Do You Want a CPWA Certification to Serve HNW Purchasers?

[ad_1]

Are you a wealth advisor trying to enter or increase your attain within the high-net-worth (HNW) market? This consumer phase contains enterprise homeowners, executives, inventive professionals, and next-gen heirs with a web price of $5 million or extra.

These potential shoppers characterize a various group with distinctive challenges and life targets far past asset accumulation. To draw and retain HNW shoppers, you’ll want superior technical experience and nuanced expertise in individuals and household dynamics administration.

How will you get or fine-tune these expertise? Incomes the Licensed Personal Wealth Advisor® (CPWA®) certification from the Investments & Wealth Institute (IWI) is one method to accomplish this purpose. However is it well worth the time, effort, and cash you’ll dedicate to the method?

That can assist you make your resolution, let’s evaluation what getting a CPWA certification includes and the way it may gain advantage wealth advisors who want to serve HNW shoppers.

What Is a CPWA Certification?

The CPWA certification program includes a singular, multidisciplinary strategy to addressing the monetary wants of HNW shoppers. Candidates to this system can select between two enrollment choices:

-

A 6-month on-line program together with a 1-week, in-person class at a high enterprise college

-

A 12-month online-only program

The stipulations are:

Lastly, you could move a four-hour last examination protecting 135 questions.

What Are the High Causes to Take into account the CPWA?

The first advantages cited by many advisors holding this certification are:

-

Aggressive differentiation within the crowded HNW market

-

Extra confidence in working with ultrawealthy shoppers

-

Superior information particular to fixing complicated planning challenges

-

Potential for increased compensation and profession development

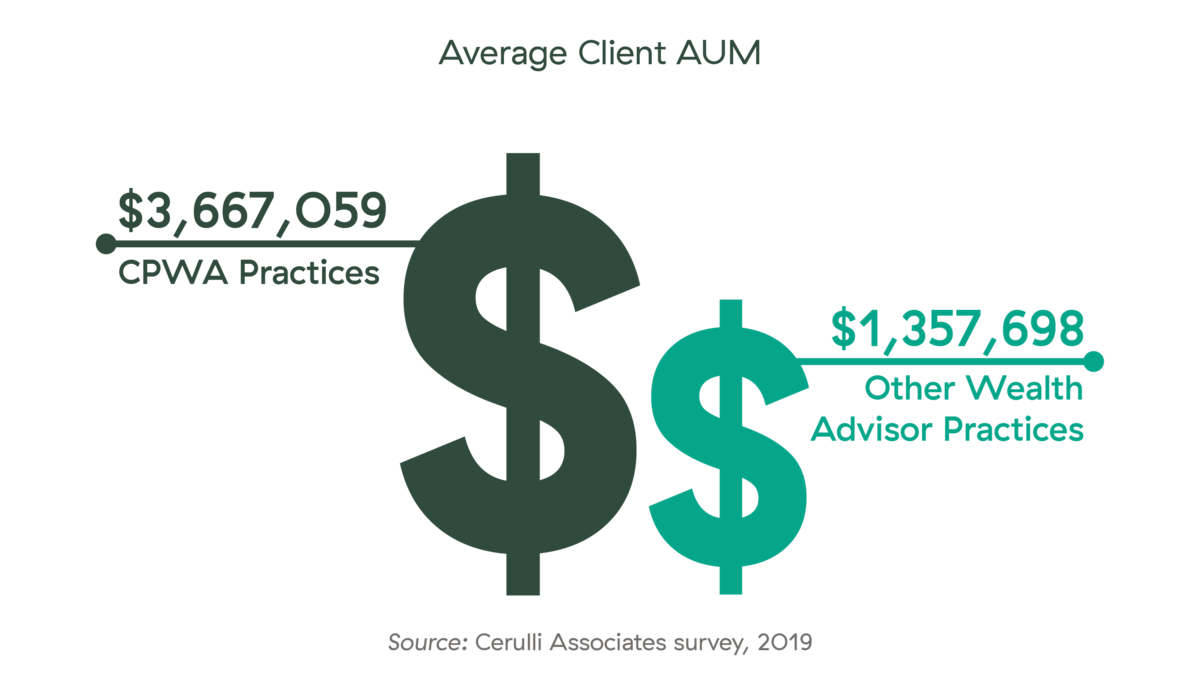

And, latest information tells us {that a} CPWA certification could also be an efficient method to develop your observe. In response to Cerulli Associates, CPWA practices have the biggest common consumer measurement within the trade:

What Will You Study?

The CPWA program’s curriculum is designed to provide the principle and sensible strategies you’ll must serve HNW shoppers—and to move the required certification examination. The 11 core subjects are damaged down into the next 4 classes:

1. Wealth administration. Understanding the massive image is crucial to optimizing planning for the ultrawealthy. This phase will provide help to analyze and suggest tax-efficient options and discover ways to construct and handle portfolios that meet complicated HNW targets.

-

Tax planning. This deep dive into HNW-specific taxation will information you in speaking about methods with shoppers, simplify planning, and provide help to work successfully with shoppers’ tax attorneys.

-

Portfolio administration. This phase will elevate your skills to harmonize wealth-building strategies, threat administration, tax consciousness, and portfolio methods with shoppers’ assets and targets.

-

Threat administration and asset safety. You’ll be taught to guage applicable insurance coverage and asset methods to guard shoppers via life occasions together with marriage, divorce, and demise.

The [CPWA program] content material was incredible and considerably elevated my capacity so as to add worth to my goal market ($1 million–$5 million investable, primarily company VP-level individuals).”

Justin Hutt, CooperDavis Monetary Group,with Commonwealth since 2017

2. Human dynamics. Working with any consumer phase requires sturdy expertise in managing expectations, decision-making, and relationships, however you’ll want to boost your sport when serving the extremely prosperous.

-

Ethics. Studying to determine and classify moral and regulatory points throughout the wealth administration spectrum will can help you work confidently with a classy consumer base.

-

Behavioral finance. Cognitive and emotional biases can intrude with a consumer’s capacity to make sound selections. By studying methods to determine biases, you’ll be higher outfitted to appropriate or complement these tendencies.

-

Household dynamics. Tailoring methods for household organizations, trusts, and enterprise entities will depend on your understanding of key household roles, household workplace infrastructures, and the nuances of performing consumer discovery.

3. Legacy points. In the event you haven’t mastered the complexities of how charitable and property planning options assist shoppers switch wealth, this phase provides you with the superior expertise you want.

-

Charitable giving and endowments. You’ll be taught to evaluate the benefits and drawbacks of private and non-private charities, foundations, and trusts, in addition to the tax implications of giving methods in complicated consumer situations.

-

Property trusts and wealth switch. Though components of property planning could lie exterior your obligations, a full understanding of wealth switch, end-of-life planning, and fiduciary points is crucial to the work of an HNW wealth advisor.

4. Specialty consumer companies. There are particular challenges concerned with enterprise planning along side HNW shoppers’ broader planning and portfolio administration wants.

-

Govt compensation. This phase addresses methods to consider inventory choices, deferred and fairness compensation plans, and concentrated inventory conditions, together with guidelines, restrictions, and tax implications.

-

Intently held companies. As a big inhabitants of the $5 million-plus consumer base, intently held enterprise homeowners want advisors who could make applicable suggestions about enterprise entity constructions and their tax implications, buy-sell agreements, valuation strategies, the enterprise lifecycle, and succession planning.

-

Retirement. To information shoppers with huge belongings via the distribution section, you’ll want to grasp return sequencing, analytical forecasting, tax remedies, Roth conversions, distribution necessities, and analysis of certified plans and web unrealized appreciation (NUA) guidelines.

So, Is the CPWA Certification a Worthwhile Funding?

If your small business purpose is to draw and retain HNW shoppers, the information and insights supplied by a CPWA certification could provide help to goal—and higher serve—this nook of the advisory market. However, be certain you have got a transparent plan earlier than diving in. Making lasting connections together with your desired clientele all the time is determined by your agency’s service choices and the consumer expertise you ship.

FREE DOWNLOAD

Superior Monetary Planning Methods

for Excessive-Web-Value Purchasers

Discover inventive, complete monetary planning options—from asset safety to

charitable giving—to your high-net-worth shoppers’ distinctive wants.

Commonwealth and IWI are separate and unaffiliated entities. Please seek the advice of your member agency’s insurance policies and procure prior approval for any designation/certification packages.

[ad_2]