How Low cost (or Costly) is the Inventory Market Proper Now?

[ad_1]

I’ve by no means been an enormous fan of monetary jargon as a result of more often than not it’s used to impress individuals reasonably than assist them perceive what you’re speaking about.

Right here’s a chunk of jargon that by no means made a lot sense to me — honest worth.

Our honest worth of the S&P 500 is 4,357 primarily based on blah, blah, blah.

Honest relative to what? Historic information? Different markets? Earnings? Gross sales? Free money circulate? Rates of interest? Taylor Swift live performance ticket costs?

The issue in making an attempt to nail down honest worth is there are such a lot of completely different valuation measures to select from.

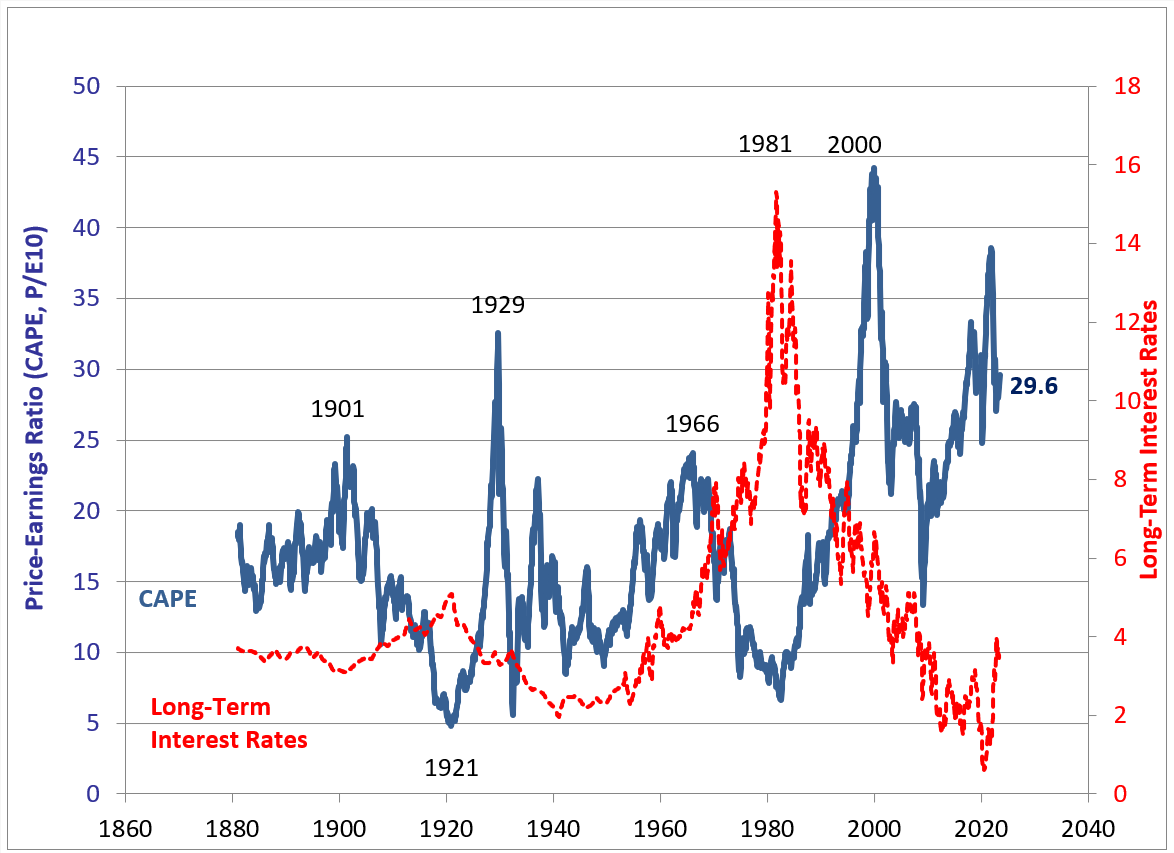

Historic valuations. Robert Shiller has CAPE ratio information going again to 1871:

The present CAPE at practically 30x inflation-adjusted trailing 10 12 months earnings definitely seems to be excessive relative to the 17.4x common if we return to when Ulysses S. Grant was president.

But it surely’s not that a lot increased than the 27x common we’ve seen this century.

Every common is skewed in its personal approach. Valuations have been on the excessive aspect of historical past the previous few a long time whereas they had been a lot decrease earlier than we had vehicles or private computer systems.

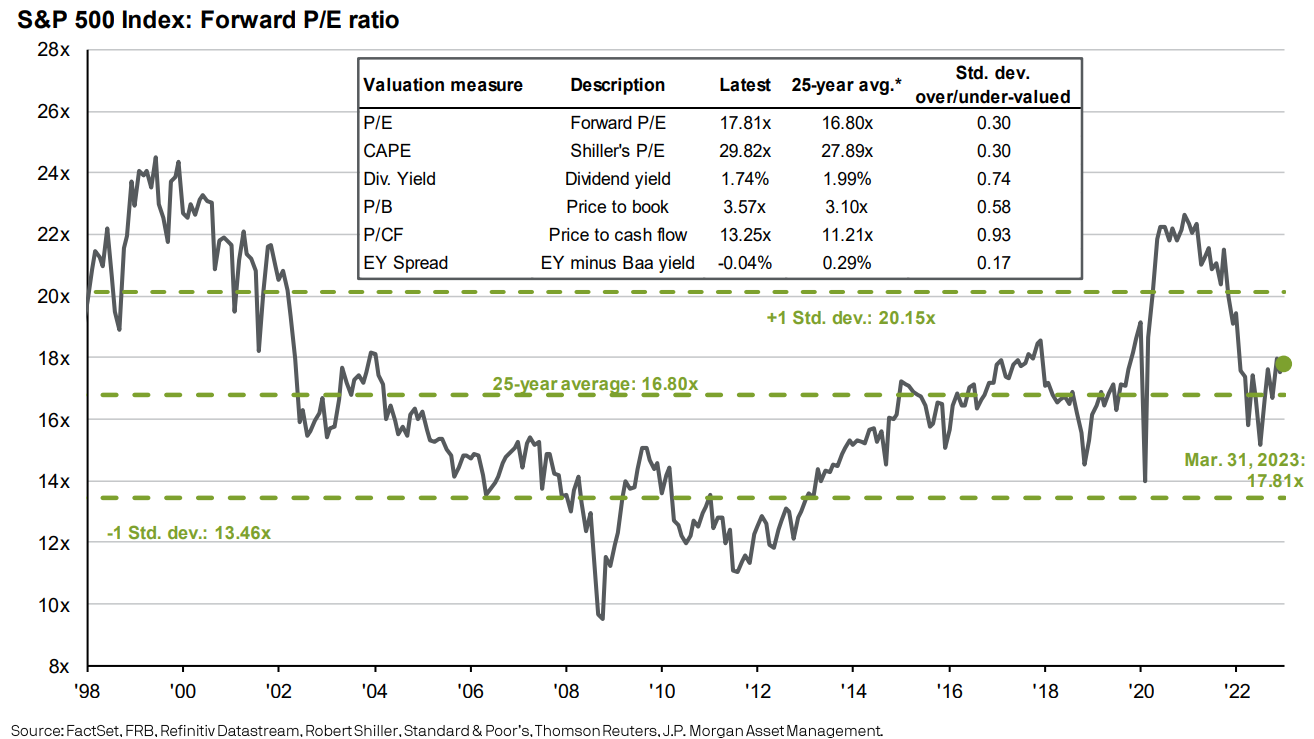

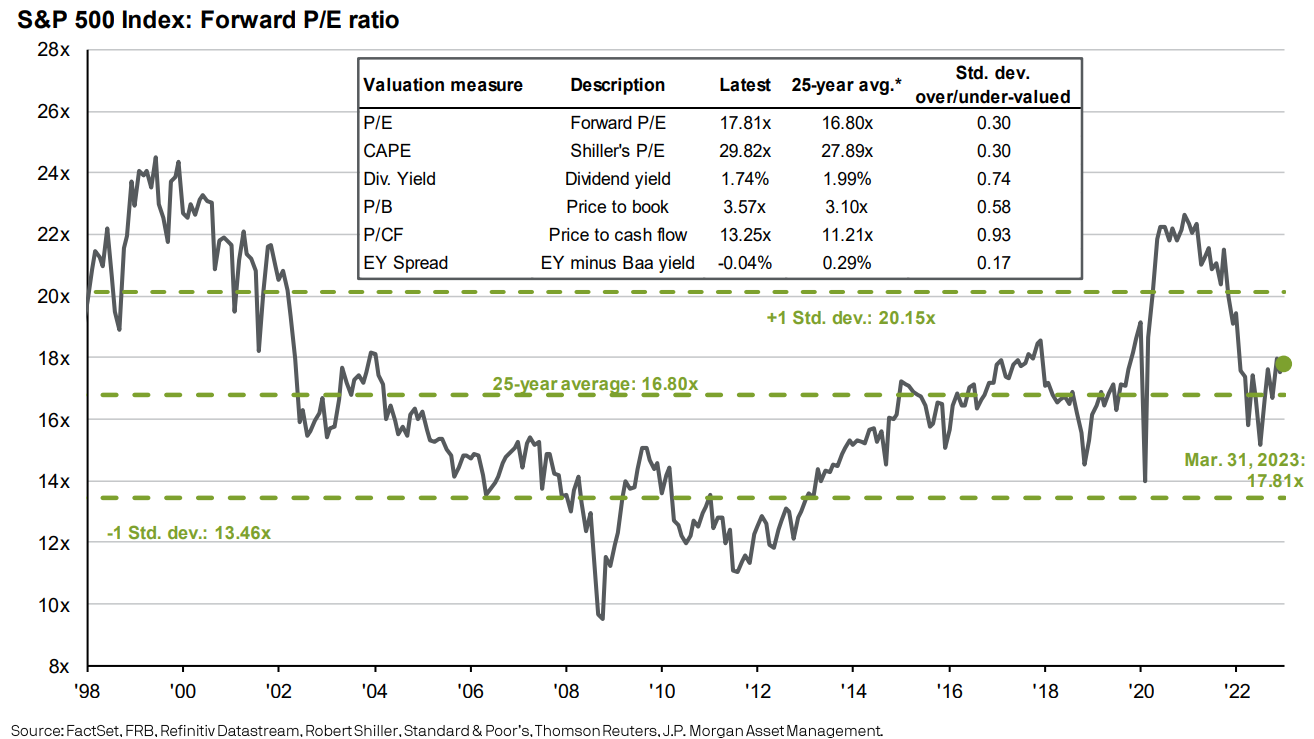

Relative valuations to latest historical past. JP Morgan has a chart that appears at valuations on the U.S. inventory market utilizing a bunch of various measures — earnings, CAPE, dividend yield, price-to-book, price-to-cash circulate and the unfold between the earnings yield and company bonds:

Issues look a tad wealthy relative to the previous 25 years however roughly according to the averages.

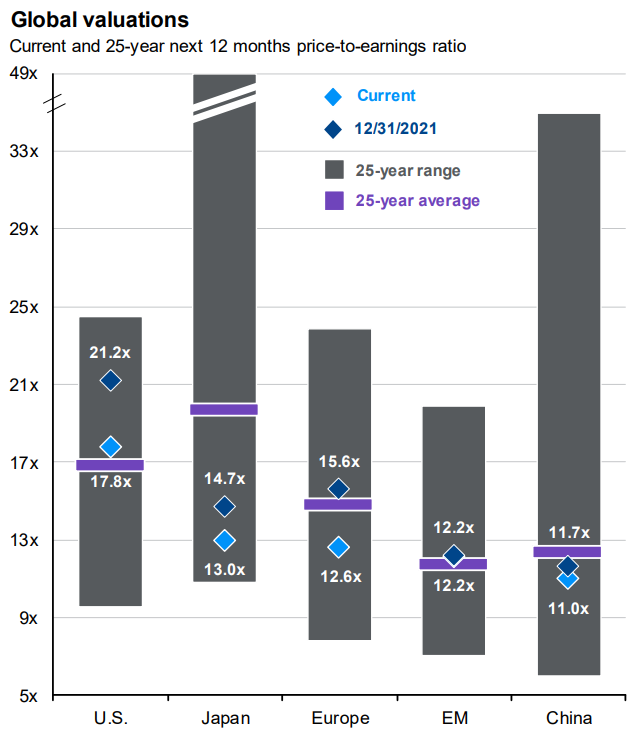

JP Morgan additionally has a comparability of worldwide valuations over the previous 25 years:

Appears like common within the U.S., China and rising markets and comparatively cheap in Japan and Europe.

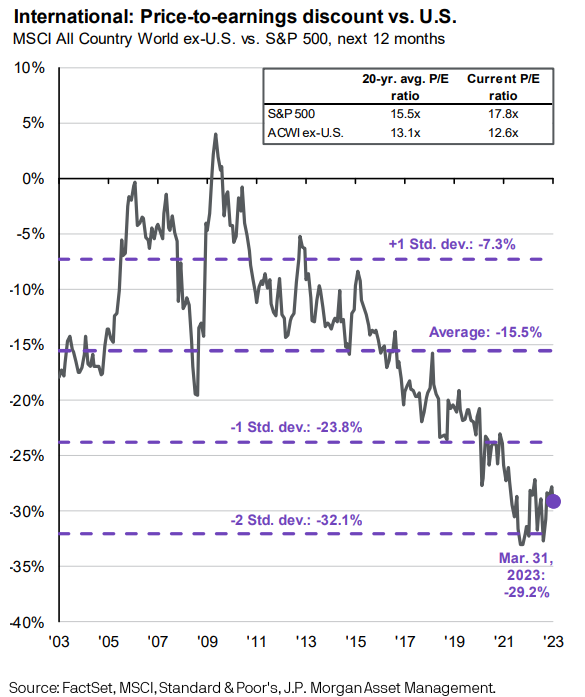

We are able to additionally have a look at relative valuations between international shares and U.S. shares:

Worldwide shares are low-cost compared to america but it surely’s been that approach for some time now.

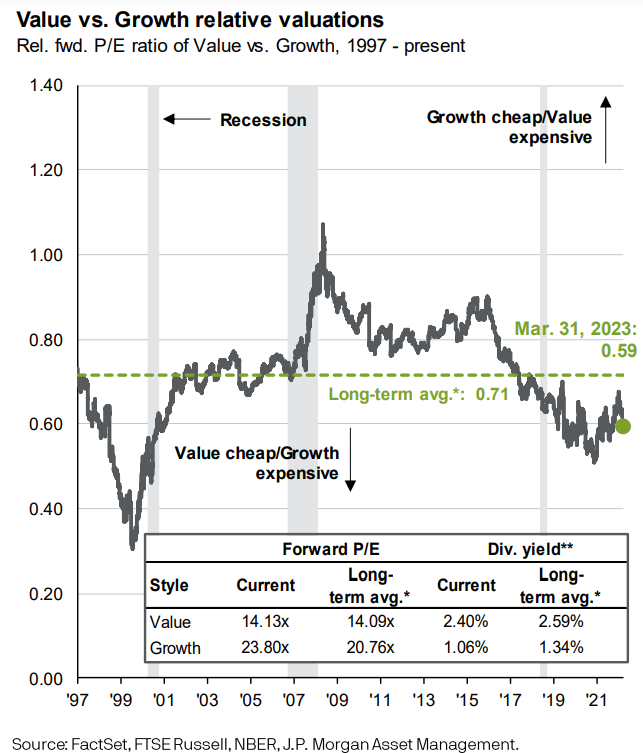

Or how about progress versus worth:

Worth shares are all the time cheaper than progress shares however every group isn’t too far off historic norms.

And since we’re taking a look at varied valuation metrics right here it’s price mentioning that there are all kinds of various methods to have a look at “worth” and “progress” in the case of shares.

Confused but?

Let’s preserve going.

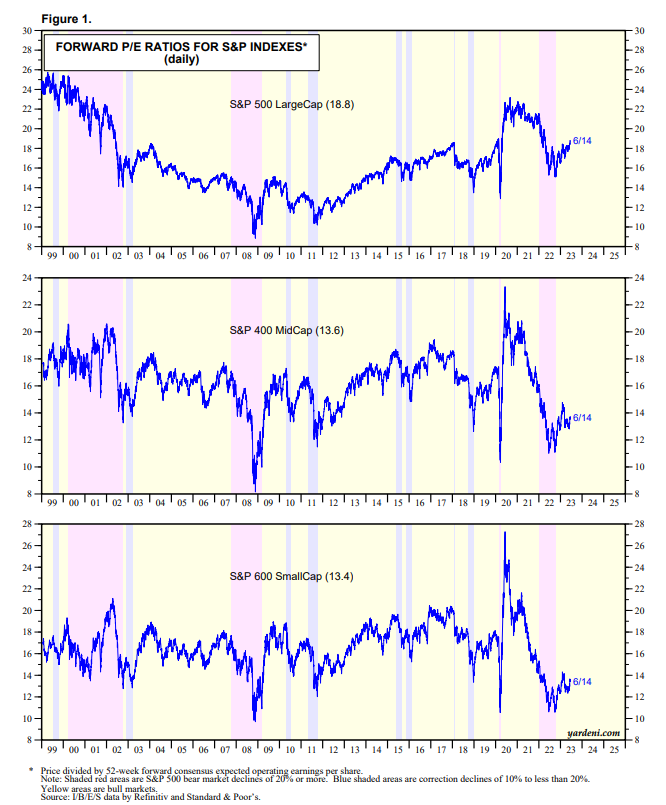

Ahead-looking valuations. Yardeni Analysis has valuation metrics for mid caps and small caps as nicely going again to 1999:

Based mostly on ahead P/E ratios that have in mind earnings estimates, smaller and mid-sized companies look loads cheaper relative to their very own historical past than giant cap shares in the intervening time.

Adjusted valuations. There are additionally varied methods to regulate present valuations.

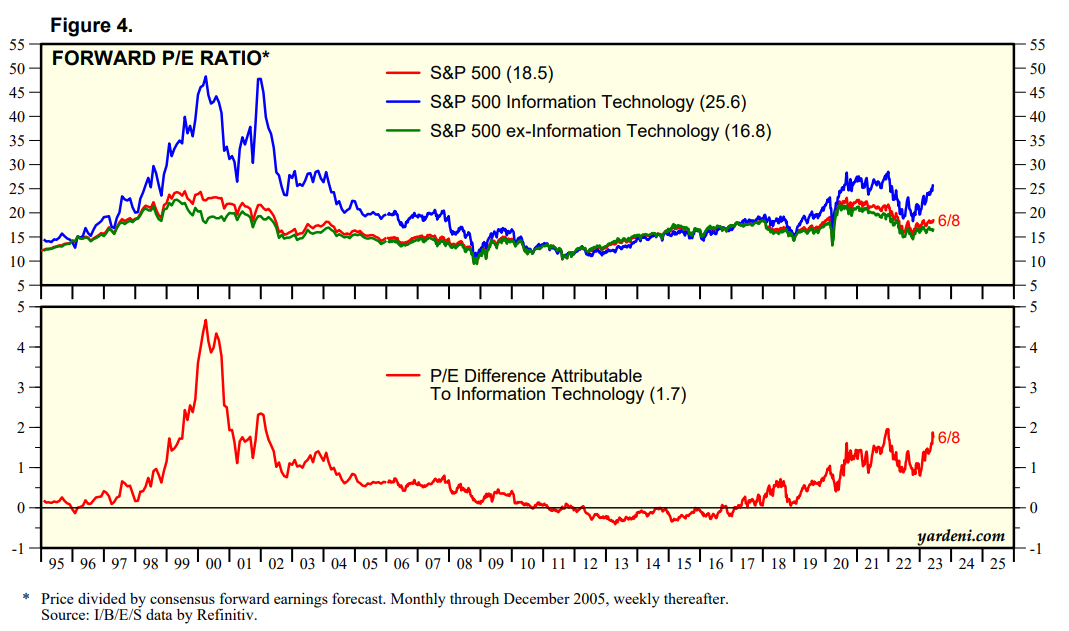

Many individuals assume tech shares deserve a higher-than-market a number of as a result of they’re extra environment friendly, require fewer staff and have increased margins than extra capital-intensive companies of the previous.

Yardeni breaks down ahead P/E ratios by S&P 500, expertise shares within the S&P and the S&P ex-tech:

When you take out the tech sector inventory market valuations don’t look too unhealthy.

I assume it depends upon how you’re feeling about whether or not tech shares deserve a premium or not. It is sensible to me in the intervening time however I do not know what that premium needs to be or how lengthy it ought to final.

However there’s a case to be made that the remainder of the market seems to be fairly low-cost for those who take out the comparatively costly tech names.

Relative valuations. That is the primary time in practically 20 years that bonds have given shares a run for his or her cash when it comes to yields.

T-bills, muni bonds and company bonds at the moment are all yielding over 5%. That’s a a lot increased hurdle price than the yields traders had been used to seeing within the 2010s and early pandemic years.

The inverse of the ahead P/E ratio of 18.8x would give us an earnings yield on the S&P 500 of 5.3%. The earnings yield is increased for mid caps (7.4%) and small caps (7.5%).

I’m not suggesting that earnings yields can precisely predict future returns. They’ll’t.

However the unfold between what you possibly can earn on bonds and what you possibly can earn on shares has compressed significantly over the previous 15 months or so.

And the anticipated returns for bonds are a lot simpler to forecast than the anticipated returns for shares. Bonds are principally simply their beginning yield. Fairly easy.

There are such a lot of different parts concerned in future inventory market returns that transcend the basics.

I may provide the dividend yield and future earnings progress price for the inventory market and it could nonetheless be practically unimaginable to foretell what returns are going to be since nobody is aware of what traders are prepared to pay for these earnings sooner or later.

The excellent news is it doesn’t look like the inventory market is egregiously overvalued in the intervening time. Some would even argue we’re buying and selling at or close to honest worth however I’m not going to say that as a result of I don’t just like the phrase.

Nobody cares about 5% bond yields when the inventory market is ripping increased by double digits. However I do assume the prospect for yields to remain increased for longer may find yourself being the largest headwind for shares within the intermediate-term from right here.

The excellent news for diversified traders is that we’ve gone from one of many worst years ever final 12 months to a reasonably good set-up up to now this 12 months.

The inventory market is up double-digits. You’ll be able to earn 5% in brief period, cash-like belongings.

My recommendation is to get pleasure from it whereas it lasts.

Michael and I talked about inventory market valuations and extra on this week’s Animal Spirits video:

Subscribe to The Compound so that you by no means miss an episode.

Additional Studying:

Now right here’s what I’ve been studying recently:

[ad_2]