How inflation can finish the fairness market dream run?

When the booze is overflowing continuous in a celebration using on

excessive octane, only a few drinkers actually take into consideration the ensuing hangover when

the celebration stops. In such a excessive adrenaline environment, many grossly overestimate

their capability to drink, inspired by behaviour of their mates & crowd round

them.

The world markets are going by way of an analogous celebration. The

booze (straightforward cash) is provided by central bankers everywhere in the world in excessive

amount they usually promise they received’t cease anytime sooner.

The heady cocktail of straightforward cash has been holding the celebration

occurring for a very long time. Emboldened by the current successes within the fairness

markets the place liquidity has lifted all of the boats, many buyers are doubling

down on their bets by overestimating their capability to soak up losses. Many

consider that the potential for losses could be very minimal for the reason that central banks

are on their aspect.

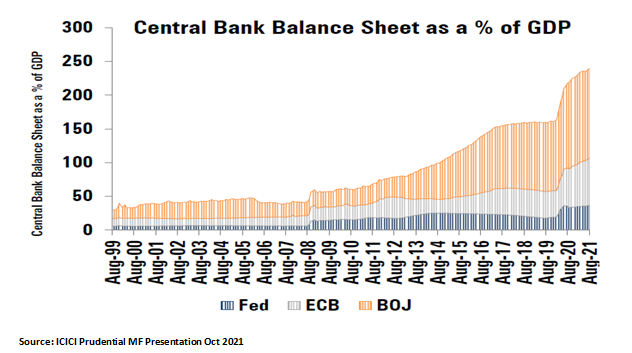

To quantify, the Central financial institution of the USA – Fed printed greater than 20% of whole US {dollars} ever printed within the final yr.

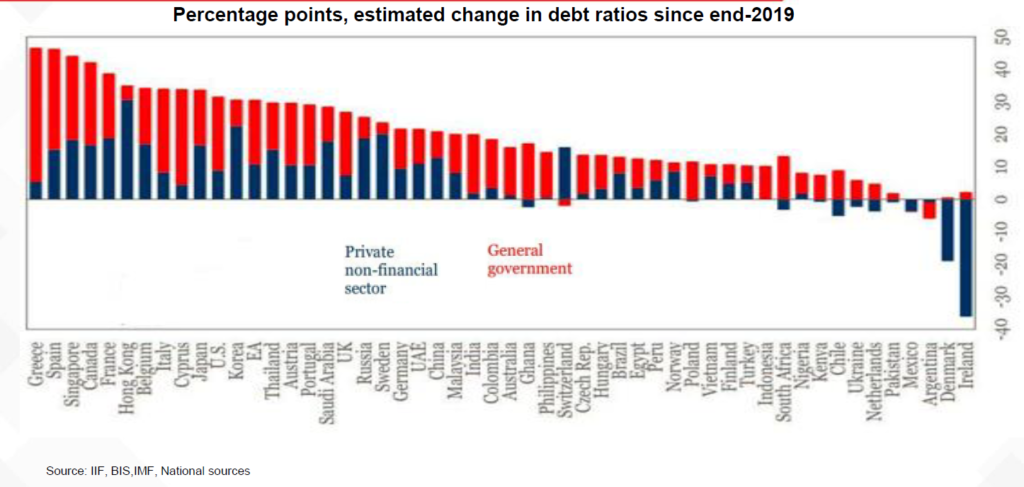

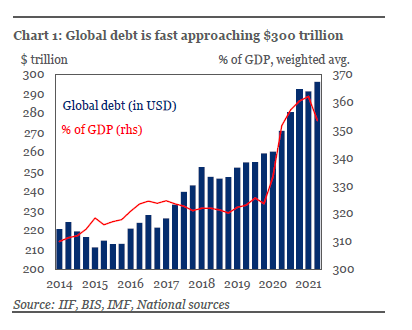

Tremendous unfastened financial coverage additionally inspired many nations & corporations to go on a debt binge. The debt as a proportion of general GDP has risen sharply.

Low rates of interest have additionally performed a significant position to push individuals in direction of speculative asset lessons. And to date, the bulk have seen the worth of their funding going up solely in a really quick span of time with out a lot draw back volatility. Investments in cryptos, fairness, and different speculative performs are seen as get-rich-quick schemes and to date, nobody is complaining. World markets in some manners resemble casinos.

The speedy cash printing and low-interest charges have made

many individuals wealthy and consequently blissful. Why then central banks by no means did such

a factor earlier which may make so many individuals rich. The newly minted rich

and consequently blissful inhabitants will clearly love the Govt insurance policies and

will proceed to vote for a similar set of politicians. Isn’t it the only

and sensible concept for politicians to eternally keep in energy? They didn’t do it

for a easy cause – Inflation.

Why you must fear about inflation in case you are investing within the fairness or debt market? How inflation can finish the fairness market dream run? To grasp this, one must go not very far prior to now. The financial situation through the 1970-80s serves as a superb reference level.

The world financial system was linked to Gold for a really very long time. This implies the amount of cash printed ought to be backed by gold. In 1971, the hyperlink of cash printing to gold was utterly damaged and the period of fiat forex started. This gave central banks the ability to print as a lot cash as they like with none restriction.

The US

adopted an ultra-loose financial coverage by holding rates of interest low and by

printing cash. That resulted in momentary low unemployment and better financial

progress. Buoyed by the success of recent financial coverage considering, individuals

re-elected their president – Richard Nixon in 1972.

Inside just a few months after the elections, inflation greater than doubled to 8-9%, due to the simple financial coverage and help from a pointy rise in oil costs. Later within the decade, it will go to 12%. By 1980, inflation was at 14%. To curb inflation, rates of interest have been raised to shut to twenty%. Fairness market index – S&P 500 which went up till 1972, enthused by the brand new financial coverage, crashed by 50% over the subsequent two years. The following 10 years annualized returns on the index have been unfavourable 9% (Index Worth: Oct 1972/Aug1982 – 761/301). Unemployment shot as much as 10%. Rising rates of interest prompted a calamity for interest-sensitive industries, equivalent to housing and automobiles. Naturally, hundreds of thousands of Individuals have been indignant with the Authorities by the late Seventies.

Right here is the straightforward financial logic – if the speed of cash printing is greater than the speed of manufacturing of products and providers in an financial system, the costs will improve. In easy phrases, if in case you have x amount of cash in the present day and it turns into 2x tomorrow as a result of extreme cash printing holding the speed of progress of products and providers at zero, then what you could possibly buy for x earlier, you’ll have to ultimately spend 2x to buy the identical quantity of factor due to the influence of inflation. Increased demand, fuelled by extra cash, with out comparable enchancment within the provide aspect ends in a bidding battle that takes the costs of products and providers greater. Thus, in actuality, even when your cash is doubled, your buying energy remained the identical. The worth of cash has simply gone down by 50%, leaving you in the identical financial state as earlier.

Poor undergo essentially the most from the influence of inflation since they

have very low publicity to belongings whereas meals & gas accounts for a significant

a part of their family funds. Politicians can’t afford to maintain so many

voters sad they usually attempt the whole lot to convey down inflation or else they

danger dropping the general public help.

Studying

from the failure of America’s “path breaking” financial coverage of the early

Seventies, the policymakers understood the significance of sustaining the fiscal

self-discipline to forestall long-lasting inflation and its disastrous results.

Nonetheless, this fiscal self-discipline was thrown out of the window in 2008 after the subprime disaster. Led by US Fed, many central banks printed big quantities of cash, greater than doubling their steadiness sheet dimension in just a few years. They have been warned by the economist that this might lead to greater inflation. However as a result of varied components like rising investments in shale fuel, international manufacturing shifting to China for his or her capability to provide items at low value, ageing demography and productiveness good points from expertise helped calm the value pressures. Furthermore, the cash printed was disbursed to the banks and monetary establishments that invested the excess to capital markets.

This gave confidence

to central bankers that cash printing won’t lead to greater inflations.

Earlier than the covid struck, the central banks have been making an attempt to scale back their inflated

steadiness sheet and improve rates of interest. Nonetheless, when the corona-led

financial shutdowns occurred, the central banks ran their printing machines at

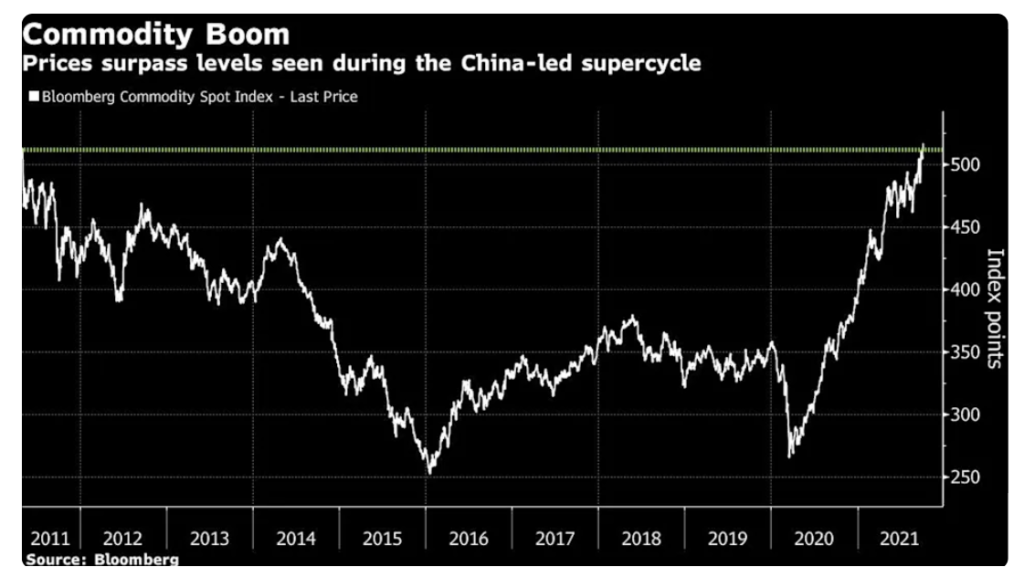

full capability. Consequently, the costs of many commodities and providers

began rising, as a result of greater demand and supply-side disruption.

A number of the broadly used commodities and their value actions:

Commodities index hits the document as world rebound meets shortages.

All of the economies are getting affected by a pointy rise in inflation. In India, commodity inflation has been denting the profitability of client corporations. Asian paints not too long ago reported 29% YoY revenue decline in its Q2 FY22 outcomes. The rationale administration gave – “unprecedented inflation” like we haven’t seen within the final 30-40 years.

Central banks are

sustaining that the present bout of inflation is transitory. Nonetheless, it might

not be transitory as earlier considered as a result of following causes.

– Producers transferring out of China for regional diversification result in growing prices of manufacturing of products. China can also be dealing with an power disaster and a scarcity of products. Manufacturing facility value inflation in China is operating in double-digit.

– In comparison with the cash printing in 2008 which went to the banks, this time many Individuals have additionally obtained cash instantly of their checking account

– The tempo and quantum of cash printing has been excessively excessive

–

Wages have began rising sooner in lots of a long time as a result of scarcity of

labour as in comparison with the variety of vacancies

–

Important funding shift in direction of sustainable power sources resulted

in Greenflation i.e., rising costs for metals and minerals such as

copper, aluminium, and lithium which are important to photo voltaic and wind energy,

electrical automobiles, and different renewable applied sciences.

If inflation continues to rise for an extended time, central banks will likely be pressured to extend the rates of interest to curb inflationary expectations. The rise in rates of interest will improve the price of proudly owning fairness leading to a fall in fairness costs. Increased rates of interest will result in heavy mark to market losses on long-term debt papers and will result in contagion in all of the asset lessons which have been inflated by large systematic liquidity.

Keep in mind the taper tantrum of 2013? At the moment fairness markets and debt markets went down sharply as a result of concern of reversal of unfastened financial coverage. Now the worth of fairness and debt is sort of 50% greater as a proportion of world GDP as in comparison with 2013. What is going to occur to the markets if the central banks determine to start the tip of straightforward financial coverage?

Now the essential query is learn how to shield our portfolio

from extreme decline if inflation doesn’t turn into momentary and power the

fingers of the Central banks to boost rates of interest.

Our

easy recommendation – preserve fairness publicity in your

portfolio to the extent the place a 50-60% fall received’t have an effect on your peace of thoughts.

For debt allocation one can think about quick maturity portfolios like ultra-short-term,

low period, or floating price funds. Having a 15-20% allocation in Gold may

additionally assist in occasions of hyperinflation. You possibly can learn extra in regards to the significance

of gold allocation right here and about asset allocation right here.

No one is aware of when the music on the inventory market celebration will cease. However all of us are sure about this one factor – greater the celebration and the cocktail consumption, greater and worse are the hangover results.