US inflation falling quick, whereas in Australia the top-end-of-town are partying on huge wage will increase

[ad_1]

It’s Wednesday and as traditional I contemplate a number of subjects in much less depth than a single weblog submit, as a precursor to the music section. Yesterday’s US inflation information from the Bureau of Labor Statistics (June 13, 2023) – Shopper Worth Index Abstract – Could 2023 – exhibits an additional vital drop within the inflation fee as among the key supply-side drivers proceed to abate. All the information is pointing to the truth that the US Federal Reserve’s logic is deeply flawed and never match for objective. At this time, I additionally talk about the stupidity that’s about to start in Europe once more, because the European Fee begins to flex its muscle tissues after it introduced to the Member States that it’s again to austerity by the tip of this yr. And at last, some magnificence from Europe within the music section.

The US inflation scenario

The BLS printed their newest month-to-month CPI yesterday which confirmed for Could 2023 (seasonally adjusted):

- All Objects CPI elevated by 0.1 per cent over the month (down from 0.4 per cent in April) and 4.1 per cent over the yr (down from 5 per cent in April and 6.4 per cent in January).

- The height month-to-month rise was 1.2 per cent in June 2022.

The BLS be aware that:

The index for shelter was the biggest contributor to the month-to-month all objects improve, adopted by a rise within the index for used automobiles and vehicles. The meals index elevated 0.2 p.c in Could after being unchanged within the earlier 2 months … The power index, in distinction, declined 3.6 p.c in Could as the key power element indexes fell …

The all objects index elevated 4.0 p.c for the 12 months ending Could; this was the smallest 12-month improve because the interval ending March 2021.

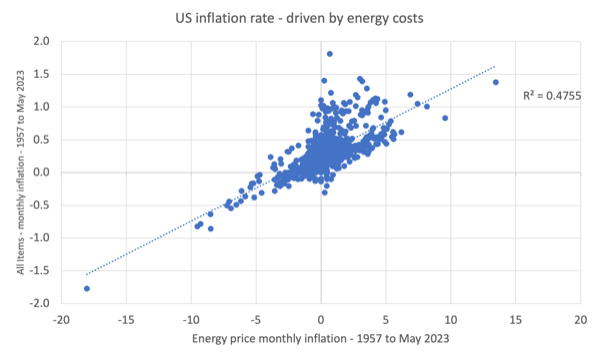

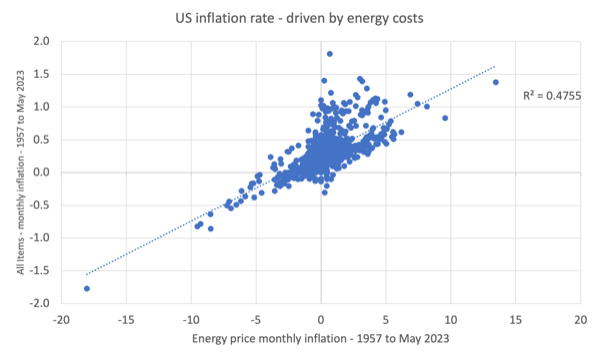

The next graph exhibits the significance of power costs to the general US inflation fee.

The straightforward regression line (dotted) yields an R2 of 0.48. That signifies that round 48 per cent of variation within the total CPI is pushed by power value variation.

It is a bit more sophisticated than that in statistical phrases, however, that tough determine is an effective information to how influential power costs are.

Successfully, the sharp drop in US inflation is all the way down to the sharp drop in power and petrol costs.

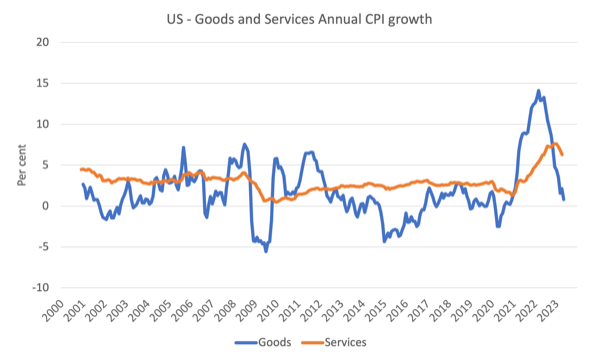

The subsequent graph exhibits the evolution of annual value rises for the products sector and for the companies sector since 2000 – as much as Could 2023.

The rivalry all the time has been that the inflation has been largely pushed and instigated by the availability components that constrained the flexibility of the economic system to satisfy demand for items – the Covid manufacturing unit and transport disruptions and the like.

The graph exhibits clearly that these components have been in retreat because the second-half of 2022 as the availability chain constraints ease.

The companies sector, which is by-product of the availability drivers, lagged behind the products sector and whereas nonetheless recording increased inflation that the products sector, now seems to be to have peaked and can be on the way in which down.

And the inflation has been falling sharply whereas the US labour market has been relatively secure.

I analysed the most recent Bureau of Labor Statistics employment launch on this weblog submit – US labour market – maybe at a turning level with unemployment rising (June 5, 2023).

Whereas there was a slight slowdown in employment progress there isn’t a signal of a big recession-type slowdown.

The purpose is that the shortage of correspondence between the labour market dynamics and the inflation dynamics exhibits the poverty of the logic utilized by the Federal Reserve Financial institution to justify their rate of interest rises.

The Federal Reserve logic is all in regards to the energy of the labour market (they consider the precise unemployment fee is under the NAIRU) and that drives their zeal to create extra unemployment and kill off wages progress, which, in flip, stops inflation in its monitor.

We additionally know that family consumption expenditure isn’t declining in a short time.

The info is thus not form to the Federal Reserve logic.

The employment launch additionally demonstrated that actual wage cuts proceed (whereas moderating), which actually takes wages out of the image when assessing the dynamics of the CPI at current.

Inflation is falling pretty rapidly as a result of the principle drivers, which aren’t notably rate of interest delicate, are in decline.

One rule for some (most), one other rule for others (a number of)

I’ve been analysing the commentary supplied by the RBA governor Philip Lowe on how is he justifying the ridiculously extreme rate of interest will increase in Australia for a while now.

He geese and dives as one story line fails to match the fact however a reasonably fixed declare is that until staff take actual wage cuts, the RBA will hike charges by much more than now as a result of the wages progress will threaten the inflation goal.

Typically he places this within the context of actual wages progress – that is his productiveness story line the place he accurately notes that growing actual dwelling requirements in any nation require such progress.

However extra not too long ago he has used the productiveness line to assert that with out productiveness progress, actual wages need to fall – a delicate shift.

The shift is from productiveness progress offering the non-inflationary room for nominal wages to develop sooner than the inflation fee, to, productiveness progress is required for nominal wages to progress as quick because the inflation fee.

The previous rivalry is appropriate, the latter isn’t justified by something apart from the RBA governor thinks that it’s affordable in an inflationary episode for companies to improve their revenue margins.

The governor has been claiming wages progress will compromise the combat towards inflation and even claimed final week, within the gentle of the most recent improve within the minimal wage that giving the bottom paid staff are wage rise was one issue that led to the RBA’s choice to additional improve rates of interest.

Nicely, I’m wondering when he’s going to touch upon the most recent information on government pay.

At this time (June 14, 2023), the – Governance Institute of Australia, launched their newest report – 2023 Board & Government Remuneration Report.

The Governance Institute was previously generally known as the Chartered Secretaries, Australia organisation, and focuses on “selling sound follow in governance and threat administration”, which incorporates monitoring CEO remuneration.

Whereas staff’ pay is being reduce severely in actual buying energy phrases at current, and the RBA governor desires even harsher wage outcomes – or else he’ll wield his huge stick additional – the bosses are partying.

The Governance Institute report surveys many Boards of firms, not-for-profits and public organisations.

It discovered that:

1. “vital remuneration will increase throughout ASX 200 firms with 42% of ASX board administrators and 71% of ASX senior executives receiving a pay rise within the final 12 months.”

2. “The remuneration of firm secretaries was one such progress space with a mean remuneration bump of 11%. Particularly, for ASX 200 firms, this improve was increased at 13%, and 24% when firm secretaries of huge, listed firms.”

3. “Threat managers additionally acquired a mean remuneration improve for the final yr with a 15% improve.”

4. “Increased bonuses (the potential most bonuses that may be provided) have been additionally supplied to those professions with threat managers from ASX 200 firms in a position to obtain as much as 45% of their mounted wage in bonuses. Likewise, Common Counsel & Firm Secretaires acquired an total common improve of 49%.”

Attempt rationalising that with the RBA governor’s insistence that staff needed to tighten their belts and take the true wage cuts.

And take a look at rationalising that with the calls for from the big employer teams and companies that the Truthful Work Fee not improve the wages for the bottom paid by greater than 3 per cent in nominal phrases, which, after all, represents an enormous actual wage reduce.

There is no such thing as a rationalisation doable.

That is one legislation for some (most of us) and one other for others (the top-end-of-town).

One media commentary (from a normally business-biased newspaper) wrote at present (Supply):

… tone-deaf company boards which can be awarding these base wage will increase to their senior executives are risking a neighborhood backlash and doubtlessly some blowback from shareholders.

The company largesse for executives is much more offensive when companies have been combating calls to pay their staff extra to match inflation. Wage and wage earners are being instructed to toe the road and take the ache to keep away from a wages spiral that will gas and entrench inflation.

The Governance Institute research demonstrates that senior executives, already sufficiently properly remunerated to be immune from the price of dwelling pressures felt by many wage earners, are being over-compensated for inflation.

We live in obscene instances for positive.

I urge all readers to jot down to the Australian firms that pay out these booming rewards to their CEOs and different executives and inform them that you’re organising by your social networks widespread boycotts of their merchandise.

Till we actually get organised as customers, this type of disgusting largesse will proceed.

I’m performing some extra analysis on the problem to get a listing of the worst offenders.

Music – Ola Gjeilo

That is what I’ve been listening to whereas working this morning.

I first heard this album – Winter Songs – on an extended flight from Japan. The album was launched by Decca in 2017.

It’s from Norwegian composer – Ola Gjeilo – who works with varied string ensembles and choirs to supply a really trendy classical sound.

On this monitor – The Rose II – he combines with the – 12 ensemble – with cellist Max Ruisi.

Very mellow solution to research inflation information.

And if choral is your factor, then the Royal Holloway therapy of the track is a deal with:

That’s sufficient for at present!

(c) Copyright 2023 William Mitchell. All Rights Reserved.

[ad_2]