Inflation Slows to Lowest Stage since March 2021

[ad_1]

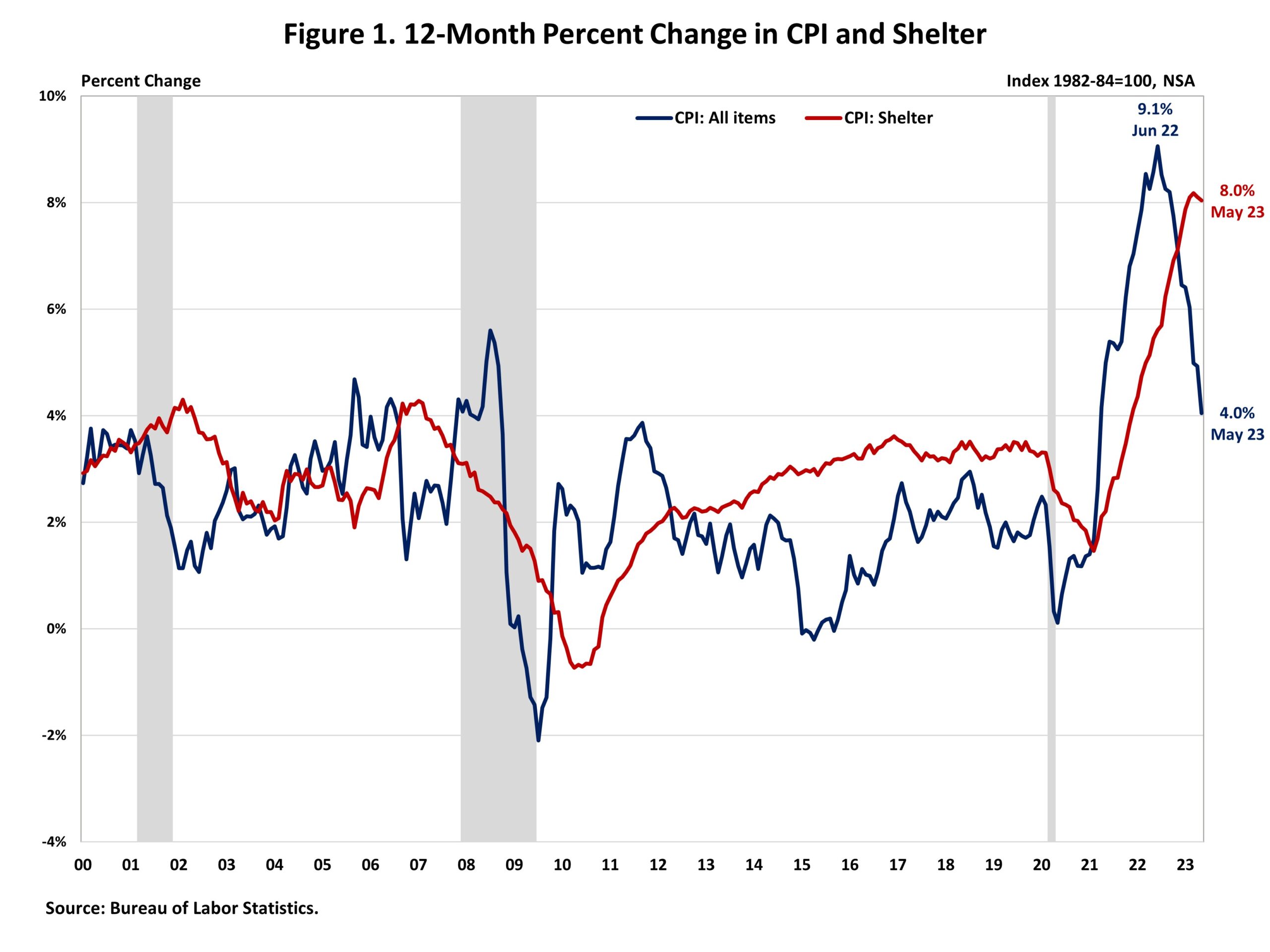

Client costs in Might noticed the smallest year-over-year achieve since March 2021, primarily pushed by decrease vitality costs. This marked the eleventh consecutive month of deceleration. Whereas this measure aligned with expectations, core inflation remained persistent as a result of enhance in hire costs. The shelter index (housing inflation) continued to be the most important contributor to each headline and core inflation, accounting for over 60% of the rise in all objects excluding meals and vitality.

The Fed’s means to deal with rising housing prices is restricted as shelter value will increase are pushed by an absence of reasonably priced provide and rising growth prices. Extra housing provide is the first resolution to tame housing inflation. The Fed’s instruments for selling housing provide are at finest restricted. The truth is, additional tightening of financial coverage will harm housing provide by rising the price of AD&C financing. This may be seen on the graph beneath, as shelter prices proceed to rise regardless of Fed coverage tightening. Nonetheless, the NAHB forecast expects to see shelter prices decline later in 2023, supported by real-time knowledge from personal knowledge suppliers that point out a cooling in hire development.

The Bureau of Labor Statistics (BLS) reported that the Client Value Index (CPI) rose by 0.1% in Might on a seasonally adjusted foundation, following a rise of 0.4% in April. The worth index for a broad set of vitality sources fell by 3.6% in Might because the gasoline index (-5.6%), the pure gasoline index (-2.6%) and the electrical energy index (-1.0%) all decreased. Excluding the unstable meals and vitality elements, the “core” CPI rose by 0.4% in Might, because it did in April and March. In the meantime, the meals index elevated by 0.2% in Might with the meals at house index rising 0.1%.

In Might, the indexes for shelter (+0.4%), used automobiles and vehicles (4.4%) and motorcar insurance coverage (2.0%) had been the most important contributors to the rise within the headline CPI. In the meantime, the indexes for family furnishings and operations (-0.6%) and airline fares (-3.0%) declined in Might.

The index for shelter, which makes up greater than 40% of the “core” CPI, rose by 0.6% in Might, following a rise of 0.4% in April. Each the indexes for homeowners’ equal hire (OER) and hire of major residence (RPR) elevated by 0.5% over the month. Month-to-month will increase in OER have averaged 0.6% over the past 5 months. These features have been the most important contributors to headline inflation in current months.

In the course of the previous twelve months, on a not seasonally adjusted foundation, the CPI rose by 4.0% in Might, following a 4.9% enhance in April. This was the slowest annual achieve since March 2021. The “core” CPI elevated by 5.3% over the previous twelve months, following a 5.5% enhance in April. The meals index rose by 6.7% whereas the vitality index fell by 11.7% over the previous twelve months.

NAHB constructs a “actual” hire index to point whether or not inflation in rents is quicker or slower than total inflation. It offers perception into the availability and demand situations for rental housing. When inflation in rents is rising quicker (slower) than total inflation, the actual hire index rises (declines). The actual hire index is calculated by dividing the value index for hire by the core CPI (to exclude the unstable meals and vitality elements). The Actual Lease Index rose by 0.1% in Might.

Associated

[ad_2]