Australia – inflation nonetheless falling whereas the RBA governor retains inventing ruses to maintain mountaineering charges

[ad_1]

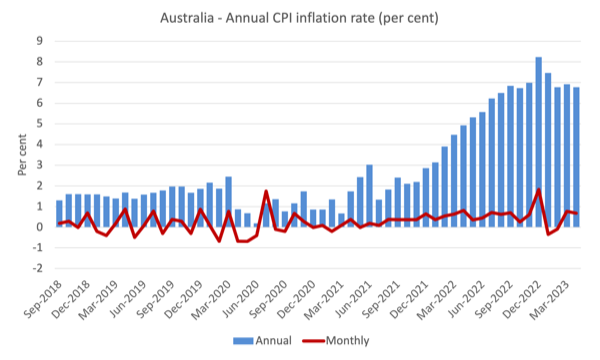

It’s Wednesday and there’s a lot happening within the information launch sense – housing finance, building and at the moment, the Australian Bureau of Statistics launched the most recent – Month-to-month Client Worth Indicator – which covers the interval to April 2023. On an annual foundation, the month-to-month All Gadgets CPI charge of enhance was 6.8 per cent down from 6.9 per cent. There may be some stickiness in a number of the parts within the CPI however general inflation peaked final yr and is slowly declining because the elements that prompted the pressures within the first place are abating. Tomorrow I plan to debate an obvious rigidity within the Fashionable Financial Idea (MMT) group as as to whether rate of interest will increase are expansionary or contractionary. However at the moment we simply take into account the information after which take heed to some dub.

Inflation continues to say no in Australia

Right this moment’s information exhibits the month-to-month enhance within the CPI was right down to 0.68 per cent from 0.77 per cent in March.

This new experimental month-to-month sequence from the ABS solely covers about 60 per cent of the gadgets that seem within the extra detailed quarterly launch, though the ABS famous that it “is constant to enhance the month-to-month CPI indicator the place attainable and has added a brand new month-to-month sequence for electrical energy costs within the indicator”.

In order time passes, the indicator will get nearer to the extra correct commonplace quarterly measure.

Nonetheless, because it stands, it nonetheless supplies good info for assessing the place the inflationary pressures are heading.

The ABS Media Launch (Might 31, 2023) – Month-to-month CPI indicator up 6.8% within the yr to April – famous that:

The month-to-month Client Worth Index (CPI) indicator rose 6.8 per cent within the yr to April 2023 …

This month’s annual enhance of 6.8 per cent is greater than the 6.3 per cent annual rise reported in March 2023, however is under the excessive of 8.4 per cent recorded in December 2022 …

It’s essential to notice {that a} vital contributor to the rise within the annual motion in April was automotive gas. The halving of the gas excise tax in April 2022, which was totally unwound in October 2022, is impacting the annual motion for April 2023.

As soon as once more we’re seeing worth results of discretionary choices by authorities, that are unrelated to the state of general spending within the economic system.

The RBA’s rate of interest mountaineering escapade is all conditioned on there being a demand-side drawback.

Clearly, if the federal government had not manipulated the gas excise charge then the present inflation charge can be a lot decrease.

So it could be felony of the RBA to make use of this determine to argue that inflation is just not falling quick sufficient after which use that to justify an extra rate of interest rise.

However after all smart logic disappeared a long-time in the past on the RBA.

I’ll return to that later.

The subsequent graph exhibits, the annual charge of inflation is heading in a single route – down and shortly.

The blue columns present the annual charge whereas the crimson line exhibits the month-to-month actions within the All Gadgets CPI.

1. In December 2022, the annual charge recorded was 8.2 per cent.

2. In January 2023, the annual charge was 7.5 per cent.

3. In February 2023, the annual charge was 6.8 per cent.

4. In March 2023, the annual charge was 6.9 per cent.

5. In April 2023, the annual charge was 6.8 per cent.

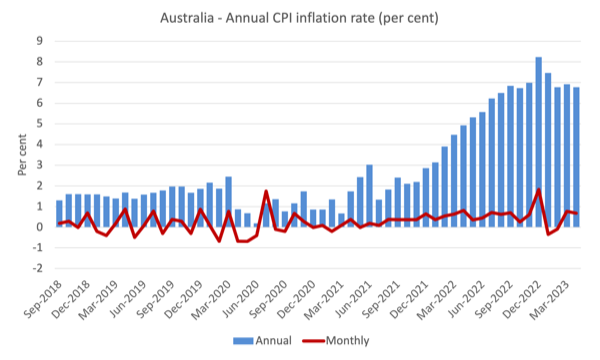

The subsequent graph exhibits the actions between December 2022 and April 2023 for the primary parts of the All Gadgets CPI.

Basically, the preliminary sources of the CPI strain are in fast decline and a number of the by-product parts – for instance, clothes and footwear (by-product as a result of transport prices had been greater for some time).

The rise in schooling prices are, partially, because of worth gouging from the personal faculty operators, sensing they’ll get nicely forward of unit value rises with out anybody noticing.

Well being care prices rose due to indexing preparations in personal medical insurance – once more an administrative artefact impressed by the privatisation of well being safety.

And the monetary sector is again on the town with huge revenue in search of (see graphs under).

However general, the inflation charge is declining as the provision elements ease.

Curiously, the RBA governor appeared at the moment earlier than the Commonwealth Senate Estimates Committee, which serves to grill public figures on what they’ve been as much as.

Right this moment the hearnig from the Economics Laws Committee interrogated the RBA boss however the official transcript is just not but accessible.

Nonetheless, the ABC radio and TV providers coated the hearings and we realized amongst different issues that:

1. The RBA admitted at the moment that it has been underpaying an ‘unspecified’ variety of its workers many hundreds of {dollars} in pay.

And if that wasn’t dangerous sufficient it known as in PwC, the personal administration and accounting agency to work out the answer.

Why is that scandalous?

Nicely PwC has now been uncovered for systematically utilizing confidential info gained from their consulting contracts with the federal authorities about tax coverage to assist their personal purchasers enhance their earnings.

The consultancy had been designed to advise on insurance policies that might clamp down on company tax avoidance.

It now seems that PwC abused the belief that’s fundamental to consulting contracts with authorities to additional their very own ends and undermine public objective.

Neoliberalism has seen the general public service hollowed out and these accounting and administration consultancy corporations transfer in to fill the house in coverage growth.

Public coverage is supposed to advance basic well-being.

However PwC noticed these consultancies as an open door to assist itself with the unwitting authorities handing over confidential info by way of these contracts.

So for the RBA to proceed to make use of PwC is a scandal in itself.

However we at the moment are studying that PwC has many contracts with varied authorities departments value thousands and thousands if not billions.

Corruption is apparent.

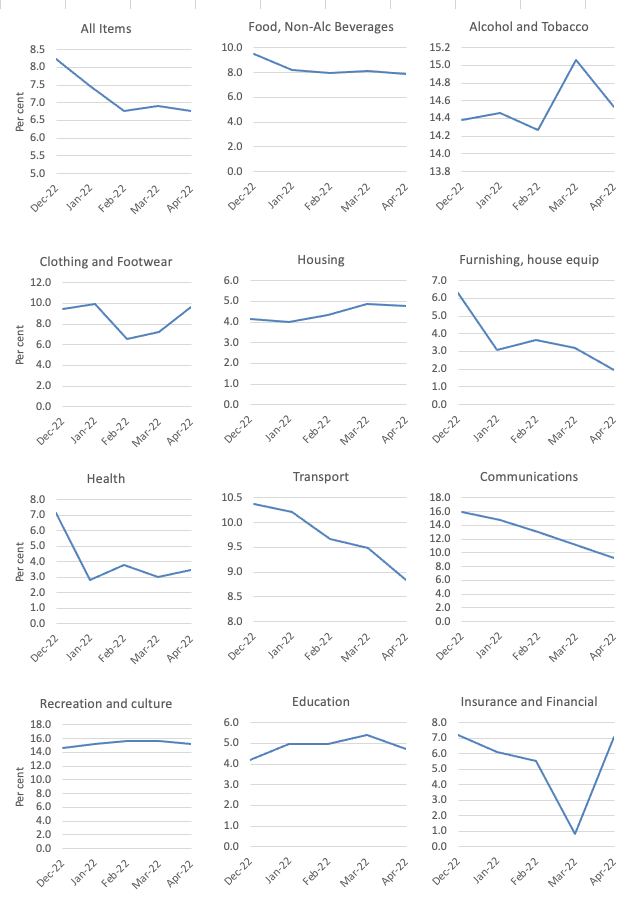

2. The governor was requested whether or not revenue gouging is driving inflation and he flatly denied it and said that “Earnings haven’t risen exterior the assets sector.”

Nicely that assertion is just not fairly correct is it?

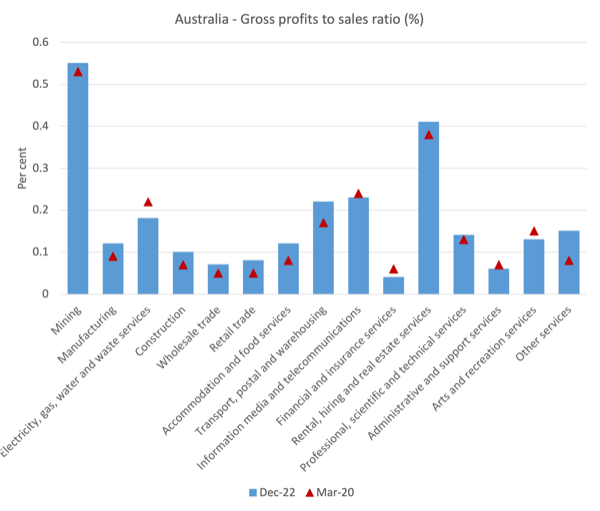

The primary graph derived from official ABS information present the that earnings have been rising in most industrial sectors and the second graph exhibits the that earnings have risen relative to gross sales in most sectors.

The useful resource sector has loved substantial progress in earnings because the pandemic. However so have many different sectors.

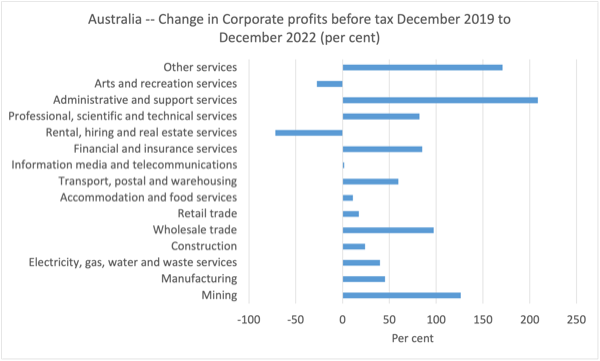

This graph exhibits the gross earnings to gross sales ratio and the crimson triangles depict the March-quarter 2020 on the onset of the pandemic and the blue columns present the December-quarter 2022 outcomes.

If the bar is above the triangle then it implies that corporations are increasing earnings per unit of gross sales.

That clearly has been occurring proper throughout the commercial panorama.

It’s a pity the Senate Committee members weren’t higher knowledgeable and in a position to drive the RBA governor to retract his assertion.

His assertion is after all cowl for what he’s doing with financial coverage.

He couldn’t justify the rate of interest will increase if revenue gouging was a significant factor driving the inflation (which it now’s, regardless of his denials).

3. The governor pulled out the inflation expectations card once more as a result of the previous sorry ‘we danger a wage-price spiral’ ruse to justify the speed rises is carrying slightly skinny, on condition that wages are clearly not driving the inflationary episode.

So what else however to fall again on the opposite previous ruse that one of many causes he gave for the final rate of interest rise, within the face of falling inflation:

… was to strengthen the concept in the neighborhood’s thoughts that we’re critical about this, that we are going to do what’s essential to get inflation to come back down …

However with inflation already peaking within the second-half of 2022 and no information suggesting that inflationary expectations had been something apart from benign, this declare that the charges need to hold rising to make individuals realise the RBA was critical is parlous at finest.

4. He tried to disperse blame again on the fiscal coverage by claiming that the “Capital inventory not rising in keeping with the inhabitants means Australians have much less capital to work with” and that extra funding by authorities is required.

He notably argued that there was a necessity for extra housing inventory and governments needed to make investments extra.

However beforehand he has warned that if the federal government didn’t tighten fiscal coverage then rates of interest would rise by greater than they’ve already performed so.

Why didn’t the senators choose him up on this?

Music – St Germain

That is what I’ve been listening to whereas working this morning.

This monitor – Dub Expertise II – appeared on the 1995 debut studio album – Boulevard – French band – St Germain.

Possibly referring to St Germain as a band is pushing it a bit given that it’s the state alias for the French home and jazz producer who assembles just a few precise musicians to accompany his sampling and different results.

Anyway, it is a fantastically produced dub which I reacquainted myself with yesterday on a protracted flight from Perth to Melbourne.

The entire album is value listening to.

That’s sufficient for at the moment!

(c) Copyright 2023 William Mitchell. All Rights Reserved.

[ad_2]