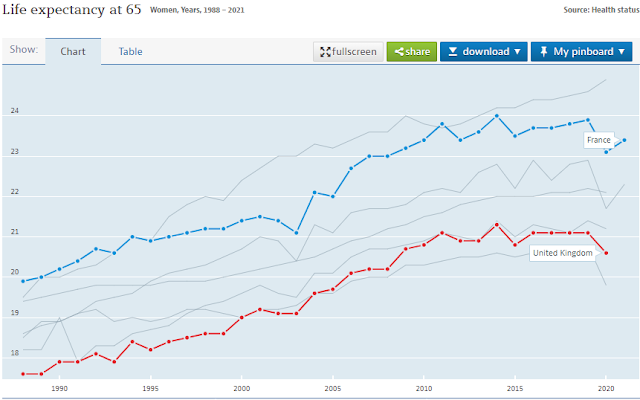

will increase have been extra modest since then. The OECD

knowledge beneath is for girls within the G7 international locations. Be aware that

UK life expectancy has at all times been low in comparison with all different G7

international locations besides the US.

The French pension

age was raised to 62 from 60 in 2010, and by 2019 (earlier than Covid) life

expectancy at 65 had risen by

round half a year since 2010. So the case for

elevating the retirement age in France from 62 to 64 just isn’t clearly

due to will increase in life expectancy since 2010. Certainly

projections counsel that the French pension system, whereas it would go

into deficit on the finish of this decade, will break

even once more by 2035 with none improve in pension

age.

So how does France

afford to have a comparatively low retirement age in comparison with different

international locations? It’s not as a result of state pension ranges are low. France

spends round 12% of GDP on state pensions, which is considerably

increased than the OECD common, which itself is above

the UK. The reply subsequently needs to be increased ranges of

contributions, both immediately or not directly by way of a tax subsidy. I

famous in a

current publish that though France had increased ranges of

productiveness than the UK, imply family incomes weren’t increased, and

a significant motive for that is that French staff retired earlier.

Larger French productiveness was paying for a decrease retirement age than

the UK and elsewhere, slightly than increased post-tax incomes.

France has not

at all times been an outlier when it comes to having a low retirement age. It

was the socialist President François Mitterrand who in 1981 minimize the

retirement age from 65 to 60. Has France acquired this trade-off between

earnings and retirement proper, as Simon Kuper suggests,

and most different international locations have it improper? The power of in style

feeling in opposition to Macron’s increased retirement age would

counsel French individuals assume so, though it’s not possible to understand how

a lot of that is seeing a profit (retiring early) with out seeing the

price of that profit (decrease post-tax incomes whereas working).

The primary lesson

that France has to show the UK (and maybe different international locations) is to

have that debate. One of many penalties of getting a predominantly

proper wing press and a predominantly proper wing authorities is that

early retirement within the UK is seen

as an issue, slightly than an achievement. Debates over

pensions within the UK too typically deal with contribution charges as given,

slightly than a part of a trade-off between the retirement age and

contribution ranges. As I’ve famous earlier than, the UK debate sometimes

fails to position issues into an intertemporal context, and as an alternative

talks about staff versus pensioners as if staff won’t ever

retire.

The second lesson

that France has to show the UK is whether or not it is smart to have a

nationwide retirement age in any respect. As soon as we transfer from the mixture to

fascinated by people, the unfairness of a uniform retirement

age turns into apparent. If the retirement age was 64, somebody who begins

work from the age of 18 will work (and subsequently contribute) for 46

years earlier than retiring. Somebody who has a level will, in the event that they retire

at 64, work three years much less however nonetheless get a state pension. It will

appear to be fairer at a person stage to put off a retirement

age, and as an alternative be allowed a full state pension after working a

sure variety of years. (The choice to retire earlier than that variety of

years ought to at all times be obtainable, however with a lower than full pension.)

This unfairness is

recognised in France, however not within the UK. France has had a

‘lengthy careers’ provision the place those that began working at an

early age can retire on a full pension earlier than the official retirement

age. That system is

strengthened as a part of elevating the retirement age to

64, so individuals who have labored for 43 years can retire with a state

pension earlier than 64. Thomas Piketty argues

that If in case you have 43 years of service, then you must be capable to take

your full pension, full cease. [1]

Nonetheless this concept of

changing a retirement age by a years labored standards emphasises a

totally different potential unfairness downside, as a result of state pensions are

annuities that you simply obtain for so long as you reside. If everybody had

the identical life expectancy, then those that began work early and

subsequently retired early would obtain a pension for longer than these

who retired later. How a lot is that this a difficulty? Simply as if you begin

work varies by (or even perhaps defines) class, so life expectancy

additionally varies by class.

It will be simple to

argue that this potential unfairness, created by changing a hard and fast

retirement age by years of service standards, doesn’t come up in

follow due to an ‘sad coincidence’ that the life

expectancy of those that begin work earlier is shorter by the identical

variety of years than those that work later. The proof now we have from

France for these benefiting from ‘lengthy careers’ and subsequently

early retirement in France is

advanced, however doesn’t counsel such an sad

coincidence exists. Nonetheless, even when there was no distinction in life

expectancy between those that begin work at 18 and people who begin

work at 21, say, that’s not an argument for a typical retirement age,

as a result of that’s clearly unfair to those that begin work at 18 and

subsequently contribute extra to their pension with no extra

profit. [2]

If those that began

work at 18 can retire on a full pension at 61 by way of the lengthy profession

route, why does France have a retirement age in any respect and why is it

being raised? The reply lies within the element, and in

explicit the allowances for taking break day to look

after kids. On this respect the UK system, which supplies credit score for

these receiving youngster profit, is extra beneficiant than the system in

France, though after all it’s simpler to be beneficiant when the extent

of the state pension is a lot decrease. It may appear odd that these

particulars have provoked a lot anger, however as Piketty factors out if

they didn’t have an effect on lots of people by a substantial quantity Macron

wouldn’t be utilizing a lot political capital on insisting on elevating the

retirement age to 64.

The controversy in

France over pensions has slightly little to do with affordability, and

as an alternative is about lifetime alternative and equity throughout class. France

was uncommon in comparison with most international locations as a result of staff paid extra to

fund and luxuriate in an extended retirement, significantly for the working

class who began work at 18 and significantly working class ladies.

The hazard in ending that is it would create another weapon for the

populist proper.

[1] Why does France

recognise the unfairness to those that begin work early created by a

mounted retirement age, whereas the UK doesn’t? Certainly, why does elevating

the retirement age within the UK trigger so little controversy in comparison with

France. The plain motive is class, and particularly the lack

of political energy within the UK for individuals who didn’t do

a level. Elevating the retirement age from 62 to 64 in France

primarily impacts the working class, as a result of those that did a level

and began work of their early twenties will want and sometimes need to

work past the age of 64 to get their full pension. It’s the commerce

union motion in France that’s main the protests in opposition to elevating

the retirement age.

[2] A technique of

coping with totally different life expectations throughout occupations has been

proposed

by Ian Mulheirn. He suggests treating the pension as a lump sum that

must be invested in an annuity, and the annuity supplier

would regulate for various group life expectations. My very own view is

{that a} authorities run scheme could be preferable, as a result of personal

annuities expose pension holders to rate of interest threat.

[ad_2]