Submit Brexit UK is seeing increased expert labour coming into from non-EU international locations to help a variety of companies (public and differen

[ad_1]

It’s Wednesday and so earlier than we get to the music section we now have time to debate a couple of points. The primary pertains to the progress Britain is making in its post-Brexit actuality. There may be now rising proof that, regardless of predictions of economists supporting the Stay case, the newly gained freedom that Britain now enjoys because of leaving the EU has allowed it to limit the entry of lower-skilled and lower-paid migrants (from the EU) and appeal to a big enhance in expert migration from non-EU nations with web advantages to the home financial system. Second, it appears the mainstream is now discovering the work of Marxist economists from 5 or extra many years in the past and concluding that it gives a a lot better rationalization of the inflation course of than that supplied by Monetarists (extreme cash provide development) or the mainstream New Keynesian theories which emphasise “departures from a pure charge of output or employment” (NAIRU narratives). That’s progress even when it took some time. Upon getting absorbed all that there’s some nice improvisational music to appease your senses.

Britain’s web migration and Brexit

There was a uncommon admission of error from a British economist yesterday within the UK Guardian article (Could 23, 2023) – Why the panic over rising immigration? The post-Brexit system is working.

I’ve been following the British migration knowledge for the previous couple of years attempting to return to a definitive evaluation of the impacts of the choice to depart the European Union.

Do not forget that among the many predictions of doom, the Stay foyer claimed Britain can be unable to take care of a viable labour provide due to the brand new border restrictions that will accompany Brexit.

Jonathan Portes was a notable critic of the choice to depart.

We additionally disagreed (diametrically) on the British Labour Celebration’s use of the fiscal credibility guidelines, of which he performed an element within the drafting.

The following lot of migration knowledge from the Workplace of Nationwide Statistics will probably be launched tomorrow and I’m awaiting it with curiosity.

However from the information we have already got obtainable – as much as June 2022 – Lengthy-term worldwide migration, provisional: 12 months ending June 2022 (launched November 24, 2023) – we have already got a good suggestion of what’s taking place and the route that the migration is taking.

And it helps Brexit moderately than ratifying the Stay camp’s predictions.

The ONS notes that the June 2022 knowledge was “distinctive” as a result of there have been many uncommon components influencing the information:

… this included the continued restoration in journey following the coronavirus (COVID-19) pandemic, a variety of migration occasions together with a brand new immigration system following transition from the EU, and the continuing help for Ukrainian nationals and others requiring safety.

A few of these components will decline in affect clearly (the Ukraine scenario for instance).

Add into that the Hong Kong scenario additionally, which has produced one-off flows of individuals into the UK.

The information confirmed that:

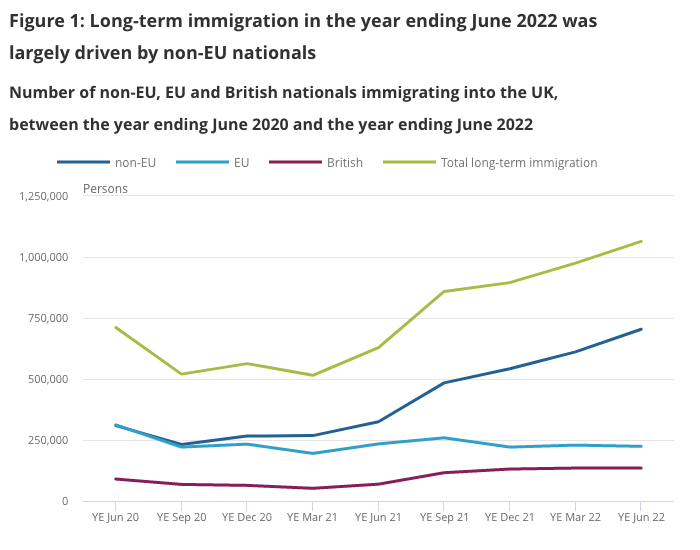

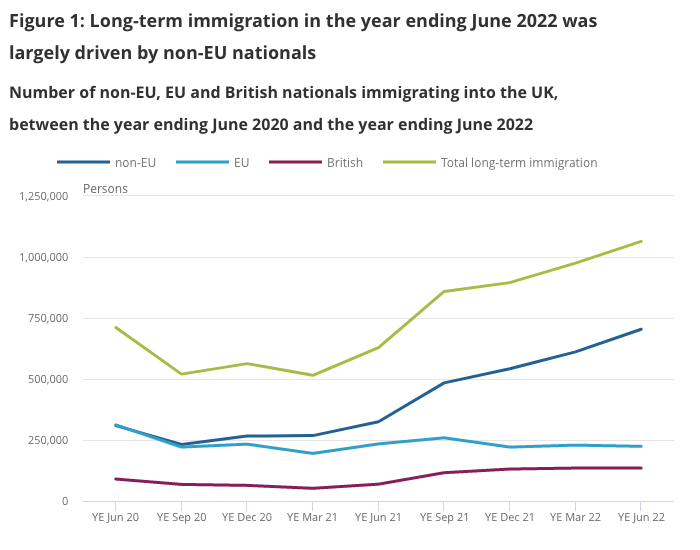

General, web migration continued so as to add to the inhabitants within the YE June 2022, with an estimated 504,000 extra folks arriving long-term to the UK than departing; web migration of non-EU nationals was estimated at 509,000 within the YE June 2022, in contrast with destructive 51,000 and 45,000 for EU and British nationals respectively.

That’s fairly a big web influx of non-EU nationals.

A few of that circulate was as a result of the journey restrictions regarding Covid have been relaxed and college students got here again into the UK to check.

However the development in long-term immigration within the UK is being pushed by non-EU nationals (66 per cent of whole).

And, considerably:

The immigration of EU nationals remained broadly secure within the final 12 months, accounting for 21% of whole immigration (224,000).

So whereas Britain has retained the folks flows with the EU, regardless of Brexit, it has picked up robust development from the non-EU nations (an increase of 379,000 within the 12 months to June 2022).

The next graph (from the ONS publication) tells the story.

The fascinating side of this surge in non-EU web migration is the response of each main political events, which have performed into the palms of the loopy anti-migrant Proper.

Each the related minister and her shadow within the Labour Celebration have indicated they are going to come down laborious on migration.

However those that have studied this, together with Jonathan Portes, know that one of many penalties of Brexit is that the British authorities can now management the folks flows throughout its borders far more than when the nation was a supplicant Member State of the EU and sure to take route on a variety of issues from Brussels as a part of the one market.

Jonathan Portes accurately notes that:

In actual fact, the migration statistics replicate one thing that’s uncommon certainly within the UK proper now – a profitable coverage applied effectively and successfully and, even rarer, the crystallisation of a real “Brexit alternative”.

Who would have thought? Credit score to him.

He notes that there are nonetheless talent shortages being reported within the UK, partly as a result of the “home labour provide constrained by the rise in unwell well being and early retirement.”

The rise in everlasting incapacity arising from Covid is but to be totally documented and measured however it will likely be vital regardless of all of the claims by the mad ‘Covid was a Flu’ gang who’ve teamed up with the Proper to current some bizarre conspiracy narrative.

However other than the Covid impacts, Brexit has modified issues basically in ways in which the Stay camp may by no means understand.

The British authorities is now in cost.

As Jonathan Portes writes:

The federal government has been compelled to make coverage selections round which occupations and sectors must be open to migrant employees.

He additionally notes that the majority economists believed that the lack of commerce and migration flows from the EU because of Brexit would dwarf any features from being extra open to the remainder of the world.

He now concedes:

We have been mistaken.

He’s acknowledging that the information is now displaying that with free motion over, “the circulate of comparatively decrease expert and decrease paid employees to some sectors” has fallen considerably.

On the identical time, by opening as much as the remainder of the world, Britain is now tapping right into a considerably elevated circulate of expert employees who’re:

… coming to work within the NHS, the care sector, and high-skilled and high-paid roles in info and communications know-how, finance {and professional} companies.

This may enhance British productiveness and supply room for increased actual wages as soon as all of the inflation is settled.

As we get extra knowledge on migration and different facets (commerce and many others) it’s doubtless that the newly gained freedom that Britain now enjoys because of leaving the EU will exhibit related web advantages.

Which was my level all alongside when in 2016 I strongly supported the Depart case a lot to the angst of individuals like Jonathan Portes.

However the knowledge is now talking.

The reinventions of inflation idea

I learn a brand new working paper from the Nationwide Bureau of Financial Analysis (NBER) right now – Inflation is Battle – which has determined that “Inflation is because of battle, it can’t be defined by financial coverage or departures from a pure charge of output or employment”.

Additionally they conclude that:

Battle must be considered because the proximate explanation for inflation, fed by different root causes

You will get a non-subscriber model – HERE.

These conclusions appear moderately revolutionary when in comparison with the mainstream narrative, which is at the moment pushing central banks to hike rates of interest in a useless software of a defunct idea.

A younger scholar coming into the world of literature simply now may suppose this ‘new’ thought about battle is genius, given the failures of mainstream approaches so far.

It rejects the concept that inflation arises due to an extreme development within the cash provide.

So there goes Monetarism and all its spinoff concepts – out the window. See ya later.

The authors say that:

… this battle perspective is each insightful and normal.

Genius.

Additionally they realise that that must “purposefully keep away from commonplace macroeconomic fashions, such because the New Keynesian mannequin” on this exposition to keep away from being sidetracked by all of the micro-foundation nonsense that purports to be science however is de facto simply deep faith – and fairly silly faith at that.

I’ll write extra about faith in economics tomorrow.

Wait to be astounded.

After which we get to the purpose.

These new students will then learn:

The battle view on inflation is under no circumstances new, but this angle is essentially unknown to most economists. It was developed and embraced by a relative minority related to a Submit-keynesian custom. Rowthorn (1977) supplied the seminal contribution …

Observe first the acknowledgement of Groupthink amongst “most economists”.

The literature they discuss with is well obtainable and has a protracted standing.

However “most economists” – learn, these within the mainstream custom – haven’t learn it nor even develop into acquainted with it.

Closed minds.

That situation defines my occupation – extra about which tomorrow.

Second, the seminal contribution didn’t come from Robert Rowthorn’s 1977 article – Battle, inflation and cash – which was revealed within the Cambridge Journal of Economics (Quantity 1, No. 3, pages 215-239).

This demonstrates to me that these newcomers within the mainstream to the progressive (heterodox) literature have not likely totally explored that literature to hint the trail that these concepts have taken over time.

It may additionally exhibit an unwillingness to acknowledge that the concepts they’re now pursuing got here out of the Marxist literature.

Robert Rowthorn is perhaps seen because the gentle fringe of that literature given his earlier affiliation with Cambridge College within the UK.

Should you learn the 1997 guide by Susan Unusual – On line casino Capitalism – (Manchester College Press) – you’ll discover a reference to her evaluation that Robert Rowthorn was “one of many few Marxists … who’s learn in enterprise faculties.”

So that may clarify these mainstream authors ignoring the huge literature that influenced Rowthorn’s personal work.

There was a sequence of articles in Marxism As we speak in 1974 which superior the notion of inflation being the results of a distributional battle between employees and capital.

One such article by – Pat Devine (1974) – ‘Inflation and Marxist Principle’, Marxism As we speak, March, 70-92 is price studying if you will discover it.

It’s extra ‘seminal’ than Robert Rowthorn’s subsequent spinoff work.

As an apart, you possibly can view an restricted archive of Marxism As we speak since 1977 which is a really priceless useful resource.

Battle idea recognises that the cash provide is endogenous (versus the Monetarist’s Amount Principle of Cash which assumes, wrongly, that the cash provide is fastened).

On this world, companies and unions have some extent of market energy (that’s, they’ll influences costs and wage outcomes) with out a lot correspondence to the state of the financial system. They each need some targetted actual output share.

In every interval, the financial system produces a given actual output which is shared between the teams with distributional claims. If the specified actual shares of the employees and managers is per the obtainable actual output produced then there isn’t a incompatibility and there will probably be no inflationary pressures.

However when the sum of the distributional claims (expressed in nominal phrases – cash wage calls for and mark-ups) are better than the actual output obtainable then inflation can happens by way of the wage-price or price-wage spiral famous above.

The wage-price spiral may additionally develop into a wage-wage-price spiral as one part of the workforce seeks to revive relativities after one other personnel succeed of their wage calls for.

That’s, the battle over obtainable actual output promotes inflation.

Varied dimensions can then be studied – the extent to which totally different wage contracts overlap and are adjusted, the speed of development of productiveness (which gives “room” for the wage calls for to be accomodated with out squeezing the revenue margin), the state of capability utilisation (which disciplines the capability of the companies to move on rising prices), the speed of unemployment (which disciplines the capability of employees to push for nominal wages development).

Battle theories of inflation word that for this distributional battle to develop into a full-blown inflation the central financial institution has to in the end “accommodate” the battle.

What does that imply?

If the central financial institution pushes up rates of interest and makes credit score dearer, companies will probably be much less capable of pay the upper cash wages (the conceptualisation is that companies entry credit score to “finance” their working capital wants upfront of realisation by way of gross sales). Manufacturing turns into tougher and employees (in weaker bargaining positions) are laid off.

The rising unemployment, in flip, ultimately discourages the employees from pursuing their on-going demand for wage will increase and in the end the inflationary course of is choked off.

Nonetheless, if the central financial institution doesn’t tighten financial coverage and the fiscal authorities don’t enhance taxes or reduce public spending then the incompatible distributional claims will play out and inflation turns into inevitable.

Pat Devine’s article (famous above) additionally launched the notion that inflation was a structural assemble. He argued that the elevated bargaining energy of employees (that accompanied the lengthy interval of full employment within the Submit Second World Warfare interval) and the declining productiveness within the early Seventies imparted a structural bias in the direction of inflation which manifested within the inflation breakout within the mid-Seventies which he says “ended the golden age”.

In one in every of my early articles (1987) – within the Australian Financial Papers – The NAIRU, Structural Imbalance and the Macroequilibrium Unemployment Charge – I developed the notion of a macroequilibrium unemployment charge based mostly on inflation as a battle between labour and capital.

In that work I outlined a conceptual unemployment charge, which is related to worth stability, in that it briefly constrains the wage calls for of the employed and balances the competing distributional claims on output.

So my early work was creating to the view that inflation was the product of incompatible distributional claims on obtainable earnings.

When nominal combination demand is rising too shortly, one thing has to provide in actual phrases for that spending development to be appropriate with the actual capability of the financial system to soak up the spending.

Unemployment can briefly stability the conflicting calls for of labour and capital by disciplining the aspirations of labour in order that they’re appropriate with the profitability necessities of capital.

That was Michał Kalecki ‘s argument which I thought of within the weblog publish – Michal Kalecki – The Political Features of Full Employment (August 13, 2010).

In my 1987 article I wrote:

Inflation outcomes from incompatible distributional claims on obtainable earnings, unemployment can briefly stability the conflicting calls for of labour and capital by disciplining the aspirations of labour in order that they’re appropriate with the profitability necessities of capital … The wage-price spiral lull may very well be termed a macroequilibrium state within the restricted sense that inflation is secure. The implied unemployment charge beneath this idea of inflation is termed on this paper the MRU and has no connotations of voluntary maximising particular person behaviour which underpins the NAIRU idea …

That may be a essential distinction – it’s no shock in a capitalist system that when you create sufficient unemployment you’ll suppress wage calls for on condition that employees, by definition, must work to reside.

However you possibly can underpin this notion of equilibrium with out recourse to the individualistic and optimising behaviour assumed by the mainstream economists.

I wrote that 36 years in the past.

Pat Devine’s preliminary contribution was 49 years in the past.

The mainstream are slowly catching up.

Music – The world at struggle

That is what I’ve been listening to whereas working this morning.

That is from one my favorite Australian bands – The Necks – who’re a three-piece, avante-garde jazz band within the post-minimalist custom (borderline).

Should you go to one in every of their concert events anticipate to listen to about 3 items all through the night as they lay down a fundamental theme then improvise on that and go all kinds of locations with the sound.

This monitor – The world at struggle – comes from their second studio album – Subsequent – which was launched in 1990 and stays my favorite.

The Necks are a trio:

1. Chris Abrahams – piano, organ.

2. Tony Buck – drums and percussion (occasional electrical guitar).

3. Lloyd Swanton – double bass and electrical bass guitar.

However on this monitor you may as well hear the sax enjoying of Timothy Hopkins and the trumpet of – Mike Bukovsky.

You simply put the monitor on and let your thoughts go the place it goes when listening to the band.

Chilled.

That’s sufficient for right now!

(c) Copyright 2023 William Mitchell. All Rights Reserved.

[ad_2]