A Prime Precedence - Wiser Girls

[ad_1]

IMPACT (ACLI weblog) article by Cindy Hounsell

August 3, 2022

Each day monetary wants like meals, household and shelter take precedence over saving for retirement. Plus, understanding the best way to plan and the way a lot to save lots of is tough for a lot of adults since nobody is aware of precisely how lengthy they’ll dwell. Because of this, about 1 in 4 U.S. adults haven’t any retirement financial savings.

The U.S. Congress is presently contemplating laws that may assist extra People put together and save for retirement. Generally known as SECURE 2.0, the payments will deal with gaps within the retirement system and make office retirement plans extra accessible by together with part-time staff – who’re twice as prone to be ladies – in addition to army spouses.

Importantly, the laws additionally incorporates key provisions that can assist two underserved teams who have confronted further challenges constructing monetary safety: lower-income staff and girls. Decrease-income People are eligible to obtain a tax break referred to as the Savers Credit score when making contributions to their retirement accounts. SECURE 2.0 will change the earnings necessities for the saver’s tax credit score making extra staff eligible to say the credit score.

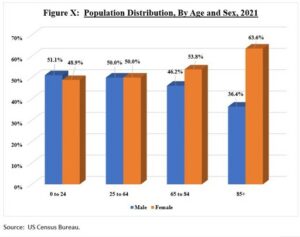

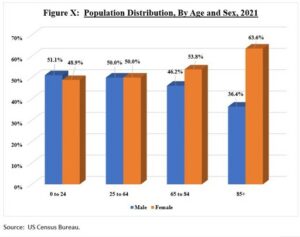

The SECURE 2.0 laws would additionally replace the principles surrounding Certified Longevity Annuity Contracts or QLACs. The proposed change would make it simpler for retirees to maneuver funds into a long life annuity (QLAC), which is a type of deferred annuity that begins to supply assured earnings later in life, on or earlier than age 85. This provision may particularly assist ladies, who on common dwell about 5 years longer than males. In reality, greater than six in 10 People 85-and-older are ladies. With higher entry to assured earnings, extra ladies will be capable to keep away from outliving their financial savings.

Earlier this 12 months, the Home handed the Securing a Sturdy Retirement Act by a 414-to-5 margin. The Senate Finance and HELP Committees have taken motion on many comparable payments. These Home and Senate measures construct upon 2019’s SECURE Act, which modernized the united statesretirement system for staff for the primary time in additional than a decade. It’s time for Congress to complete the replace by passing a last model of the SECURE 2.0 laws.

Cindy Hounsell, JD is President and Founding father of the nonprofit Girls’s Institute for a Safe Retirement (WISER). An legal professional and retirement professional, Ms. Hounsell is Director of the Nationwide Useful resource Middle on Girls & Retirement in partnership with the U.S. Administration on Ageing. Ms. Hounsell was awarded a lifetime achievement award by the Plan Sponsor Council of America (2018) and named an Influencer in Ageing — a thought chief redefining rising older in America by the PBS web site – Subsequent Avenue.

To see the article on-line, go to: https://influence.acli.com/a-top-priority/?utm_source=Twitter&utm_medium=Social&utm_campaign=SECURE2_Women080322

[ad_2]