Contained in the Financial institution of England governor’s desires – the wage-price spiral we can't see – William Mitchell – Trendy Financia

[ad_1]

Many central financial institution officers have been making an attempt all types of conditioning narratives to persuade us that their rate of interest hikes have been justified. Now they’re really defying the data offered within the official knowledge to easily make issues up. Final Wednesday (Could 17, 2023), the Financial institution of England governor gave a speech to the British Chamber of Commerce – Getting inflation again to the two% goal − speech by Andrew Bailey. It got here after the Financial institution raised the financial institution price by an extra 25 factors to 4.5 per cent the week earlier than. In that speech, he admitted inflation was declining and the principle supply-side drivers have been abating. However he mentioned the speed rises have been justified and unemployment needed to rise as a result of there was now persistent inflationary pressures coming from a “wage-price spiral”. The issue with this declare is that there is no such thing as a knowledge to help it.

There’s a wage-price spiral within the UK – pity I can’t see it.

The Financial institution of England governor advised the Chamber of Commerce gathering that Britain was in an “extraordinary scenario” (Covid, and so forth) and like all nations had been hit with “a sequence of huge provide shocks”, together with the decline in output as Covid restricted exercise and households shifted spending from providers (which have been constrained) to items.

This shift in 2020 and 2021 prompted some economists to assert that inflation was a demand-side phenomenon, which required exhausting authorities internet spending cuts and rate of interest rises.

Nonetheless, my place all alongside is that it’s a somewhat weird development of occasions to think about the suitable treatment is to stifle demand – which has the end result that unemployment rises – when the availability contraction was momentary and would resolve in the end.

The very last thing we ought to be doing is creating unemployment as a result of when governments have interaction in demand suppression both instantly by fiscal coverage or not directly by financial coverage, unemployment tends to rise shortly and fall slowly, leaving a path of non-public and group hardship and drawback behind it.

The proper response was the one taken by the Japanese authorities and financial authorities.

Japan was subjected to the identical international provide constraints which pushed up prices however the central financial institution governor advised us that they’d fashioned the view that the availability pressures have been transitory and didn’t justify an all out assault through rate of interest will increase which might endanger the nation’s low unemployment.

The Cupboard agreed and used fiscal coverage to offer some money help to households to ease the (momentary) value of dwelling pressures and to companies as a part of a deal to suppress revenue margins and maintain the value rises down.

The results of this method has seen inflation dropping properly under the degrees in different superior nations and unemployment stay very low.

By any measure successful.

And it’s a marvel that the mainstream press ignores the ‘experiment’ and simply mimics the narratives offered by the opposite central financial institution governors.

I even heard an economist telling the nationwide ABC radio the opposite day in a key characteristic on the economic system that ‘central banks are rising charges in all places’.

Which was a lie and the journalist failed to choose her up on it.

In his speech to the Chamber of Commerce, the Financial institution of England governor acknowledged that:

… international provide pressures have eased.

Considerably to say the least.

He additionally indicated that the rising power prices because of the Ukraine scenario “may also now reverse”.

So then what’s driving inflationary pressures within the UK?

Effectively he claims that the third:

… provide shock has been a home one …

And there we be taught that Covid led to a pointy fall within the “dimension of the workforce” by inactivity – which largely is due to sickness.

The latest labour market knowledge from the Workplace of Nationwide Statistics (launched Could 16, 2023) – Labour market overview, UK: Could 2023 – is sort of surprising in its revelations.

1. “these inactive due to long-term illness elevated to a report excessive.”

2. “2.55 million individuals weren’t capable of work within the three months to March, which is over 6% of the nation’s working inhabitants. That was up practically 100,000 on the earlier quarter.” (Supply).

3. “the pandemic is more likely to be one of many predominant causes for the rise within the variety of long-term sick over the previous three years or so, together with these affected by lengthy COVID signs similar to post-viral fatigue.”

4. “That is now comfortably the biggest variety of individuals out of the labor market resulting from long-term well being issues that we’ve got ever seen”.

The fact is that our nations will endure a big (and rising) cohort of staff with everlasting incapacity because of Covid infections.

The cavalier manner through which we at the moment are in full stage denial of this downside is astounding.

However the governor can also be eager to notice that the workforce shortages that turned acute throughout the early years of Covid are “reversing considerably”.

Then there are “meals costs”, partly arising from the “disruptions to Ukraine’s provide of agricultural merchandise to the worldwide market”, which have been a significant contributor to British inflation within the final yr (“the annual CPI inflation for meals and non-alcoholic drinks in the UK has risen from 5.9% in March 2022 to 19.1% within the newest March 2023 numbers”).

All of those factors are incontestable actually.

As is his remark that inflation hurts “the least well-off more durable” as a result of they spend extra of their earnings on the gadgets which have inflated probably the most.

However there is no such thing as a retreat from his view that the rate of interest rises have been important – even when they damage the low-income households probably the most – “to convey inflation down”.

He famous that the “actual earnings” losses that come up from rising imported uncooked supplies or merchandise can’t be solved by financial coverage.

So why did they increase charges?

His easy clarification is that the Financial institution had:

… to take motion to make sure that inflation falls because the exterior shocks abate – that inflationary impulses from these exterior sources don’t trigger persistent ‘second-round’ results on home wage and value setting that might maintain inflation up for longer. That’s the reason we’ve got elevated Financial institution Charge by practically 4½ proportion factors from December 2021, from 0.1% then to 4.5% now.

Ah, the wage-price spiral argument – lastly.

The ‘dreaded second-round results’.

He claimed that despite the fact that inflation is falling as the availability drivers abate, there’s a harmful persistence setting in resulting from these “second-round results”.

What are they?

Effectively, he mentioned the Financial institution had desired an increase in unemployment (a “shallow however lengthy recession”) the issue is that the rise has been “occurring at a slower tempo than we anticipated in February”.

In different phrases, they haven’t but achieved their aim of pushing tens of hundreds of staff into joblessness.

Consequently, he claimed that the MPC:

… continues to evaluate that the dangers to inflation are skewed considerably to the upside, primarily reflecting the potential for extra persistence in home wage and value setting.

So we’ve got moved from narratives, similar to these pushed by the Reserve Financial institution of Australia governor that they ‘worry’ a wage-price spiral, to extra definitive claims that the inflation is now being pushed by the presence and operation of such a spiral.

Which has turn out to be their justification for the on-going rate of interest hikes.

The proof?

Central financial institution governors like to say their personal briefings with the enterprise sector and have claimed in these conferences they discovered about increased wages progress.

Initially, we couldn’t refute the claims as a result of we didn’t have sufficient official knowledge, which might have ultimately revealed the rising wage pressures had they been occuring.

However now greater than 18 months into the rising inflationary pressures, the official knowledge for Britain continues to be recording actual wage cuts, of a scientific nature, which guidelines out any wage-price spiral dynamics.

If we noticed a leapfrogging sample – the place a big nominal wage improve resulted in actual wage will increase was adopted by a surge in inflation subsequent quarter and so forth – then we would conclude that the distributional battle between labour and capital as to who would take the losses in actual earnings because of the imported value will increase.

However when the true wage cuts are systematic then it’s a lot more durable to assemble the issue as an interactive wage-price spiral.

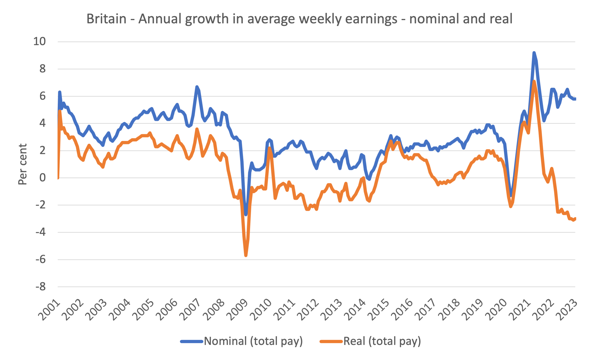

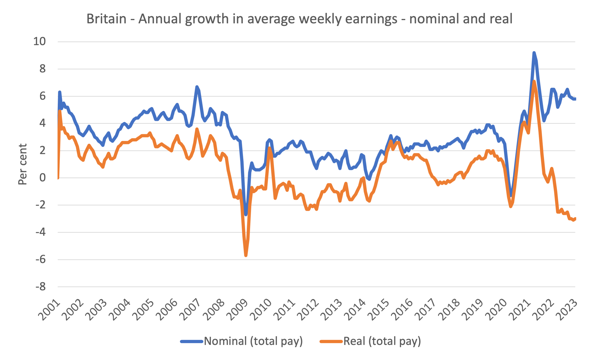

The most recent ONS wages knowledge (launched Could 16, 2023) – Common weekly earnings in Nice Britain: Could 2023 – the day earlier than the governor made his speech reveals that:

Progress in workers’ common whole pay (together with bonuses) was 5.8% and progress in common pay (excluding bonuses) was 6.7% in January to March 2023.

Nonetheless, and that is the numerous level:

Progress in whole and common pay fell in actual phrases (adjusted for inflation) on the yr in January to March 2023, by 3.0% for whole pay and a pair of.0% for normal pay; for actual whole pay an analogous fall was seen within the earlier three-month interval and stays among the many largest falls in progress since comparable information started in 2001.

The next graph reveals the annual progress in nominal and actual common weekly earnings (whole pay) from the March-quarter 2001 to the March-quarter 2023 (newest knowledge).

Be aware the dynamics.

The preliminary restoration in earnings from the lockdown interval quickly gave option to a scientific lack of buying energy because the supply-side inflation powered off and nominal wages didn’t catch up.

Since mid-2022, staff have endured actual wage cuts every quarter.

Even the nominal wage inflation has been pretty steady because the finish of final yr.

The final two quarters have seen no acceleration in nominal wages.

Conclusion

Bear in mind when the inflation was simply taking off, the Financial institution of England governor advised British staff that they needed to take a pay reduce or else he would make extra of them unemployed than he was already planning on doing through the rate of interest hikes.

Effectively, they did take that pay reduce, albeit in an involuntary manner, and actual wages have fallen systematically over the past yr.

Now the identical governor is blaming staff for making a persistent second-round wage-price spiral by refusing to just accept a good bigger actual wage reduce.

I do know all of the financial fashions of wage-price spirals – mainstream and others – and none would recommend that such a dynamic may actually happen and persist when there are systematic actual wage losses being incurred.

There is no such thing as a trace of a leap-frogging sample in Britain.

That is one other central financial institution governor that must be rendered unemployed.

That’s sufficient for at this time!

(c) Copyright 2023 William Mitchell. All Rights Reserved.

[ad_2]