The time has lastly come

[ad_1]

In my a number of conversations with buyers through the bull-run since 2014, there was nobody who mentioned that I can’t make the most of investing in fairness when the market will crash. In good instances i.e. when the market valuations are normally very excessive, everybody agrees to the logic of shopping for low and promoting excessive. However curiously, only a few implement this technique. As a substitute, the bulk have a tendency to take a position when markets are going greater and better, getting costly and creates a possible for vital draw back danger. They comply with the herd, take choices primarily based on feelings and throw logic out of the window by succumbing to the psychological stress of witnessing rising market ranges and from the actions taken by their friends.

Investing is easy however not simple. A few of the main errors which individuals commit in an overvalued market are:

1. Investing with out understanding the market cycle. Click on right here to learn our weblog on market cycles

2. Not understanding tips on how to worth belongings. You’ll be able to examine Value vs. Worth by clicking right here. Shopping for one of the best of companies at improper costs may grow to be a foul funding.

3. Not understanding the position & significance of tactical asset allocation (chubby debt in euphoric instances and chubby fairness in a time of acute pessimism) in creating superior returns over the long run.

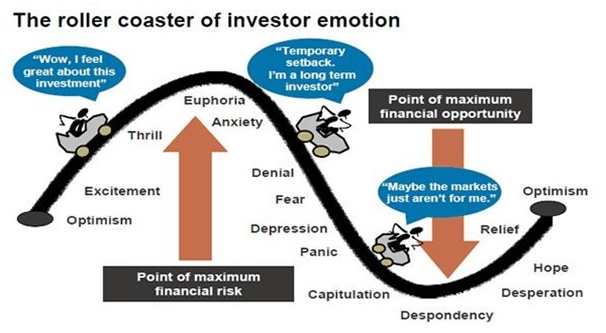

I’m a pupil of the market cycles. One factor may be very clear to me. Like we expertise good days and dangerous days in our lives, markets additionally expertise good instances and dangerous instances. Market worth actions are the apt manifestation of collective human feelings. I wish to reproduce one in all my favorite diagrams – market sentiment cycle.

There had been many market cycles of growth and bust previously and lots of will comply with sooner or later. Each time the explanations for the flip in market cycles are completely different and are sudden however comply with the identical behavioral template. These cycles are inevitable and no mortal on earth has the ability to completely cease it from occurring. Though, that may be delayed because it was completed by the World Central banks by pumping within the large sum of money at any time when markets gave the impression to be on the brink of correction. Folks in energy may delay the larger steadiness sheet downside by flooding the market with low cost cash however didn’t know that the unseen micro enemy will assault the revenue assertion by paralyzing the financial actions. Regardless of pondering that every thing is underneath our management, again and again we’re jolted by such occasions that remind us that we’re simply fallible people and weak in entrance of the need of nature. It’s nature’s manner of humbling us down.

Now a few of chances are you’ll say that no person predicted {that a} virus named Covid-19 will create havoc all around the globe, so it was not doable to be ready for such a danger. Precisely my level – the actual danger is one thing that we can not foresee a lot upfront, all of the identified dangers get already discounted and provisioned for. That’s why the margin of security precept ought to by no means be forgotten. It merely states that the longer term is unsure and unknown, subsequently, the investments ought to be made on the costs equal to or decrease than the long run truthful valuations. This precept, which is on the coronary heart of worth investing, ensures that any unexpected danger that would set off a meltdown won’t lead to a big draw back to the portfolio. Those that had adopted the precept of the margin of security, like us, are sitting fairly on money and equivalents. Having short-sightedness whereas investing or taking part in the momentum recreation may grow to be a really harmful proposition.

Google Search tendencies for the Coronavirus. No one noticed it coming in an enormous manner until January-February 2020:

We’re, nonetheless, lucky to have shoppers who understood our price investing method, saved their belief in our technique, understood the advantage of endurance and persist with us after we remained conservative whereas the markets had been exhibiting indicators of euphoria. We had been sustaining 0-35% large-cap fairness allocation (relying on danger urge for food and time of funding) in all of the portfolios underneath our administration during the last two years because of our evaluation of being within the late stage of the market cycle that was additionally mirrored within the costly fairness costs. We efficiently averted the carnage in mid & small cap in 2018-19 by exiting from all such schemes at the start of 2018 and in addition received benefitted from taking respectable publicity in gold a 12 months in the past when it was buying and selling at INR 32,000-34,000 unit costs. Whereas benchmark Sensex is down by greater than 25% in the final one 12 months, our portfolios returns are within the vary of 0% to five%.

After a pointy fall, the margin of security has considerably gone up i.e. draw back danger potential has drastically diminished. Benchmark PE ratios have additionally come nearer to their long run averages. Now could be the time to make use of the availability created in debt mutual funds to regularly shift to fairness. The utmost draw back out there because of Corona and the anticipated influence on the financial system could possibly be as a lot as 25%-30% from the present ranges. Please word, it’s the most draw back in our evaluation and never very sure to occur. Since, no person can catch the underside, we have to regularly and strategically take greater fairness publicity, inside a restrict of most tactical allocation primarily based on our respective danger profile, because the market goes by means of a downward (sentimental) cyclical development. This can make sure that our common shopping for is at cheaper costs (with a excessive margin of security). So when the market cycle will inevitably flip up once more, which may take a number of months to some years, we might have set a powerful basis for excellent returns sooner or later.

By mere memorizing what Warren Buffet mentioned, “Be grasping when others are fearful and be fearful when others are grasping” gained’t make you wealthier except you implement this saying in spirit. In instances (and alternatives) like these which come as soon as in a decade, it takes braveness, sanity of thoughts and endurance to generate excellent returns in the long run.

Please take all obligatory precautions to remain protected and wholesome. We as a human race have come out of the tough instances attributable to world wars, world pandemics and main monetary crises previously and have solely progressed in the long run. This unlucky time upon us shall cross too.

Truemind Capital is a SEBI Registered Funding Administration & Private Finance Advisory platform. You’ll be able to write to us at [email protected] or name us on 9999505324.

[ad_2]