Australian labour market – rebound after weak month however 10 per cent of obtainable and prepared labour stay idle

[ad_1]

The Australian Bureau of Statistics (ABS) launched of the newest labour pressure knowledge right this moment (June 15, 2023) – Labour Pressure, Australia – for Could 2023. The Could consequence reverses two consecutive months of weaker outcomes from the Labour Pressure survey. Employment rose by 75.9 thousand (a powerful month-to-month consequence), participation rose by 0.1 level to a file excessive, and unemployment fell by 16,500. However one month is just not a development and it must be emphasised that there are 10 per cent of the obtainable and prepared working age inhabitants who’re being wasted in a method or one other – both unemployed or underemployed. That extent of idle labour means Australia is just not actually near full employment regardless of the claims by the mainstream commentators. I’m ready for the RBA governor to assert the autumn within the unemployment charge justifies additional rate of interest will increase. It doesn’t however since when has logic and info received within the street of his agenda.

The abstract ABS Labour Pressure (seasonally adjusted) estimates for Could 2023 are:

- Employment rose by 75,900 (0.5 per cent) – full-time employment rose by 61,700 and part-time employment elevated by 14,300.

- Unemployment fell 16,500 to 515,900 individuals.

- The official unemployment charge fell by 0.1 level to three.6 per cent.

- The participation charge rose 0.1 level to 66.9 per cent.

- The employment-population ratio rose by 0.2 factors to 64.5 per cent.

- Mixture month-to-month hours fell 36 million hours (-1.8 per cent).

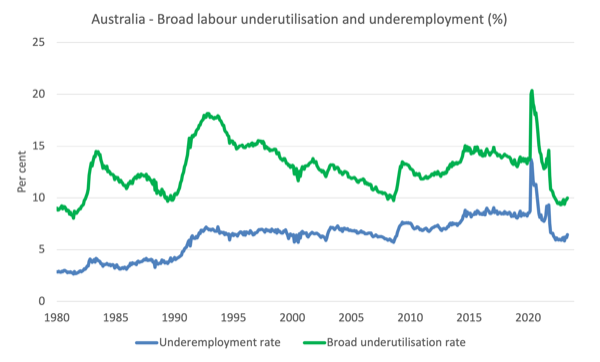

- Underemployment rose 0.3 factors to six.4 per cent (an increase of 45.2 thousand). Total there are 936.6 thousand underemployed staff. The overall labour underutilisation charge (unemployment plus underemployment) rose by 0.2 factors to 10 per cent. There have been a complete of 1,452.5 thousand staff both unemployed or underemployed.

In its – Media Launch – the ABS famous that:

… The unemployment charge fell 0.1 share level to three.6 per cent in Could (seasonally adjusted) …

The robust development in employment in Could adopted a small lower in April, round Easter, when employment fell by greater than it normally would over the vacation interval …

Trying over the previous two months, the employment will increase common out to round 36,000 further employed individuals every month. That is nonetheless across the common over the previous 12 months of 39,000 individuals a month.

Conclusion: Following a comparatively weak month in April, the Could knowledge exhibits a strengthening scenario.

Employment rose by 75,900 (0.5 per cent) in Could 2023

1. Full-time employment rose by 61,700 and part-time employment elevated by 14,300.

2. The employment-population ratio rose by 0.2 factors to 64.5 per cent, which is a file excessive.

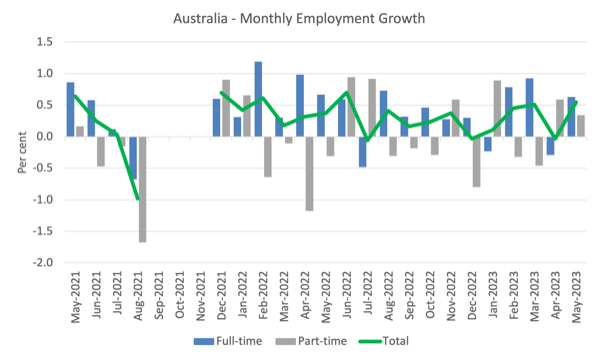

The next graph exhibits the month by month development in full-time (blue columns), part-time (gray columns) and whole employment (inexperienced line) for the 24 months to Could 2023 utilizing seasonally adjusted knowledge.

I took out the observations from September to January 2021 – they have been outliers because of the Covid wave at the moment.

The next desk gives an accounting abstract of the labour market efficiency during the last six months to offer an extended perspective that cuts via the month-to-month variability and gives a greater evaluation of the developments.

Given the variation within the labour pressure estimates, it’s typically helpful to look at the Employment-to-Inhabitants ratio (%) as a result of the underlying inhabitants estimates (denominator) are much less cyclical and topic to variation than the labour pressure estimates. That is an alternate measure of the robustness of exercise to the unemployment charge, which is delicate to these labour pressure swings.

The next graph exhibits the Employment-to-Inhabitants ratio, since January 2008 (that’s, for the reason that GFC).

The ratio ratio rose by 0.2 factors to 64.5 per cent in Could 2023, which is a file excessive.

For perspective, the next graph exhibits the typical month-to-month employment change for the calendar years from 1980 to 2022 (so far).

1. The typical employment change over 2020 was -8.9 thousand which rose to 36.3 thousand in 2021 because the lockdowns eased.

2. For 2022, the typical month-to-month change was 40.3 thousand.

3. To date, in 2023, the typical change is 44 thousand and rising.

The next graph exhibits the typical month-to-month adjustments in Full-time and Half-time employment (decrease panel) in hundreds since 1980.

Hours labored fell by 36 million hours (-1.8 per cent) in Could 2023

The next graph exhibits the month-to-month development (in per cent) during the last 24 months.

The darkish linear line is an easy regression development of the month-to-month change (skewed upwards by the couple of outlier outcomes).

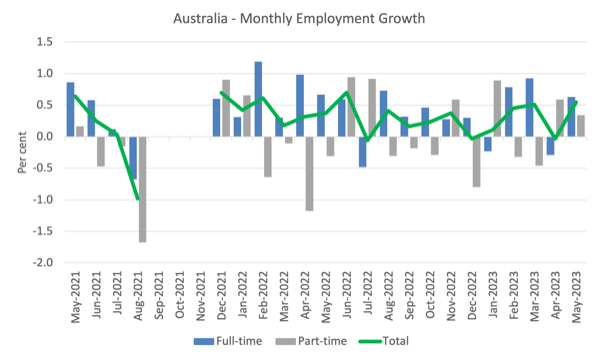

Precise and Development Employment

The Australian labour market is now bigger than it was in March 2020 and employment has now exceeded the pre-pandemic development.

The next graph exhibits whole employment (blue line) and what employment would have been if it had continued to develop based on the typical development charge between 2015 and April 2020.

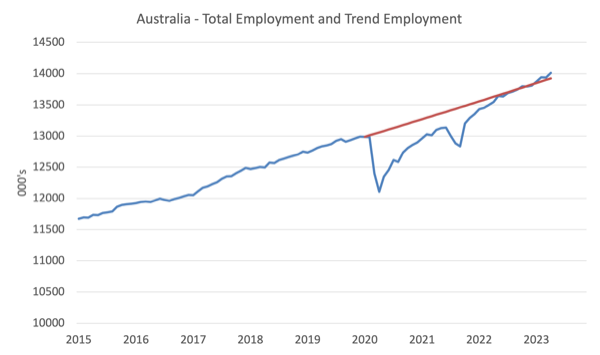

The Inhabitants Slowdown – the ‘What-if’ unemployment evaluation

The next graph exhibits Australia’s working age inhabitants (Over 15 12 months olds) from January 2015 to Could 2023. The dotted line is the projected development had the pre-pandemic development continued.

The distinction between the traces is the decline within the working age inhabitants that adopted the Covid restrictions on immigration.

The civilian inhabitants is 179.1 thousand much less in Could 2023 than it will have been had pre-Covid developments continued.

The next graph exhibits the evolution of the particular unemployment charge since January 1980 to Could 2023 and the dotted line is the ‘What-if’ charge, which is calculated by assuming the newest peak participation charge (recorded at Could 2023 = 66.9 per cent), the extrapolated working age inhabitants (primarily based on development charge between 2015 and March 2020) and the precise employment since March 2020.

It exhibits what the unemployment charge would have been given the precise employment development had the working age inhabitants trajectory adopted the previous developments.

On this weblog publish – Exterior border closures in Australia lowered the unemployment charge by round 2.7 factors (April 28, 2022), I offered detailed evaluation of how I calculated the ‘What-if’ unemployment charge.

So as an alternative of the present unemployment charge of three.6 per cent, the speed would have been 4.2 per cent in Could 2023, given the employment efficiency for the reason that pandemic.

Unemployment fell 16,500 to 515,900 individuals in Could 2023

A reversal on final month’s comparatively poor consequence – employment development robust and greater than absorbing the labour pressure development, which was pushed by the underlying working age inhabitants development and the rise within the participation charge.

All good outcomes.

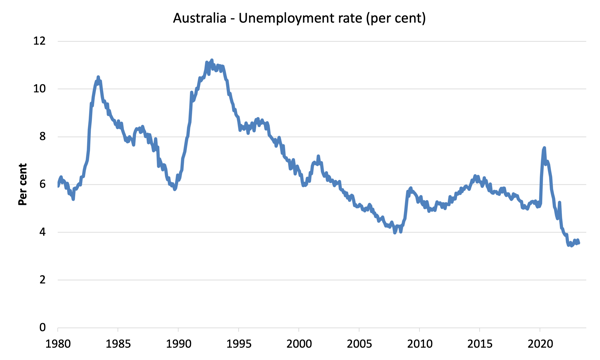

The next graph exhibits the nationwide unemployment charge from January 1980 to Could 2023. The longer time-series helps body some perspective to what’s taking place at current.

Broad labour underutilisation rises 0.2 factors to 10 per cent in Could 2023

1. Underemployment rose 0.3 factors to six.4 per cent (an increase of 45.2 thousand).

2. Total there are 936.6 thousand underemployed staff.

3. The overall labour underutilisation charge (unemployment plus underemployment) rose by 0.2 factors to 10 per cent.

4. There have been a complete of 1,452.5 thousand staff both unemployed or underemployed.

The next graph plots the seasonally-adjusted underemployment charge in Australia from April 1980 to the Could 2023 (blue line) and the broad underutilisation charge over the identical interval (inexperienced line).

The distinction between the 2 traces is the unemployment charge.

Teenage labour market sheds full-time employment in Could 2023

Youngsters gained 8.8 thousand web jobs in April with full-time jobs falling by 0.9 thousand and part-time rising by 9.7 thousand.

The next Desk exhibits the distribution of web employment creation within the final month and the final 12 months by full-time/part-time standing and age/gender class (15-19 12 months olds and the remaining).

To place the teenage employment scenario in a scale context (relative to their measurement within the inhabitants) the next graph exhibits the Employment-Inhabitants ratios for males, females and whole 15-19 12 months olds since June 2008.

You possibly can interpret this graph as depicting the change in employment relative to the underlying inhabitants of every cohort.

By way of the latest dynamics:

1. The male ratio rose 0.6 factors over the month.

2. The feminine ratio rose 0.2 factors.

3. The general teenage employment-population ratio rose by 0.4 factors over the month.

Conclusion

My customary month-to-month warning: we at all times must watch out deciphering month to month actions given the way in which the Labour Pressure Survey is constructed and applied.

My general evaluation is:

1. The Could knowledge reverses two consecutive months of weaker outcomes from the Labour Pressure survey.

2. Employment rose by 75.9 thousand (a powerful month-to-month consequence), participation rose by 0.1 level to a file excessive, and unemployment fell by 16,500.

3. However one month is just not a development and it must be emphasised that there are 10 per cent of the obtainable and prepared working age inhabitants who’re being wasted in a method or one other – both unemployed or underemployed.

4. That extent of idle labour means Australia is just not actually near full employment regardless of the claims by the mainstream commentators.

That’s sufficient for right this moment!

(c) Copyright 2023 William Mitchell. All Rights Reserved.

[ad_2]