How Ought to You Choose Your Funding Efficiency?

[ad_1]

A reader asks:

My goal date fund does rather a lot worse than SPY. Ought to I simply transfer to an index fund for my 403(b)?

The S&P 500 is the market we speak about essentially the most incessantly within the monetary media in order that’s the benchmark most traders use when attempting to gauge efficiency.

It is a mistake, particularly if you’re a diversified investor.

Let’s take a look at an instance to point out why your targetdate fund may be underperforming the S&P 500.

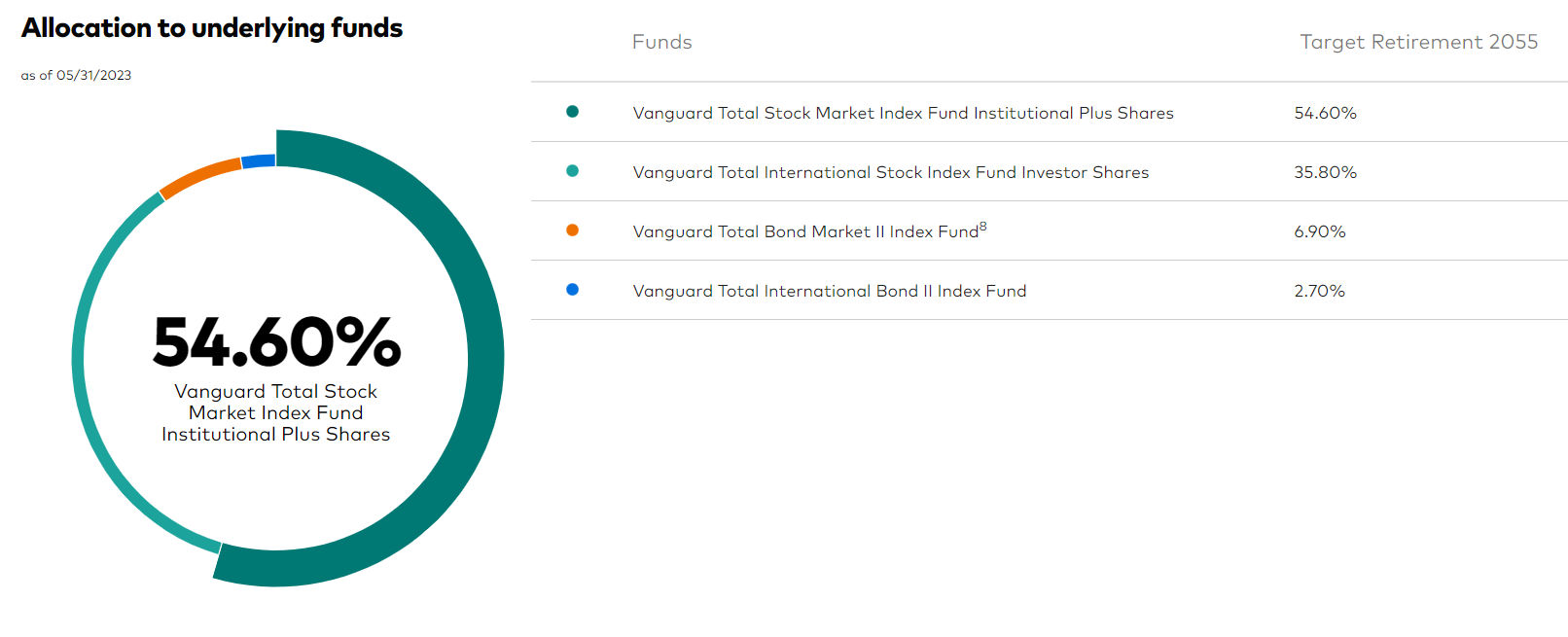

I don’t know which targetdate fund you’re utilizing however let’s take a look at Vanguard 2055 targetdate fund to see what the allocation seems like:

Greater than 90% of this fund is invested in shares, with a 60/40 combine between U.S. and worldwide shares (which is mainly how the world market cap seems). The opposite 10% or so is invested in U.S. and worldwide bonds.

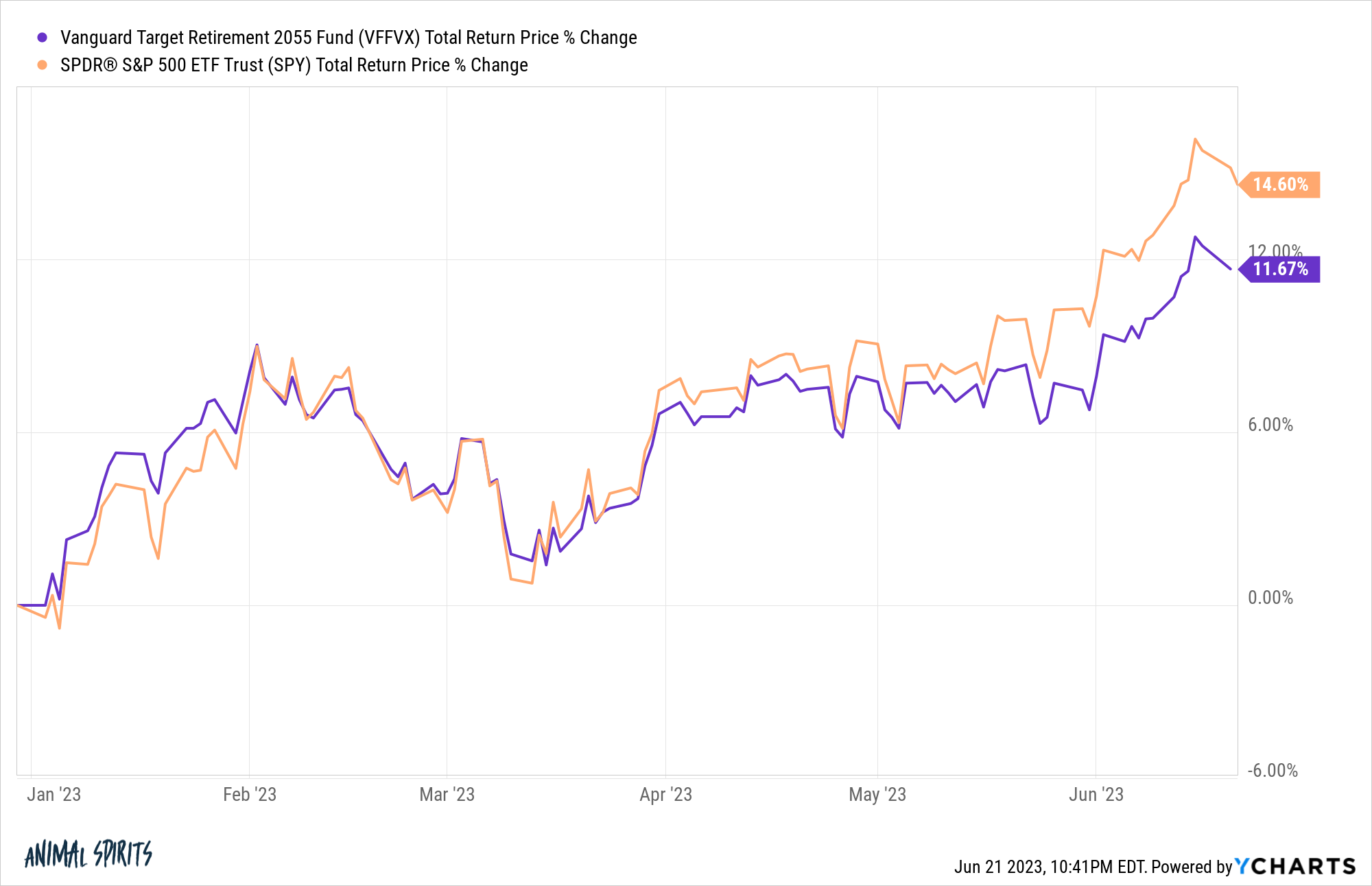

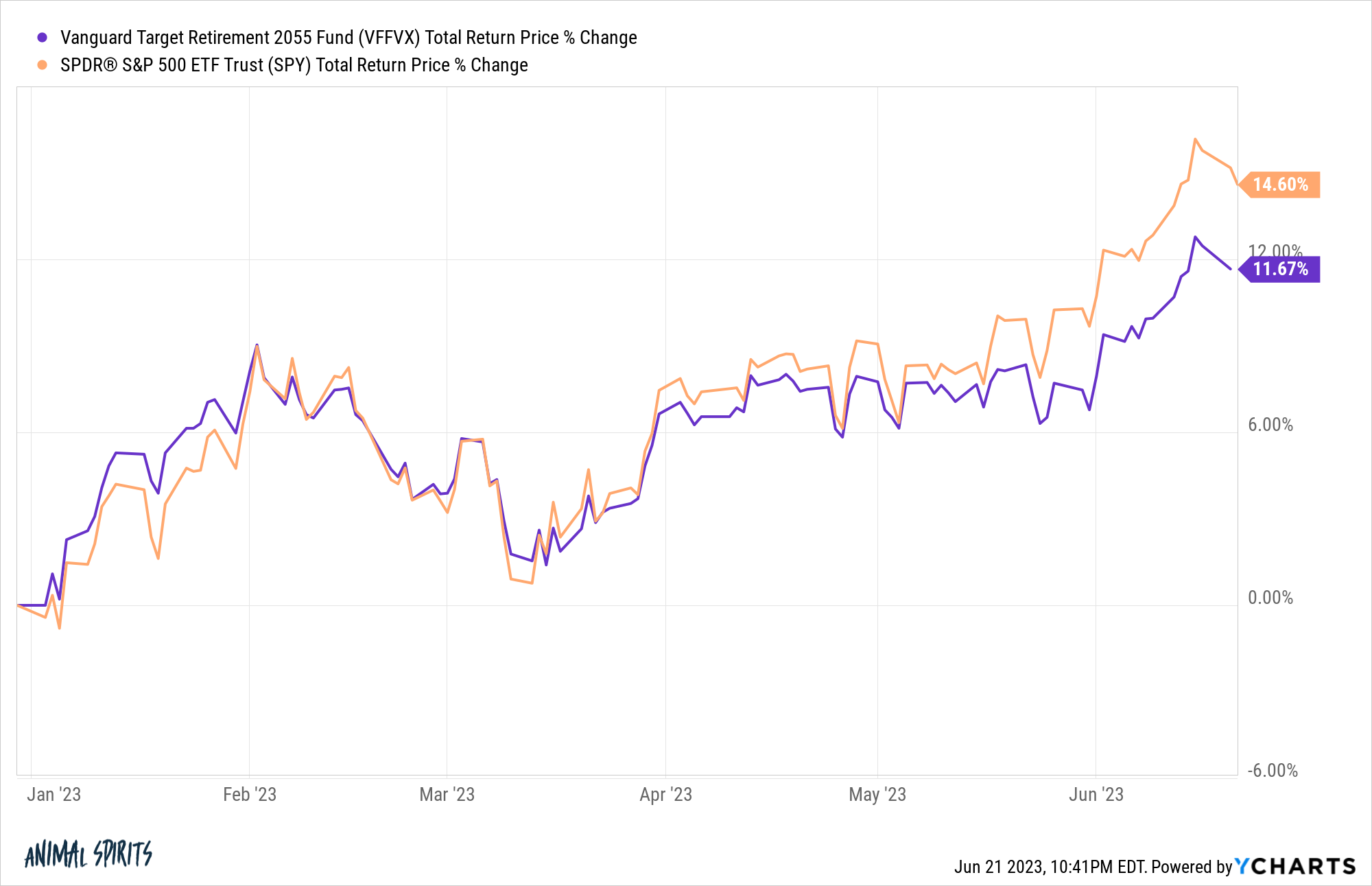

You’ll be able to see this fund is underperforming the S&P 500 this 12 months:

Why is that this the case?

It’s fairly easy actually.

U.S. bonds are up lower than 3% whereas worldwide bonds are up a bit of greater than 3%. Worldwide shares are up 10% on the 12 months whereas the S&P 500 is up greater than 14%.

In case your goal portfolio is a 100% allocation to the most important shares in america and you might be underperforming the S&P 500, that’s an issue. But when your goal allocation is one thing extra diversified then utilizing the S&P 500 as a benchmark is evaluating apples to oranges.

Early on in my funding profession, I used to be taught the SAMURAI acronym to recollect what constitutes a reliable benchmark:

- Specified upfront (ideally in the beginning of the funding interval)

- Acceptable (for the asset class or model of investing)

- Measurable (straightforward to calculate on an ongoing foundation)

- Unambiguous (clearly outlined)

- Reflective of the present funding opinions (investor is aware of what’s within the index)

- Accountable (investor accepts the benchmark framework)

- Investable (doable to spend money on it immediately)

I truly assume a targetdate fund is an efficient benchmark for diversified traders. It checks all of the bins.

I’m an enormous proponent of targetdate funds as a result of they’re typically:

- Low value

- Broadly diversified

- Rebalanced robotically in your behalf

- Easy (a single fund of funds)

- They’re professionally managed

- They modify the asset allocation for you over time

Now, it may very well be you don’t have your portfolio aligned together with your tolerance for danger. If underperforming throughout raging bull markets is an issue perhaps it’s good to be totally invested in shares.

All of my retirement funds are 100% in shares however that’s me. You additionally need to take care of the draw back of being totally invested throughout soul-crushing bear markets too. There are all the time trade-offs concerned.

Not everybody can deal with that a lot volatility however for these with the intestinal fortitude it will probably make sense.

My fear right here is the one motive you’re wanting to place your entire cash into an S&P 500 index fund is as a result of it’s top-of-the-line performing markets on the earth, not solely this 12 months, however for the previous 10+ years.

It’s one factor to make portfolio choices primarily based on modifications to your circumstances, danger urge for food or time horizon. Issues come up once you make portfolio choices primarily based on latest efficiency numbers that don’t have anything to do together with your objectives or emotional disposition as an investor.

The right portfolio will all the time look clear with the good thing about hindsight. Diversification implies that your portfolio will by no means be totally invested within the best-performing asset class, technique, issue or fund. However that’s a function, not a bug.

This query actually boils right down to the way you’re benchmarking your funding efficiency within the first place.

Benchmarking will be helpful when it’s arrange with good intentions, lifelike expectations, and a system of checks and balances to make sure it’s incentivizing the specified habits, not only a set of desired outcomes.

Benchmarking your efficiency to different traders or an funding that doesn’t match your portfolio’s allocation will be dangerous as a result of it will probably trigger you to make choices that go in opposition to your personal greatest curiosity.

It’s all the time going to really feel like it is best to’ve taken much less danger throughout a bear market and extra danger throughout a bull market. The aim is to choose a goal asset allocation that may steadiness these emotions to mean you can survive each varieties of markets.

And the one true benchmark it is best to actually care about is whether or not or not you’re on observe to attain your monetary objectives.

Actual danger for traders has nothing to do with underperformance or black swans or recessions or market crashes or any of that stuff we obsess about on a regular basis.

The true danger is that you just don’t attain your monetary objectives. I’ve by no means met a single efficiently retired one who acquired to that time by listening to alpha or Sharpe ratios.

You don’t decide your funding efficiency primarily based solely on what “the inventory market” is doing. You decide your efficiency primarily based in your asset allocation.

And that asset allocation needs to be tied to your danger profile, time horizon and objectives.

We mentioned this query on the most recent Ask the Compound:

Invoice Candy joined me but once more to debate questions on long term inventory market efficiency, the professionals and cons of Roth IRAs, the advantages of HSA accounts and when to spend Roth cash throughout retirement.

Additional Studying:

The Case For Worldwide Diversification

[ad_2]