Shopper credit score excellent grew at a seasonal adjusted annual charge of 5.7% in April 2023 per the Federal Reserve’s newest G.19 Shopper Credit score report, as revolving and nonrevolving debt grew at 13.1% and three.2%, respectively (SAAR). Complete shopper credit score excellent stands at $4.8 trillion (not seasonally adjusted), with $1.2 trillion in revolving debt and $3.6 trillion in non-revolving debt (NSA).

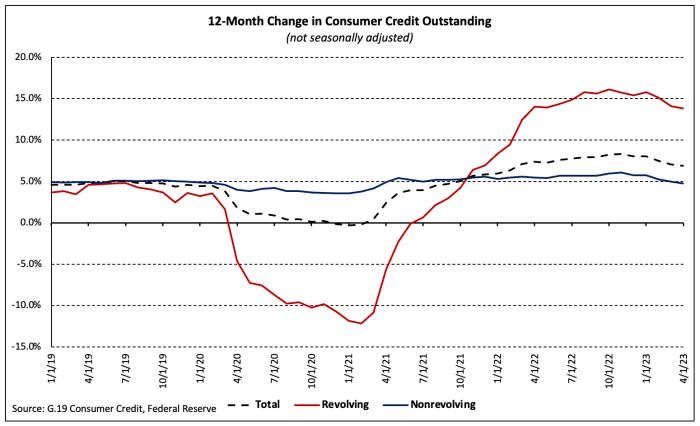

The full steadiness of shopper credit score excellent grew 6.9% over the 12 months ending April 2023 (NSA). Revolving debt grew 13.8% over the interval, practically thrice the expansion in nonrevolving debt (4.8%).

The 12-month progress charge of revolving debt exceeded 10.0% in March 2022 and has not fallen beneath that mark since. The final time progress exceeded 10.0% was from November 2000 by June 2001, a interval throughout which unemployment started to rise and the 2001 recession started.

Revolving and nonrevolving debt accounted for twenty-four.7% and 75.3% of complete shopper debt, respectively. Revolving shopper credit score as a share of the full fell to 21.8% in April 2021—the smallest share since 1986. At 24.7%, the share is roughly equal to the 10-year common of 25.1%. Between April 2022 and April 2023, revolving shopper credit score excellent as a share of the full elevated 1.5 proportion factors.