That is Why You Keep the Course

[ad_1]

Final yr was considered one of the worst years ever for monetary markets.

Name it recency or loss aversion or another Daniel Kahneman bias however for some motive, our brains are hard-wired to imagine large losses will probably be adopted by extra losses (identical to we assume large good points will probably be adopted by extra good points).1

The factor about large losses within the inventory market is typically they are adopted by large losses…however generally they’re adopted by large good points.

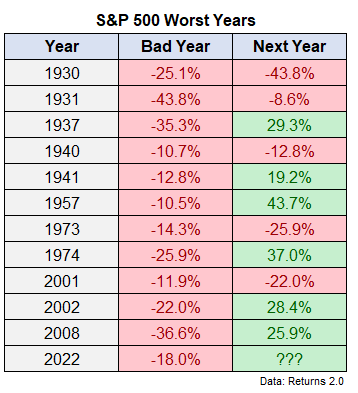

Simply have a look at each double-digit down yr for the S&P 500 going again to 1928 together with the following returns within the following yr:

Traditionally after a foul yr you’re taking a look at feast or famine. You both acquired an enormous rally or additional soul-crushing losses.

It was not a foregone conclusion that shares would rally this yr as a lot as they’ve — the S&P 500 is up virtually 14% whereas the Nasdaq 100 has gained almost 27% this yr. It might have gotten worse if inflation stayed excessive or the Fed broke one thing or we went right into a recession or another danger got here out of left discipline.

Whatever the final result, it is a good lesson within the energy of staying the course as an investor. And I imagine staying the course was the precise transfer whether or not shares cratered much more or took off like a rocket ship.

Why?

What’s the choice? Guess what’s going to occur subsequent? Good luck with that.

Even the professionals do not know what’s going to occur subsequent available in the market.

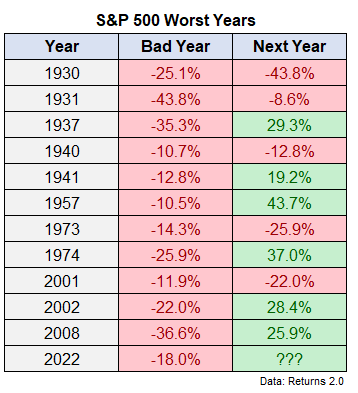

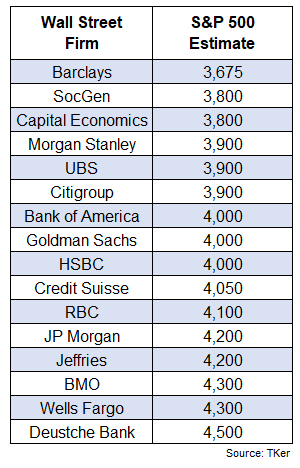

Heading into the yr, Sam Ro printed a listing of S&P 500 year-end worth targets from 16 of the largest Wall Road companies:

The S&P 500 ended 2022 at round 3,840 so there have been a handful of strategists who anticipated gentle losses in 2023 whereas most had been anticipating gentle good points.

It is sensible that Wall Road was tepid coming into the yr contemplating the inventory market fell virtually 20% in 2022.

We’re solely midway by way of the yr so it’s nonetheless somewhat early to supply a full report card for these predictions however the inventory market has outperformed expectations based mostly on the place we sit right now.

As of this writing the S&P 500 is buying and selling at roughly 4,370.

So the inventory market has already gone up greater than any of those strategists, save for Deutsche Financial institution, predicted for the entire yr.

However they’re not ready round to see if these authentic forecasts might come true. Now that shares are up double-digits for the yr many Wall Road strategists are revising their forecasts increased.

Wall Road strategists get pessimistic when shares are falling and optimistic when shares are rising. I don’t share this with you to poke enjoyable at Wall Road.

The purpose of this train is to show how tough it’s to make predictions concerning the future, particularly because it pertains to short-term actions within the inventory market.

When shares fall, our feelings make us assume they’ll fall even additional. And when inventory rise, our feelings make us imagine they will rise much more.

For this reason I’m such an enormous proponent of getting an funding plan you could follow by way of a variety of market and financial environments.

Staying the course means going in opposition to your individual feelings at instances.

Staying the course means considering and performing for the long run even when it doesn’t really feel proper within the short-term.

Staying the course means getting ready not predicting.

Staying the course means doing nothing when that’s what your plan requires.

Sadly, doing nothing is tough work as a result of markets are continuously tempting you to make modifications to your portfolio.

There’s an previous parable a couple of locksmith who had a troublesome time selecting locks when he was only a lowly apprentice studying on the job. He must use all types of instruments and it took him a very long time to open doorways when individuals locked themselves out of their vehicles or houses. However individuals noticed him sweating it out and the hassle was evident in order that they tipped him fairly properly.

However as he slowly however absolutely discovered the tips of the commerce he was in a position to choose locks faster which a lot much less effort. The issue is his ideas went down as a result of he acquired individuals into their automobiles or homes a lot sooner. He made it look too simple.

There’s a good investing lesson on this story.

Clever traders notice effort is commonly inversely associated to outcomes available in the market. Simply since you do extra or attempt more durable doesn’t assure higher outcomes. In reality, doing extra is most of the time damaging to your funding efficiency.

Doing much less or doing nothing in any respect more often than not is the precise approach ahead for almost all of traders.

For this reason you keep the course.

Additional Studying:

2022 Was One of many Worst Years Ever For Markets

1This isn’t all of us, after all. There are at all times going to be contrarians who go in opposition to the grain.

[ad_2]