RBA governor’s ‘Qu’ils mangent de la brioche’ moments of disdain – William Mitchell – Trendy Financial Principle

[ad_1]

The RBA governor had a number of ‘Qu’ils mangent de la brioche’ moments within the final week when he responded to criticisms that his manic rate of interest rising behaviour is driving low-income households into disaster by, first, saying that individuals who couldn’t discover low-cost housing ought to transfer again with their mother and father. Then he adopted that with the advice that folks ought to work tougher and get second jobs in the event that they couldn’t make ends meet as a penalties of the squeeze on their mortgage funds from the RBA’s financial coverage adjustments. Good. That is a unprecedented interval of coverage chaos – we now have an out-of-control central financial institution pushing charges up and utilizing varied ruses (chasing shadows) to justify the hikes, when inflation is falling anyway for causes unconnected to the financial coverage shifts. All of the RBA will achieve doing is rising unemployment and distress. The unemployed will finally bear the brunt of this chaotic coverage interval. However then ‘Qu’ils mangent de la brioche’ they usually can transfer again in with their mother and father!

RBA coverage choices over the long-term

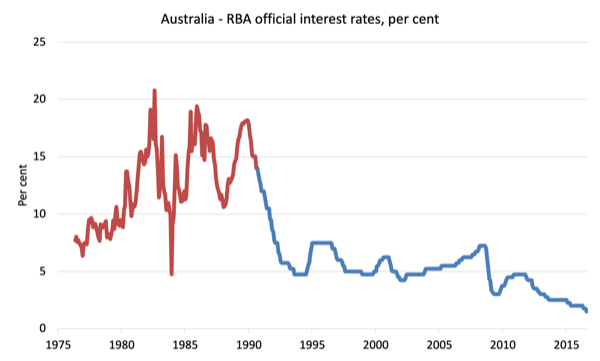

The subsequent two graphs present the rate of interest insurance policies of the RBA because the mid-Seventies.

There are two graphs as a result of the at present out there knowledge was revealed otherwise after January 2011 (day by day foundation) whereas the primary graph is month-to-month in frequency.

Additional, for the primary graph, the RBA’s Money Charge Goal knowledge (blue line) started in August 1990 and the information previous to that (the pink line) is, in reality, the month-to-month common of the Interbank In a single day Money Charge, which carefully follows the Money Charge Goal.

By splicing the 2 closely-related sequence collectively we get a greater image of the interval main as much as the 1991 recession, which was attributable to extreme rate of interest will increase coupled with the pursuit of fiscal surpluses by the then, Labor authorities.

You additionally see within the interval across the GFC how the RBA was pushing charges up simply earlier than the disaster claiming {that a} main inflation outbreak was about to happen after which had been compelled into a significant coverage reversal by the monetary collapse after which, with out justification, earlier than any restoration had occurred in the true financial system, beginning pushing up charges once more, claiming once more that they had been frightened in regards to the potential for inflation.

That untimely tightening was deserted in 2011 because the financial system slowed dramatically and the danger of a recession elevated.

The purpose is that the tradition of the RBA biases them to knee-jerk coverage responses which are sometimes proven by the details to be extreme and wrongly directioned.

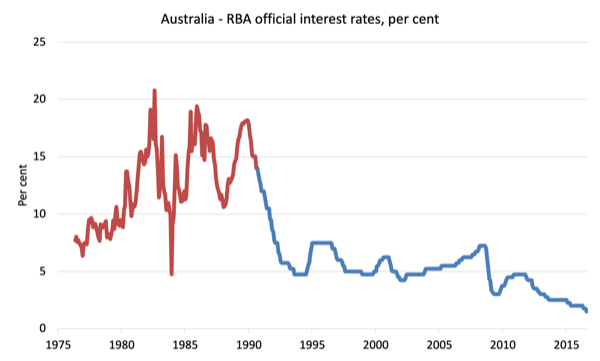

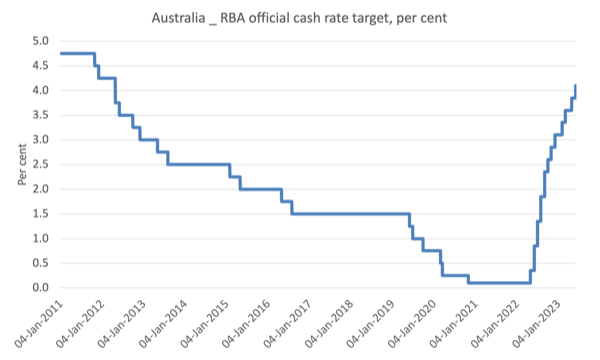

The second graph exhibits the day by day knowledge from the start of 2011 to the present interval (final statement June 7, 2023).

What you glean from this knowledge is the rapidity of the tightening within the present cycle.

The present charge hike interval is likely one of the quickest escalation of charges within the RBA’s historical past.

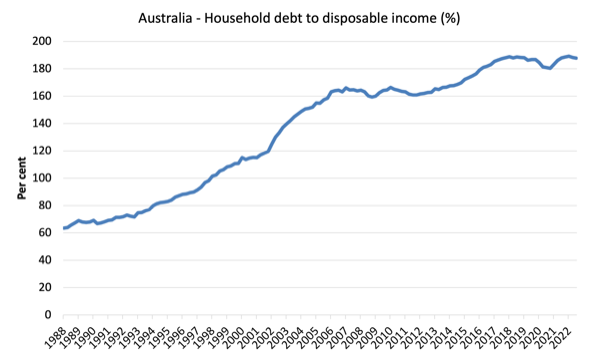

The distinction now – as proven within the subsequent graph – is that Australian households are carrying document ranges of debt relative to their disposable incomes and have little or no room to maneuver, particularly on the backside finish of the revenue distribution.

Contemplating the 2 rate of interest graphs alongside the debt graph, we realise that whereas financial coverage tightened massively within the lead-up to the 1991 recession, the burden of these rates of interest adjustments on family viability in comparison with the tightening now was really decrease as a result of the debt ranges had been decrease.

The typical mortgage steadiness was fairly low within the Eighties in comparison with now.

The diploma of vulnerability to insolvency and foreclosures is way larger now.

Elite disdain

When the French philospher Jean-Jacques Rousseau from his 1790 (English model) autobiographical e-book – Confessions – he recounted the story of a “nice princess” who “when informed that the peasants had no bread, replied ‘ Then allow them to every brioches’.”

This has change into diminished to – Allow them to eat cake – and is commonly attributed to the final Queen of France Marie Antoinette, though that attribution is clearly mistaken given she was aged 9 on the time the quote entered the lexicon and had not even ventured to France by then.

However the basic intent of Rousseau was for example the sheer disdain and dislocation that the elites had for the employees, the poor, those that wrestle to make ends meet.

I considered Rousseau’s Confessions, which I studied at college, within the final week when the RBA governor made a number of extraordinary intrusions into the general public sphere.

First, persons are beginning to realise that the RBA itself is inflicting the persistence of the inflationary pressures as a result of they’re pushing landlords into elevating rents, that are a big weight within the CPI.

I analysed that hyperlink intimately on this publish – RBA loses the plot – Treasurer ought to use powers beneath the Act to droop the RBA Board’s resolution making discretion (Could 3, 2023).

There’s a hire disaster in Australia now and the RBA is making it worse.

As mortgage charges rise, landlords are utilizing their ‘market energy’ to push up rents considerably to guard their actual margins and doubtless gouge some larger mark ups.

When confronted with actuality final week, the RBA governor denied the financial coverage tightening was contributing to the issue and as an alternative provided a type of quasi-psychological, quasi-sociological clarification.

Apparently, we now have adopted life the place we don’t crowd into homes – match as many individuals as can probably match after which some.

Additional, we ought to be staying with our mother and father for longer.

He stated:

As rents go up, folks determine to not transfer out of house, otherwise you don’t have that house workplace, you get a flatmate … Greater costs do lead folks to economise on housing …. Youngsters don’t transfer out of house as a result of the hire is just too costly, so that you determine to get a flatmate or a housemate as a result of that’s the value mechanism at work …

We’ve bought lots of people coming into the nation, folks desirous to stay alone or transfer out of house …

So all you characters on the market who need some house or need to mature and go away your loved ones house or face home violence and should stay alone suck it up and take heed to the RBA governor and squeeze in.

Possibly see if he’ll give you a bed room in his personal home.

And bear in mind he was in a position to buy his then $A1.075 million home in interior Sydney in 1997 courtesy of a house mortgage supplied by the RBA itself which “was locked at half the usual variable charge” (Supply).

If that little ‘mangent de la brioche’ second wasn’t sufficient for one week, the RBA governor addressed the monetary elites in Sydney yesterday and informed the gathering that (Supply):

… struggling Australians can in the reduction of spending or decide up extra work to scale back monetary stress …

The stress being intentionally inflicted by the RBA.

He additionally claimed that staff ought to suck up the true wage cuts as a result of “we now have to make it possible for larger inflation doesn’t translate into larger wages for everyone”.

That’s for certain, eh?

We solely need CEOs and different larger revenue sorts to get the upper pay, not the remainder of us.

What does Trendy Financial Principle (MMT) say about all this?

In fact, the rate of interest will increase are pointless – simply ask the Financial institution of Japan which has held to its low charges since this supply-side inflationary episode began and likewise seen the fiscal authorities hand out money to households and corporations to get them by the cost-of-living disaster.

I ponder why not one of the journalists on the market decline to ask the RBA governor to check his document with that of the Financial institution of Japan’s document?

However the present interval has raised points regarding Trendy Financial Principle (MMT).

After I was working in Kyoto final yr, I spent per week or so with my colleague Warren Mosler who got here throughout to Japan to meet up with us.

Every lunchtime I’d cycle all the way down to his resort from my workplace and we might sit out on a rooftop terrace discussing the progress of the MMT venture in addition to reflecting on all method of issues.

One matter pertains to as we speak’s weblog publish particularly.

I word that there’s discussions out on the Web in regards to the cut up between Warren’s present place on financial coverage and inflation and the view held by the so-called MMT teachers (which should embrace yours actually).

The purpose is that there is no such thing as a single – applies in all conditions – MMT rule on this.

Normally, MMT economists word that financial coverage that depends on rate of interest changes is unsure in affect as a result of, partly, it depends on distributional penalties whose internet outcomes are ambiguous.

Collectors acquire, debtors lose.

How does that internet out?

Unsure.

We additionally level to the chance that rate of interest will increase may have inflationary impacts through the affect on enterprise prices and landlord borrowing prices.

However, there may be some nuance that needs to be utilized when contemplating temporality – that’s, the impacts over time.

The crude model of the ‘cut up’ is that Warren believes the rate of interest will increase are in precise reality expansionary as a result of they’re prompting a fiscal coverage growth through the curiosity funds on the excellent debt.

In our discussions in Kyoto, I outlined my place (the ‘tutorial’ place) like this.

1. No-one actually is aware of whether or not the winners from the rate of interest rises will spend greater than the losers in the reduction of spending.

The proof is that wealth results on consumption spending are comparatively low when in comparison with the revenue results.

However there are numerous issues – reminiscent of saving buffers and so on – that make it arduous to be definitive.

2. Within the rapid interval after the rate of interest rises, the spending responses from debtors is more likely to be restrained as a result of they’ve capability to soak up the squeeze by adjusting their wealth portfolios (run down financial savings and so on).

And, at that temporal interval, the rate of interest rises are more likely to be inflationary as companies move on their elevated borrowing prices within the type of larger costs, and, as famous above, landlords move on their larger mortgage servicing prices as larger rents, which, in flip, feed into the CPI determine.

3. However within the medium- to long run, if rate of interest rises transfer previous some threshold, the affect is to gradual spending and improve unemployment.

Ultimately, those that profit from the rate of interest will increase, who usually have a decrease marginal propensity to devour (how a lot they spend out of each further $ acquired), run out of issues to purchase and pocket the bonuses.

And ultimately, the spending cuts from the debtors, significantly decrease revenue mortgage holders, begins to dominate.

The Australian knowledge clearly demonstrates this temporal impact.

The issue is that when a nation reaches this level, given the delays in knowledge publication and so on, the injury is already completed.

So in making an attempt to grasp these completely different accounts we now have to understand a number of issues, which incorporates:

1. The extent of family debt – the upper the debt, the extra the unfavorable impacts of the rate of interest rises will likely be on spending.

2. The proportion of inhabitants that has mortgage debt – the upper the proportion the extra seemingly it’s that the medium- to longer-term results will change into dominant.

3. Crucially, the proportion of mortgage debt that’s mounted charge in comparison with variable charge.

This final consideration is necessary in understanding why we’d think about the dynamics of rate of interest rises within the US (which is the idea of Warren’s conjectures) to be completely different to elsewhere.

On December 14, 2021, the OECD revealed an attention-grabbing Economics Division Working Paper (No. 1693) – Mortgage finance throughout OECD nations – which supplied an in depth breakdown of the incidence of variable versus mounted charge mortgages within the OECD nations in addition to different statistics relating the factors above.

We be taught that:

1. “Homeownership charges and the variety of households with a mortgage present massive variations throughout OECD nations …”

2. “A number of nations mix comparatively excessive ranges of homeownership and low take-up of mortgages.”

3. “Homeownership and mortgage use is considerably decrease for younger or low-income households … ”

4. “Low-income households spend bigger shares of their revenue on mortgage funds with appreciable heterogeneity throughout the OECD” – Decrease revenue households within the US are much less more likely to have a mortgage than in say, Australia.

5. In Australia, for instance, variable charge mortgages dominate (round 84 per cent), whereas within the US the overwhelming majority are mounted charge (round 2 per cent are variable).

6. The US additionally has a comparatively low mortgage debt service ratio (round 8 per cent) in comparison with say Australia, which is slightly below 20 per cent of family revenue.

For those who think about these variations, then we are able to see why the conduct of the Federal Reserve Financial institution at current just isn’t more likely to generate recession.

The debt ranges within the US are comparatively excessive by historic requirements, the excellent mortgages are principally mounted charge over lengthy durations and held by these additional up the revenue distribution, which implies that the rising rates of interest are much less more likely to trigger main spending cutbacks from mortgage holders.

Then the upper incomes that the wealth holders acquire from the Federal Reserve charge hikes dominate.

However think about Australia (and different nations in Europe, the UK, Canada and so on) the place the overwhelming majority of mortgages are variable charge and extra more likely to be held by low-income households, then the rising mortgage funds will squeeze disposable revenue and finally a bust happens.

In its – Monetary Stability Evaluation October 2022 – the RBA performed a sensitivity evaluation on the affect of rate of interest hikes on indebted households’ spare money flows.

They discovered that:

Rate of interest will increase of 21⁄2 proportion factors … the online impact could be a discount in month-to-month spare money stream (relative to April 2022 ranges) of round $1,300 – or 13 per cent of family disposable revenue.

That was for “a extremely indebted family incomes $150,000 of gross revenue (across the median revenue for a pair household with dependent youngsters) with $800,000 in debt.”

The state of affairs could be worse for decrease revenue households.

However that squeeze is very large and an analogous evaluation for the US would discover a a lot smaller affect.

So there is no such thing as a ‘cut up’ throughout the MMT ranks on this problem.

The distinction is outlook within the current state of affairs pertains to the completely different circumstances that may come up throughout nations.

One at all times needs to be cautious when appraising a state of affairs to not apply a ‘one-size-fits-all’ evaluation.

The world is complicated and the nuances are necessary.

Conclusion

At any charge, the RBA is driving the Australian financial system in direction of recession and forcing low-income mortgage holders to bear the brunt of its misconstrued struggle towards inflation.

Inflation in Australia has been falling for months now for causes unrelated to the financial coverage adjustments.

All of the RBA will achieve doing is rising unemployment and distress.

The unemployed will finally bear the brunt of this chaotic coverage interval.

However then ‘Qu’ils mangent de la brioche’ they usually can transfer again in with their mother and father!

That’s sufficient for as we speak!

(c) Copyright 2023 William Mitchell. All Rights Reserved.

[ad_2]