Curiosity Charges: The Outdated Regular

[ad_1]

Rates of interest are possible transitioning to a brand new regular, which is totally different from the previous regular. In different phrases, the entire projections that assume charges might be getting again to regular are fallacious—as a result of the definition of regular has modified.

Change isn’t a fast course of, although. Typically, it may be so sluggish that you simply don’t discover it till the change is sort of massive. The grass in my yard, for instance, doesn’t appear to develop till the weekend, when it abruptly wants slicing. The identical concept has been true for rates of interest, which have been dropping for many years.

Wanting on the Lengthy Time period

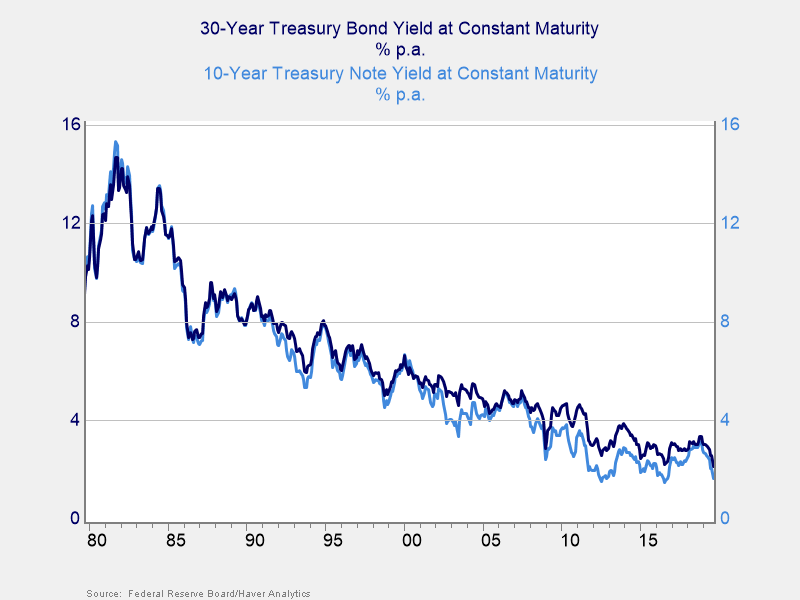

Notice the long run development may be very clear. Throughout the previous 40 years or so, nonetheless, there have been ups and downs. Over a interval of 5 to 10 years, the development is far much less clear.

There are a few takeaways from the chart above. Most present buyers had their adolescence within the Nineteen Nineties and 2000s, with some going again to the Nineteen Eighties. Throughout that point interval, charges have been sometimes within the 4 p.c to eight p.c vary, which is what most of us at a senior degree now consider as regular. You possibly can see that concept of regular fairly clearly in analyst projections of the place charges are more likely to go, as nearly all of them put charges again into that vary over a while interval. The bias of “what I grew up with” is a robust one. However as you possibly can see, that concept of regular was not very regular in any respect. My youthful colleagues, for instance, have seen charges of two p.c to three p.c as regular for all of their careers. Is that the brand new regular?

What Does Latest Knowledge Say?

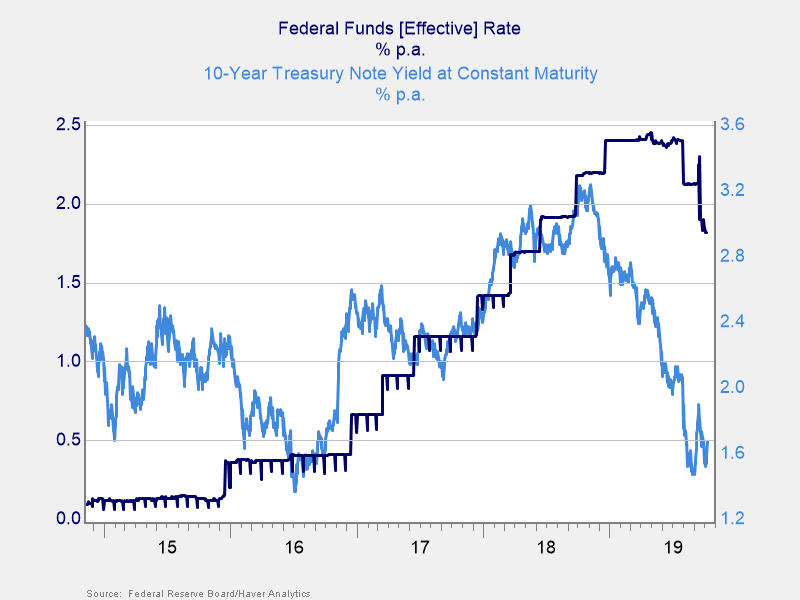

That vary could be the brand new regular, primarily based on the latest information. That 40-year chart is compelling, however current information seems a bit totally different. In 2016, the Fed began elevating charges, and the 10-year fee adopted swimsuit. From 2016 by means of 2018, it seemed like we have been headed again to the traditional 4 p.c to six p.c that individuals of my age (who, not coincidentally, run the Fed) anticipated. However then, in late 2018, one thing occurred. Whereas the Fed saved its charges up, the 10-year collapsed once more. Regular as soon as once more seemed not so regular. Somewhat than the Fed setting rates of interest, it’s now responding to the market by slicing. No matter the brand new regular is, it’s extra highly effective than the Fed—so now we have to take it significantly.

What does this shift imply for the long run? Is there a brand new regular? How will we inform? And what’s going to or not it’s? Clearly, the expectations that charges would rise again to regular is, not less than, unsure.

Not Only a U.S. Story

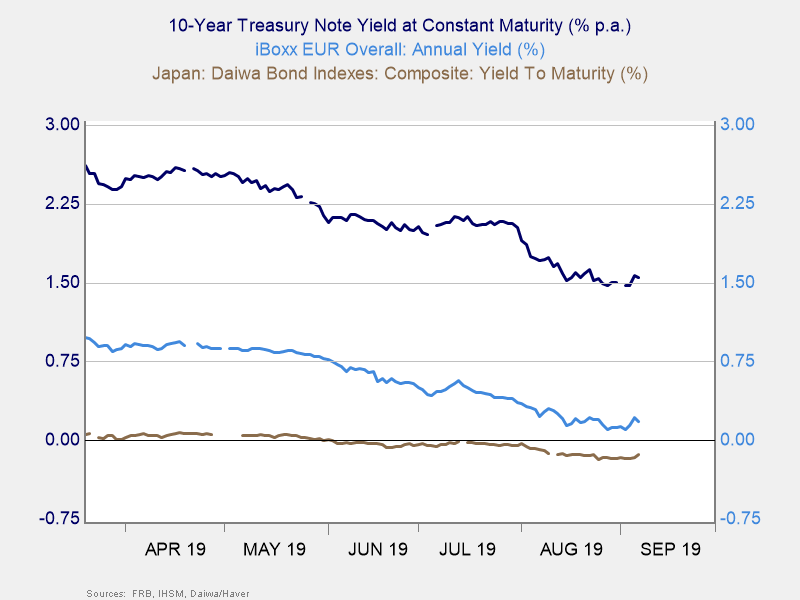

Around the globe, we see charges each very low by historic ranges (after many years of declines) and down considerably prior to now 6 to 12 months. No matter is happening is occurring world wide, and any clarification must account for that. Past that, our clarification must account for why charges are so totally different between space markets. Because the chart under reveals, U.S. charges are effectively above European charges, that are effectively above Japanese charges, that are under zero collectively. We want some form of clarification as to why that must be. In financial idea, in a world capital market, charges ought to converge, which isn’t occurring. In financial apply, regular charges are assumed, and that isn’t occurring both.

The place We Are (and The place We Would possibly Be Going)

Charges have been dropping for many years. Regular, as many people give it some thought, isn’t occurring—and isn’t more likely to occur. On prime of that, totally different areas have very totally different rates of interest; primarily based on financial idea, this shouldn’t occur. Economics doesn’t give us good steering as to what’s occurring—or what’s more likely to occur.

So, possibly one thing else is happening. Tomorrow, we’ll check out the totally different ways in which rates of interest could also be set to begin to determine what that “one thing else” could be.

Editor’s Notice: The authentic model of this text appeared on the Unbiased Market Observer.

[ad_2]