Move-By means of Entity Taxes: Mechanics, Issues, And Planning Alternatives For Navigating SALT Cap Workarounds

[ad_1]

The 2017 Tax Cuts & Jobs Act launched a $10,000 restrict on the State And Native Tax (SALT) deduction that was beforehand accessible for taxpayers who itemized their deductions. In response to the brand new deduction restrict, many states enacted legal guidelines creating a brand new Move-By means of Entity Tax (PTET) designed to assist house owners of pass-through companies (partnerships, LLCs, and S companies) keep away from the limitation and protect the deductibility of their state tax funds. With IRS giving its blessing to this strategy by way of Discover 2020-75, 33 states now have some type of PTET accessible and, in consequence, house owners of pass-through companies who stay (or do enterprise) in these states could also be contemplating whether or not to make a PTET election.

At a excessive stage, PTETs work by permitting enterprise house owners to elect to pay state taxes on their enterprise earnings – that are historically paid on their particular person tax returns – from the enterprise itself. This shifts the enterprise proprietor’s state tax funds from being a private expense (and topic to the $10,000 SALT deduction restrict for Federal tax functions) to being a enterprise expense that’s totally deductible from Federal earnings. Lastly, the enterprise proprietor will get a state tax credit score in opposition to their particular person tax legal responsibility to partially or utterly offset their share of the tax paid by the enterprise.

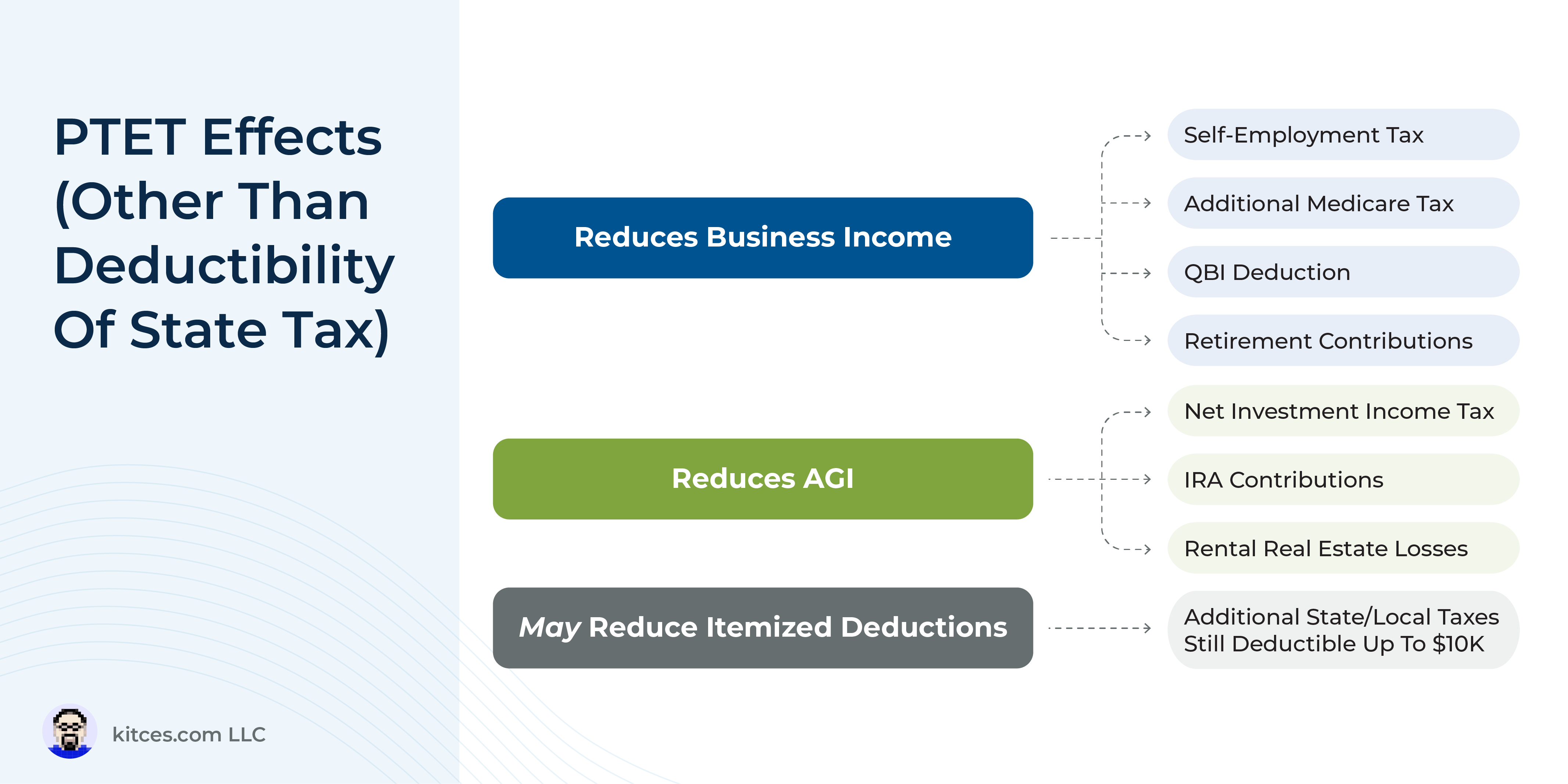

However whereas the easy description of PTETs would possibly make the choice to elect one look like a no brainer, in actuality there are myriad concerns at play that imply an in depth evaluation is mostly required earlier than deciding to make an election or not. First, PTETs usually lead to paying larger state taxes; whereas some states tax pass-through entities at a better price than people, others could not present a 100% tax credit score for taxpayers to completely offset their share of the enterprise’s PTET paid (which means {that a} portion of that earnings is successfully double-taxed). Nonetheless, regardless that the PTET may end up in larger state taxes, the financial savings in Federal taxes that may outcome from with the ability to deduct the PTET as a enterprise expense (together with not simply earnings tax however probably self-employment taxes, web funding earnings tax, and extra Medicare taxes as effectively) would possibly nonetheless make the election value it general.

One other set of concerns includes house owners of companies that function in a number of states, which may compound the complexity of electing a PTET. With a number of, usually conflicting state legal guidelines at play for enterprise house owners, deciding whether or not or to not elect the PTET in any given state includes weighing not solely the influence of the state’s PTET on any potential Federal tax financial savings, but additionally further elements concerned in electing a PTET throughout state strains. A few of these can embrace whether or not there are further submitting necessities (e.g., a enterprise proprietor who beforehand wasn’t required to file a nonresident return in a state the place they do enterprise could also be required to take action if the enterprise elects that state’s PTET) and whether or not the taxpayer’s house state will give them credit score on their particular person tax return for entity-level taxes paid to a different state (which could outcome within the enterprise earnings being taxed by 2 states directly if the credit score isn’t allowed).

In the end, for a subset of taxpayers – particularly high-income house owners of pass-through companies in high-tax states, who ideally solely do enterprise in 1 or a small variety of states to cut back the general complexity – PTETs can present a possibility for vital Federal tax financial savings. Advisors who will help their purchasers with tax planning methods to make the most of PTETs – beginning with figuring out when it’s actually worthwhile to take action – can present vital worth given the complexity of the choice. And with the SALT deduction restrict at the moment set to run out after 2025, there’s no time like the current to start out delivering that worth!

Learn Extra…

[ad_2]