In evaluating prosperity throughout international locations, productiveness and inequality are nearly all the things

[ad_1]

Paul Krugman as soon as

mentioned that to enhance a rustic’s lifestyle over time

“productiveness is not all the things, however, in the long term, it’s nearly

all the things”. I wish to use a current Decision Basis research to

look at a barely totally different query, which is what determines

variations in prosperity throughout international locations. The reply may be very

related, however with an essential modification.

The Decision

Basis report by Krishan Shah and Gregory Thwaites

compares productiveness and (PPP adjusted) incomes per family within the UK with the

US, Germany and France, and with France it seems to be at each 2008 and

2019 so we will take a look at the comparability over time. But it surely begins with

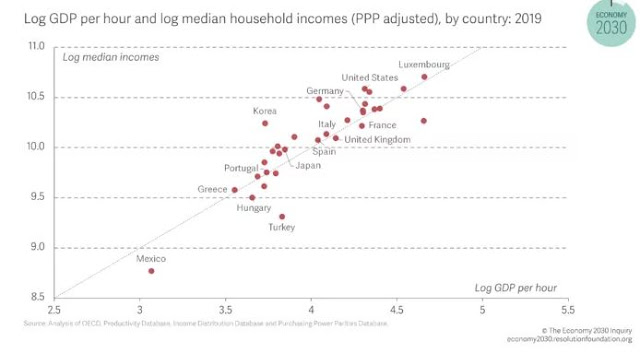

the next chart which incorporates many extra international locations.

This plots GDP per

hour (productiveness) on the horizontal axis towards median earnings

(each logged) for numerous international locations. The road passing by way of the

factors is the 45 diploma line, and the truth that the factors are

clustered round this line exhibits that variations in productiveness are

crucially essential. Nevertheless there are massive divergences from that

line, suggesting different components are essential.

The primary key level,

which may get misplaced within the element of the report, is that incomes are

not the identical as prosperity, in case you outline prosperity in a extra

basic sense. Three of a very powerful features of prosperity that

should not captured by incomes are leisure, public items and funding.

Contemplate every in flip.

Think about two

international locations. In a single, folks work lengthy hours, have few holidays and have

a protracted working life, and consequently their incomes are excessive. In

one other, folks work much less hours, have longer holidays and retire

earlier, and their incomes are much less consequently. It will clearly be

a mistake to name the nation the place folks work extra hours a extra

affluent nation. We might ask the identical query the place incomes

differ due to totally different ranges of tax, the place tax goes to pay for

extra public items. The nation the place incomes are greater however much less

items are supplied by the state is just not essentially extra affluent,

significantly if non-public sector provision of those items is much less

environment friendly (assume US healthcare). These are key points when evaluating

the US and France, for instance.

The ultimate level is

that you might increase incomes by not investing sooner or later. As

future productiveness will depend on funding at the moment, this may increase

folks’s incomes at the moment, however on the expense of their incomes

tomorrow. Variations in funding could happen not simply in producing

extra capital items, buildings and many others, but in addition with funding in

schooling, or just by way of earnings from abroad belongings.

These components are

essential to contemplate once we take a look at the connection between

comparisons of productiveness and comparisons of earnings per family.

Right here is the report’s comparability between the UK and France in 2019.

On the left we’ve got

GDP/hour labored, a measure of productiveness [1]. That exhibits that

France is 17% extra productive than the UK. The penultimate column is

common family earnings, the place France and the UK are nearly equal.

Why is France extra productive however incomes are not any greater? The primary

reply is the ‘employee/inhabitants’ column, which on this case

primarily displays earlier retirement in France (but in addition longer life

expectancy). Does that imply that the common French individual is just not

extra affluent than the common individual within the UK, regardless of being extra

productive? Virtually definitely [2] not, as a result of folks in France have

determined to make use of their larger productiveness to retire earlier.

Variations within the

proportion of employees to the inhabitants doesn’t simply mirror

retirement. There are fewer younger folks within the workforce in France.

That is partly an funding impact (extra schooling) but in addition

displays excessive youth unemployment. The opposite massive issue decreasing

common incomes in France is the ratio of home family earnings

to nationwide home earnings. This partly displays the truth that

French companies make investments extra so the share of income in GDP is greater

(and the wage share decrease), however it additionally displays greater taxes and

(nearly definitely) subsequently extra public items. [3]

I hope it’s now

clear why I wished to emphasize the excellence between incomes and

prosperity. Though common incomes in France could also be no greater than

within the UK, the French are nonetheless extra affluent as a result of they’ve

used their productiveness benefit to have an extended retirement, have

extra public items and to speculate extra sooner or later. So productiveness

stays essential to prosperity, however how folks get pleasure from that prosperity

will be fairly totally different between international locations.

A last however essential

level comes from evaluating the final two columns. Median earnings is the

earnings of the individual in the course of the earnings distribution, the place

you could have as a lot probability of getting an earnings above or beneath that

degree. If the distribution of earnings may be very unequal, and in

explicit whether it is skewed in favour of these on the high, median

earnings can be beneath common earnings. Median incomes are considerably

greater in France than within the UK, as a result of the UK is extra unequal. So

though productiveness is essential in making cross nation comparisons

of prosperity, inequality can be essential. (For a extra detailed

comparative evaluation of various earnings brackets, see John

Burn-Murdoch right here. For a dialogue of the affect of

modifications within the proportion of earnings taken by the highest 1% within the UK

over time, see right here

and significantly right here.)

The comparability for

2008 relatively than 2019 illustrates a key level that’s acquainted. Whereas

the productiveness hole in 2019 was 17%, it was solely 7% in 2009. The

final 10/15 years actually has been a interval

of UK decline. The 2019 comparability with Germany throws

up similarities and variations to France that the report goes into.

Whereas the productiveness hole is comparable, the advantages are taken in

phrases of working much less hours relatively than much less years. Turning to the

US, the productiveness hole with the UK is just like the hole with

Germany and France, however US earnings is far greater. A few of that massive

hole is as a result of employees within the US work extra hours, and taxes are decrease

as a result of public good provision is decrease, however there are additionally

variations that should mirror issues with the information used.

This evaluation by the

Decision Basis illustrates two basic factors. First,

comparisons of non-public (post-tax) earnings ranges are a partial

indicator of relative prosperity, as a result of they ignore leisure,

funding and public items. For that cause, a comparability of

productiveness ranges could also be a greater indicator of comparative

prosperity than relative earnings ranges. Second, what productiveness

ignores is the usually vital affect totally different ranges of

inequality can have on the prosperity of the everyday family.

[1] GDP/hour labored

is a really mixture measure of productiveness, and will mirror

totally different compositions of output in addition to how productive related

companies are.

[2] We might drop

the just about if we might make certain that the distinction in retirement ages

represented nationwide preferences, together with selections about retirement

incomes.

[3] In concept greater

income might mirror greater dividends relatively than greater funding,

in fact. This hyperlinks to the decoupling debate (between productiveness

and actual wages) I

talked about right here, based mostly on work

by Teichgräber and Van Reenen.

[ad_2]