The Worst Housing Affordability Ever?

Every week Redfin places out a housing market replace stuffed with helpful knowledge and nice-looking charts of traits on gross sales costs, asking costs, new listings, housing provide and extra.

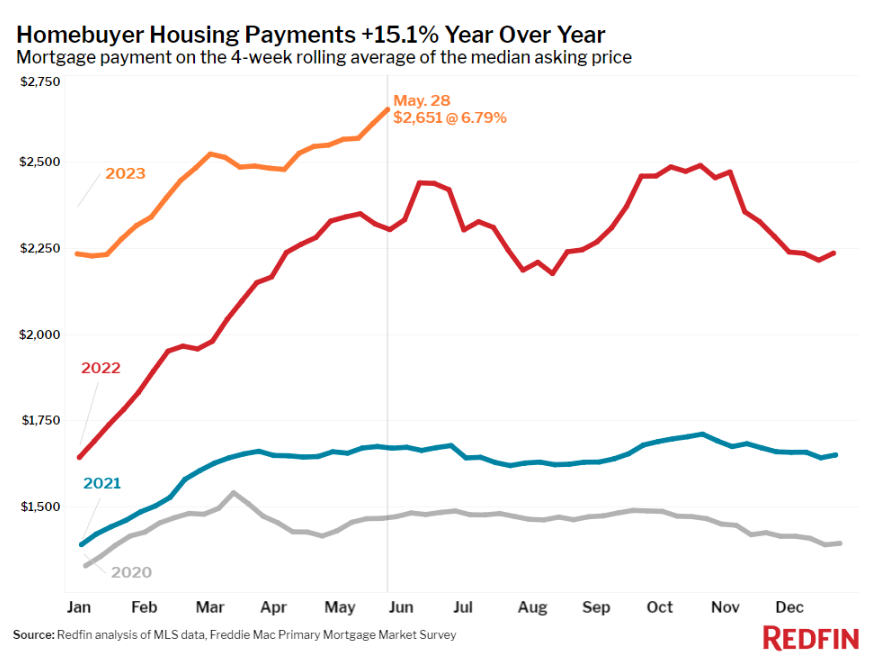

This one must be painful for anybody who’s available in the market for a home proper now:

The year-over-year numbers up 15% are dangerous sufficient being however simply take a look at how way more inexpensive issues had been as just lately as 2020 and 2021.

That is a part of the explanation the housing affordability subject is that rather more excruciating now — the tempo of the will increase occurred so shortly.

We’ve merely by no means seen costs and charges rise this quick in such a brief time frame.

The I-can’t-believe-I-missed-it issue must be off the charts proper now.

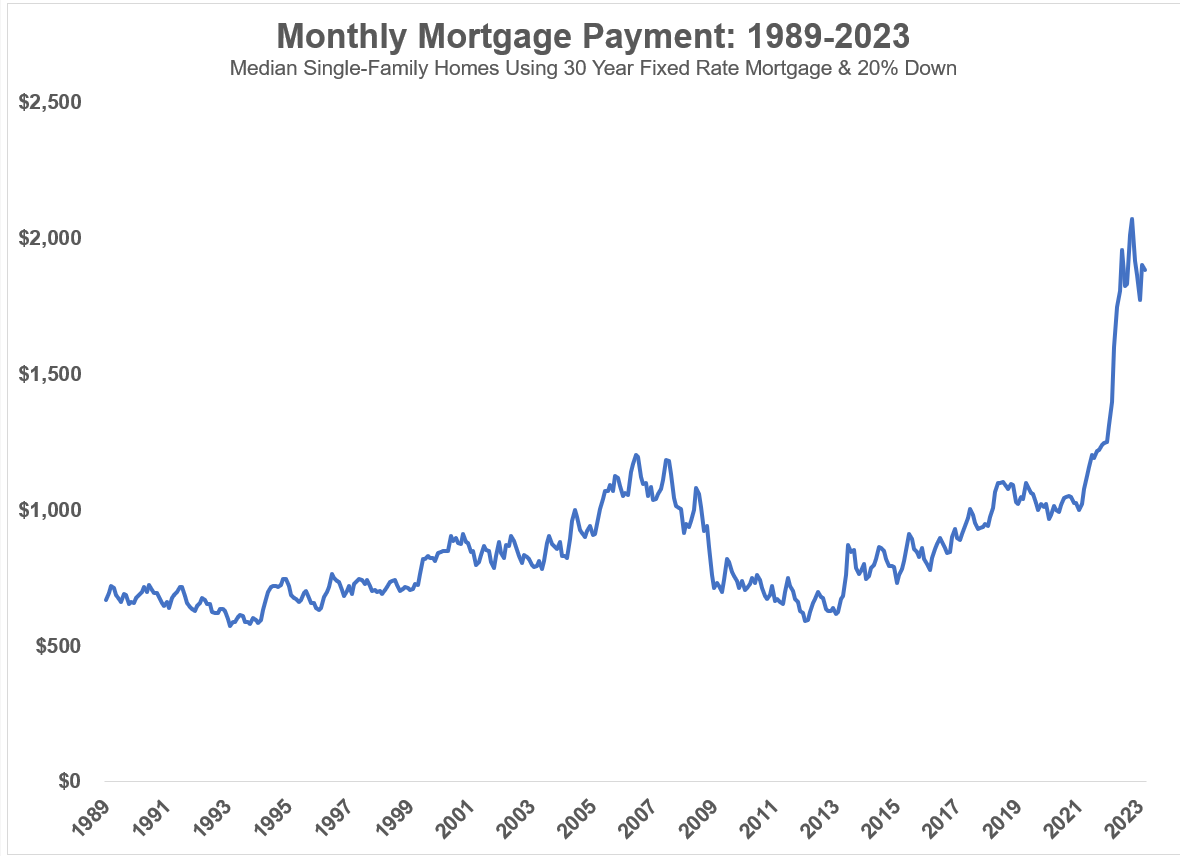

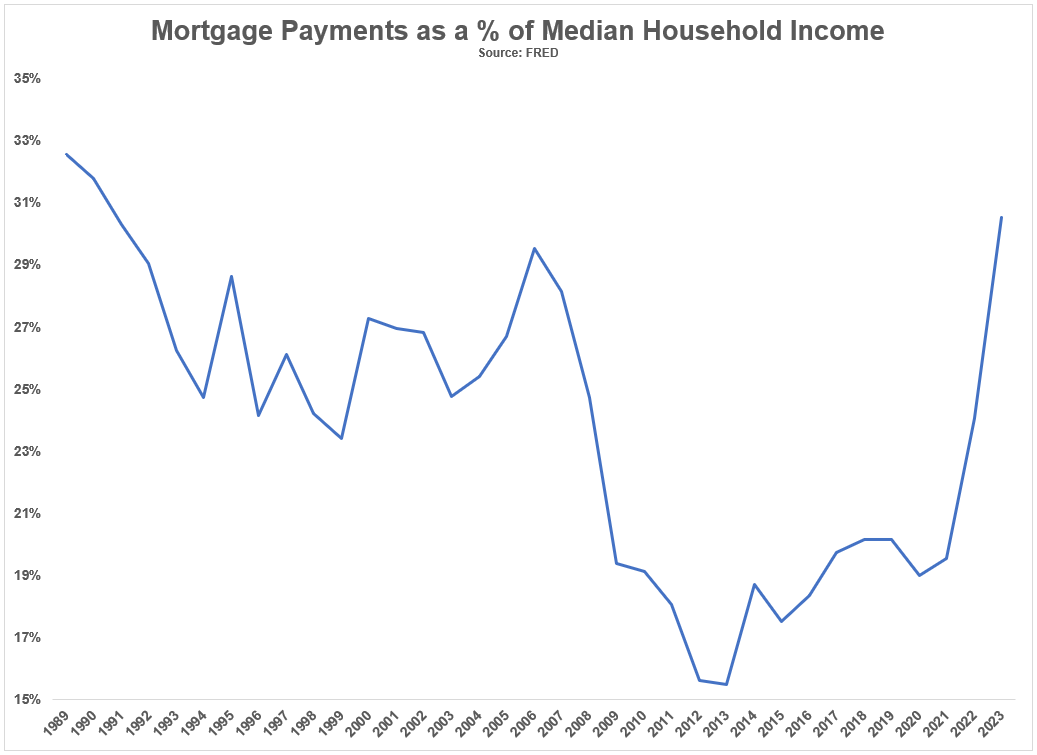

I sometimes replace a chart of common month-to-month mortgage funds over the previous three-plus many years utilizing median present house sale costs, 30 12 months mortgage charges and the belief of a 20% down cost:

See when you can spot the run-up in costs and mortgage charges.

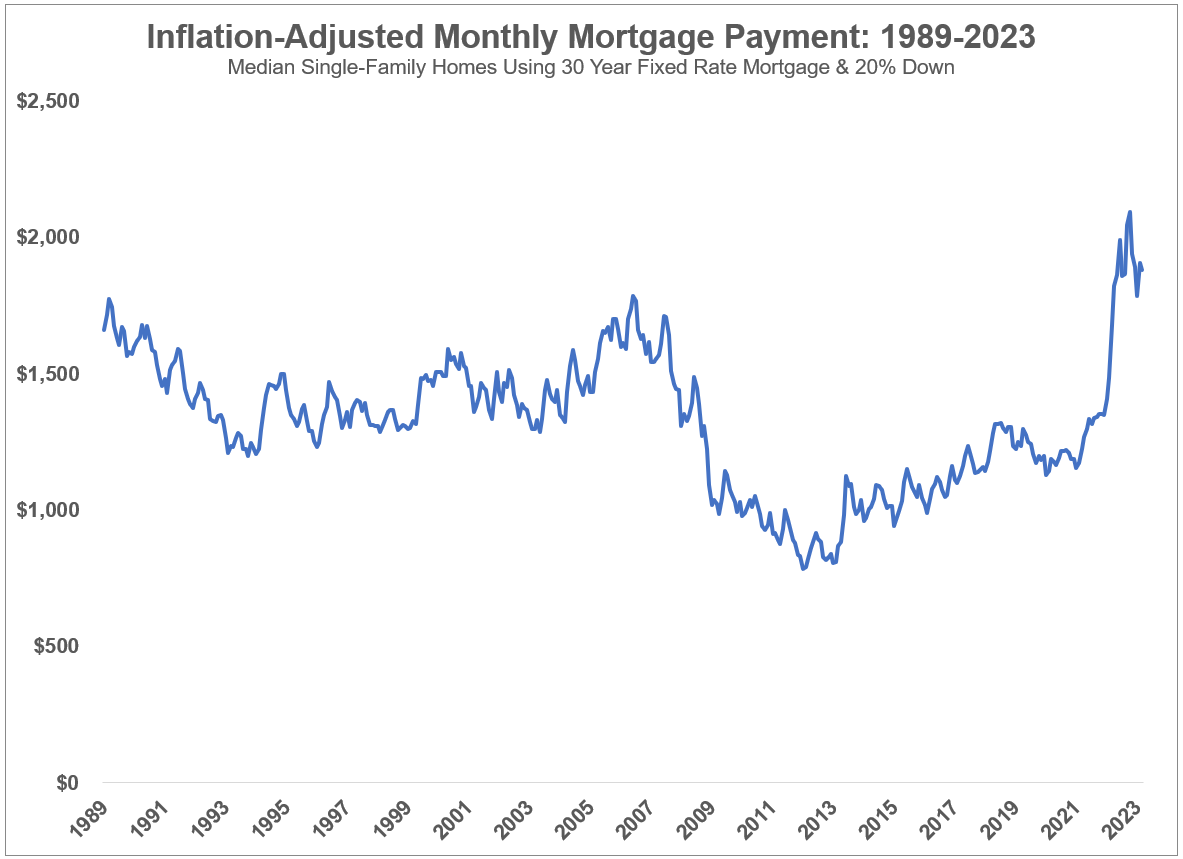

Even when adjusting for inflation to even issues out a bit, housing costs are precarious in the intervening time for anybody taking up a brand new mortgage cost:

There’s a private finance rule of thumb that goes one thing like this — spend someplace within the vary of 28-30% of your earnings on housing.

This stuff should not written in stone however that’s most likely not a foul place to begin with the standard caveats that it will depend on your circumstances, the place you reside, how a lot you save, yada, yada, yada.

Utilizing the identical median worth knowledge for present houses in america, I in contrast the month-to-month cost over time to the median family earnings going again to 1989:

That is simply month-to-month mortgage funds and doesn’t embrace issues like insurance coverage, property taxes or repairs so this isn’t all-encompassing in that 28-30% spending rule.

However this does a pleasant job of placing present mortgage funds into context. Shockingly, mortgage funds had been increased as a proportion of median family earnings again within the late-Eighties and early-Nineties.

The excellent news is actual incomes have elevated over time whereas charges had been falling. That helped.

The dangerous information is charges and costs rose so shortly that we’ve erased affordability in a single day.

It’s most likely not useful to these available in the market for a home right now, however with the good thing about hindsight, the 2008-2017-ish vary seems like a generational shopping for alternative in residential actual property.

In case you bought a house in that timeframe, contemplate your self fortunate. I do.

So what are your choices when you’re available in the market for a home proper now?

You can wait. Housing costs have come down a bit however not practically sufficient to make up for the change in charges and large features we’ve seen in recent times.

With mortgage charges again to just about 7% one would anticipate costs to proceed correcting. I may see mortgage charges staying within the 6-7% vary IF the economic system retains buzzing alongside and IF the Fed doesn’t throw us right into a recession.

Larger for longer mortgage charges may definitely be a headwind for the housing market.

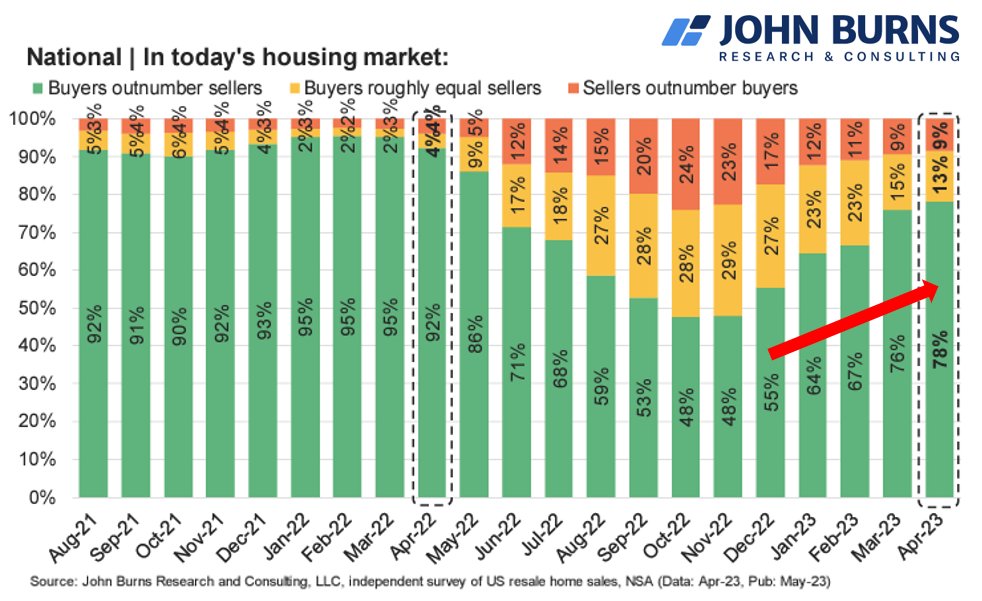

Nevertheless, that’s not a assure due to the supply-demand imbalance we now have.

John Burns Analysis exhibits patrons nonetheless outnumber sellers by a large margin in right now’s market:

The opposite drawback with ready is housing is extra of a private asset than a monetary one. The funds of it clearly matter however most individuals transfer due to life causes, not funding causes.

You can purchase and hope. Finance folks like to say that hope is just not a method. It’s a very good saying however most massive monetary choices have to include some factor of hope in them.

Let’s work by way of the totally different ranges of hope you’d be baking into shopping for a home proper now, even at these worth and mortgage price ranges:

- You hope you’ll be able to develop into your cost over time. The most effective half a couple of mounted price mortgage is your cost is, properly, mounted and your earnings will seemingly develop over time. This is among the causes housing is such a very good inflation hedge.

- You hope mortgage charges will go down. If we do go right into a recession or inflation falls much more or each you’d anticipate rates of interest to go down which might in flip imply mortgage charges would fall. That common $2,651 month-to-month cost at 6.79% would fall to $2,062 at 4.5%. I can’t promise the flexibility to refinance at these charges within the coming years however it might make shopping for at present ranges make extra sense if it occurs.

- You hope the housing market doesn’t roll over. It wouldn’t be a lot enjoyable to make one of many largest purchases of your life solely to see it fall in worth instantly after shopping for. I perceive this fear nevertheless it issues way more when you’re a short-term home-owner. I don’t like the concept of shopping for a home when you’re not going to personal it for at least 7-10 years, which might assist reduce the significance of the present worth level.

Right here’s the factor — it doesn’t matter what sort of housing market we’re in, the one variable that issues is that this: are you able to afford the month-to-month cost and ancillary prices that include proudly owning a house?

For some folks proper now that reply is a powerful NO.

Others will plug their nostril and proceed shopping for proper now as a result of they need or have to personal a house, costs and mortgage charges be damned.

Additional Studying:

The Housing Market Lottery