Because the outlined contribution business continues its tumultuous experience from complement financial savings plans to a full alternative and even an improve to outlined profit plans, many obstacles seem. A few of these obstacles are apparent, inherent to the business in addition to the shortage of assets. However one problem is inherent inside our personal personalities—we see our future selves as strangers. So why sacrifice current pleasures for somebody we barely know or save now for retirement?

Inspecting this dilemma is the life work of UCLA professor Hal Hershfield, who simply accomplished his epic tome, “Your Future Self – Methods to Make tomorrow Higher At the moment.” Hershfield’s analysis confirmed that when folks consider their future selves, it prompts the identical a part of the mind as after we take into consideration others, not ourselves.

It explains why folks battle to do issues which can be good for them and even that they are saying they wish to do. It’s why local weather change is such a troublesome and polarizing difficulty—making sacrifices within the current for future generations or, as Hershfield quotes Groucho Marx in a latest TED Discuss on NPR, “What have future generations ever carried out for us?”

UCLA professor Shlomo Benartzi introduced behavioral finance to the DC world along with his seminal ebook, “Save Extra Tomorrow.” He uncovered lots of our human character defects that stop us from doing the suitable issues at present like inertia and danger aversion. For instance, when individuals are requested per week earlier than a convention whether or not they need bananas or chocolate snacks, 70% make a wholesome selection however the identical proportion go for chocolate on choice day.

The genius of the measures Benartzi prescribed to assist folks to beat our character defects like auto-enrollment, auto-escalation {and professional} managed investments, create a dilemma—lack of engagement. Participant within the ideally suited 401(okay) plan needn’t interact.

There are numerous obstacles as DC plans try to exchange DB plans which embrace:

Information is tough to return by as suppliers are reluctant to share it and there are official privateness issues. The know-how, so wealthy and fast paced in our day by day lives, is inhibited by the platforms that handle office retirement plans. And the aim of making monetary plans by people for people is simply too pricey for the overwhelming majority of the 80 million DC members.

However these apparent business challenges won’t ever be solved till we acknowledge the actual drawback—lack of engagement as a result of our ambivalence about our future selves. This dilemma is much more poignant as we try to include retirement revenue into DC plans. Benartzi has been vocal that we can not auto-enroll folks right into a lifetime revenue resolution—we’d like engagement, and he has created an app to deal with the problem referred to as Pension Plus.

Hershfield makes an attempt to offer options to assist folks make higher selections at present like getting old software program so we are able to relate extra to our future selves however there isn’t a actual panacea like the perfect plan. However earlier than we are able to even try and deal with the issue, we have to higher perceive the foundation of the problem after which work collectively to create some easy options.

Which is why it’s so important that for the retirement business to make quantum leaps, like Benartzi helped us to do with “Save Extra tomorrow.” We should interact teachers and their brave and unbiased strategy to analysis.

Which is why it’s so important that for the retirement business to make quantum leaps, like Benartzi helped us to do with “Save Extra tomorrow.” We should interact teachers and their brave and unbiased strategy to analysis.

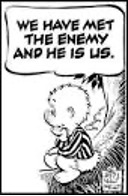

As cartoon character Pogo famously quipped, “Now we have met the enemy and he’s us.” How can we make mates with and assist our future selves? There isn’t any higher individual to assist the business navigate the obstacles and provide you with actual options, not Band-Aids that a lot of the business analysis affords, than UCLA professor Hal Hershfield.

Fred Barstein is founder and CEO of TRAU, TPSU and 401kTV.